Asian stocks finished on a negative ground, as investors turned cautious after IMF cut its GDP prediction for the third time in the last six months to the lowest since 2009, and Brexit developments. US President Donald Trump also threatened to impose tariffs on $11 billion of European Union (EU) imports as retaliation on what he claims to be unfair subsidies to Airbus.

In Japan, the Nikkei225 main index added 0,53 percent lower to 21,687, the Hang Seng benchmark in Hong Kong finished 0.31 percent lower at 30,060. The Shanghai Composite was 0.20 percent higher at 3,246 and in Singapore, the FTSE Straits Times index finished 0.04 percent lower at 3,320. Australian equities recovered from morning’s lows to finish flat on Wednesday for the second session. The ASX 200 was down as much as 0.36 percent this morning; however, gains from the big banks and gold miners helped offset the losses.

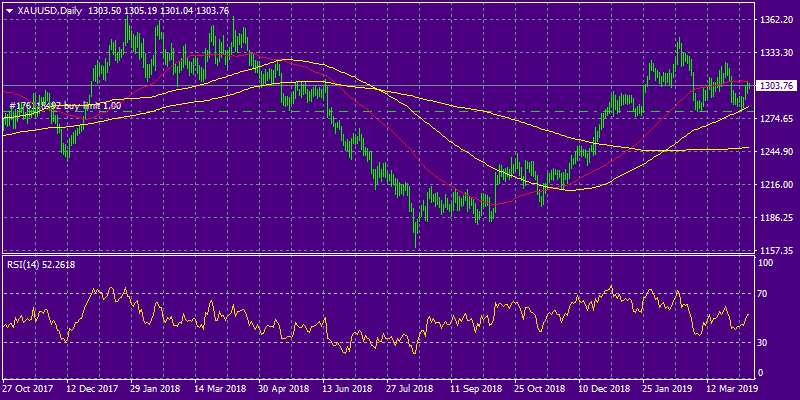

In commodities markets, Crude Oil rally is intact at a five-month high and holds recent gains above 64, supported by OPEC’s ongoing supply cuts, geopolitical uncertainty and the US additional sanctions on Iran. The near-term upside target is the 65.00 figure, but I expect some profit taking to prevail as the black gold has reached overbought levels. Brent oil started the week with a gap up and trades today at $70.80/barrel some cents away from the recent highs. Gold rebounded yesterday above $1300 at two weeks high, supported by escalating geopolitical tensions concerning Tripoli, the Libyan capital. XAUUSD technical picture is positive, and now immediate support stands at 50-hour moving average at $1300, which if broken can accelerate the downward move to 1293 and the 200-hour moving average. Strong resistance now stands at the $1307, the 50-day moving average, expect the bears to defend $1307 with full force.

European session started in easy tones as the Brexit deadline for leaving the European Union is getting closer and investors are awaiting Mario Draghi’s comments on Eurozone growth prospects. DAX30 is 0.18 percent higher to 11,869, CAC40 is 0.12 percent higher at 5,442 while FTSE100 in London is 0.15 percent lower at 7,414 and the FTSE MIB in Milan is trading 0.08 percent higher at 21,694.

In cryptocurrencies, bitcoin (BTCUSD) consolidates above the 5,000 mark, and the key 200-day moving average resistance is at $5,225, making the daily high at 5,271. Bitcoin will find support at 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) outperforming today, trading now at 181 and Litecoin (LTCUSD) gains 2 dollars to 88.95.

On the Lookout: In its 2019 World Economic Outlook, the International Monetary Fund slashed its prediction for the rate of growth in global GDP in 2019 by 0.4 percentage points to 3.3% and that for 2020 by 0.1 percentage points to 3.6%.

EU leaders for one more time are set to meet to discuss and decide on whether to grant the UK another Brexit extension and, and in that case, for how long. The US inflation figures, FOMC minutes and the ECB meeting are key events later that will keep investors busy.

