Summary: The US Dollar and Euro closed little-changed as two of the world’s most influential central banks signalled that they are willing to keep interest rates steady. The ECB left key interest rates unchanged and reiterated that it plans to hold them at current levels for the rest of the year. The Fed released the minutes of its March 19-20 meeting where policymakers hinted they would not raise rates in 2019. FOMC officials also signalled that they would stop reducing their bond holdings by September. The Euro closed at 1.1272 in New York, little-changed from yesterday’s 1.1266. The Dollar Index (USD/DXY), a measure of the value of the US Dollar relative to a basket of foreign currencies, slipped 0.08% to 96.944 (97.02). Sterling was steady after rallying 0.2% to 1.3088. The EU Summit saw European nations agree to extend Brexit until October 31. USD/JPY closed modestly lower at 111.00 (111.15).

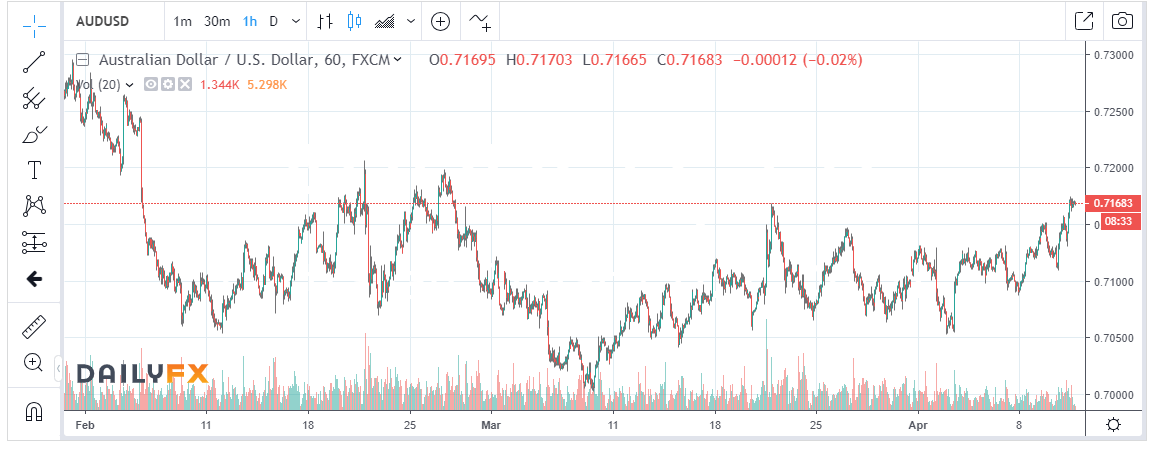

The Australian Dollar outperformed the Majors, climbing 0.57% to 0.7170 (0.7125). Emerging Market currencies rallied. The South African Rand soared 1.3% against the Greenback to 13.91 from 14.10 yesterday. Bond yields fell led by the benchmark US 10-year, down to 2.46% from 2.5%.

Wall Street stocks steadied. The DOW ended up 0.12% (26,175) while the S&P 500 rose to 2,891 from 2,878. US inflation was mixed with Headline CPI beating forecasts at 0.4% against 0.3%. Core Prices though underwhelmed at 0.1% against expectations of 0.2%. Euro-area Industrial Production in France and Italy beat forecasts. UK Manufacturing, Industrial Production and Construction Output all beat forecasts.

- EUR/USD – the Euro was steady as she goes, grinding its way up to 1.1287 before settling at 1.1272 at the close. Overnight low traded on the Euro was 1.1230 which now forms a short-term base.

- AUD/USD – The Aussie Dollar hit 6-week highs overnight (0.7175) boosted by the rally in EM currencies, a generally weaker Greenback as well as lessening expectations of near-term RBA rate cut. RBA Assistant Governor Guy Debelle, speaking in Adelaide yesterday, signalled that he isn’t convinced the Australian central bank needs to cut interest rates yet.

- USD/JPY – The Dollar slipped further against the Yen, closing at 111.00 from 111.16 yesterday. The fall in US 10-year yields by 4 basis points to 2.50% was not matched by its Japanese counterpart. Ten-year JGB yielded -0.07% from -0.06%.

- GBP/USD – Sterling rallied 0.2% to 1.3089 (1.3057) as the Eurogroup countries currently holding the EU Summit appeared to be supportive of a long Brexit extension. An agreement from the EU on an extension would initially be Sterling supportive. Reports have just been released that the EU has agreed to extend Brexit to Oct 31.

On the Lookout: The ECB and Fed both highlighted their concerns of the slowing global growth amidst the current trade tensions. The China-US trade talks saw both countries agree on enforcement agencies, which are the mechanism to policy any agreement. While it’s a first step, there is still a long way to go with other issues yet to be resolved. The EU Summit which voted to extend Brexit to Oct 31 should boost the Pound in the short term. Traders will focus on first-tier data reports from here-on-in.

Today sees the release of China’s CPI and PPI data. RBA Assistant Governor Guy Debelle speaks in Hongkong later today. Euro area reports today are Germany’s and France’s Final CPI data. US Headline and Core CPI data round off the day’s reports. FOMC members Clarida, Williams, Bullard all speak at different engagements.

Trading Perspective: With both the ECB and Fed signalling dovish outlooks, market positioning comes into play which is mildly supportive of the currencies. Speculators are long of US Dollar bets at a 3-month high. US Bond yields fell yesterday and are approaching 2.4%. Without yield support, the Dollar will find it hard to rally.

- EUR/USD – The Euro held most of its gains closing at 1.1271 from 1.1266 yesterday. The overnight low traded was 1.12295. A short-term base at 1.1210 is forming with the next resistance level at 1.1320. Immediate resistance lies at 1.129 followed by 1.1320. Immediate support can be found at 1.1240 followed by 1.1210. Net short Euro bets are at their biggest since December 2016 according to the latest COT report (2 April). Look to buy dips with a likely range today of 1.1255-1.1305.

- AUD/USD – The Australian Dollar rallied on the back of the generally softer Greenback. RBA Assistant Governor Guy Debelle put to rest, for now, any expectations of a near-term rate cut. He speaks again today in Hongkong. The rally in Emerging Market currencies also supported the Aussie Battler. Last, but not least, the speculators are short of Aussie bets. AUD/USD has immediate resistance at 0.7175 followed by 0.7200. Immediate support can be found at 0.7155 followed by 0.7115. Look to buy dips with a likely range of 0.7155-95.

- GBP/USD – The British Pound steadied above 1.30 after PM May successfully convinced EU leaders to extend the Brexit deadline to Oct 31, 2019. Upbeat UK production data released yesterday should be Sterling supportive. GBP/USD has immediate resistance at 1.3120 followed by 1.3170. Immediate support can be found at 1.3060 followed by 1.3030. Look to buy dips with a likely range today of 1.3060-1.3160.

- USD/JPY – The Dollar closed marginally lower against the Yen at 111.00. Immediate support at 110.60 is at risk. The next support level lies at 110.10. Immediate resistance can be found at 111.30 followed by 111.60. Given the slide in the US 10-year yield, USD/JPY should grind lower with today’s likely range 110.60-111.20.

Happy trading all.