Key upcoming events:

10/04/2019 ECB Interest Rate Decision

10/04/2019 Emergency EU Council Meeting

29/03/2019 (12/04/2019) UK leaves the European Union

18/04/2019 Dissolvement of current EU Parliament

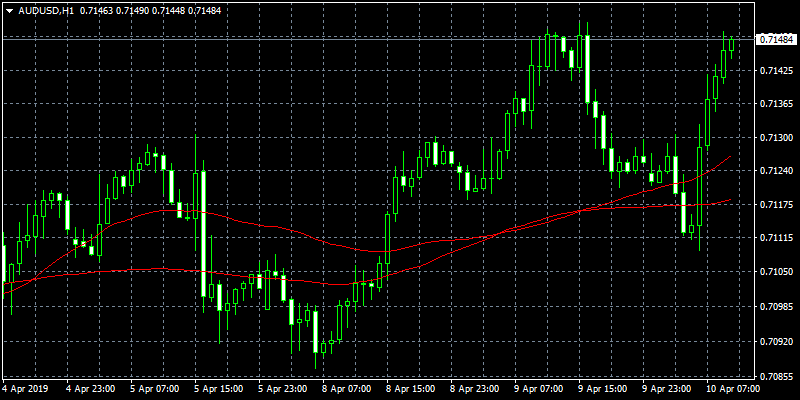

Trading Perspective: In Forex markets today most majors are sticking to tight trading ranges, AUDUSD is trading 0.35 percent higher at 0.7148 near a two-week high, supported by positive comments from RBA Deputy Governor Debelle on economic growth and domestic labor market, while Kiwi is also higher at 0.67.53 tracking AUD and strong commodity prices led by oil. The US dollar index ranges in mid 96 awaiting FOMC meeting for clues about the US interest rate outlook.

GBPUSD consolidates between the 50 and 200-day moving average. Today the pair is trading flat at 1.3072 (low at 1.3038, high at 1.3079) as investors follow the Brexit news. On the downside, major support will be found at 1.2977 at the 200-day moving average while solid protection can be found at a 100-day moving average around 1.2929. On the flipside, immediate resistance stands at 1.3195 the high from previous week session, and from there, major resistance can be found at 1.3232 while 1.3382, the yearly high, will be met with strong supply.

In GBP futures markets, open interest traders added more than 1K contracts to their open interest positions on Tuesday, while volume extended the choppy performance, rising by around 41.2K contracts.

EURUSD yesterday managed to break into the three-month trading range for one more time. The pair is flat today 1.1266 just shy of yesterday high. The pair needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215. Comments from ECB and FOMC today will provide the cues for the next short-term trend for the pair.

EURO remains in negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro futures markets, open interest shrunk by more than 1.7K contracts on Tuesday, according to preliminary figures from CME Group. In the same line, volume reversed two consecutive builds and decreased by around 14.2K contracts.

USDJPY: The Bank of Japan on Monday cut its assessment for three of the country’s nine regions, the biggest number of downgrades in six years, suggesting that the hit to exports and factory output from slowing overseas demand is broadening, The pair is flat today at 111,16 having hit the low at 111.05 and the high at 111.24. Major support for the pair stands at 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06, the March 2019 high.

Open interest in JPY futures markets shrunk by around 3.8K contracts on Tuesday from Monday’s final 169,698 contracts, the first drop after four consecutive builds. On the other hand, volume increased by nearly 22K contracts.

USDCAD consolidates just above 1.33 having lost almost 70 pips earlier this week, erasing the gains of the previous week. It printed a fresh weekly low at 1.3292, and it is holding near the bottom, with the bearish tone intact. The pair will find support at 1.3285, and the 50-day moving average which if breached will drive prices down to 200-day moving average key support. On the upside, immediate resistance stands at the 100-hour moving average at 1.3346 while more supply for the USD will be met at the 200-hour moving average around 1.3360.