Summary: Markets settled into a quiet morning in Sydney following a volatile week. The Euro held steady following the ECB’s announcement to an end of its asset purchase program. A slightly downbeat assessment on Euro area growth by the European Central Bank saw the Euro trade lower before rallying to end little-changed in New York at 1.1365. Sterling edged higher as British PM May prepared to get her Brexit deal through Parliament. The Dollar Index (USD/DXY) closed flat. US Weekly Unemployment Claims beat forecasts, falling to the lowest since September.

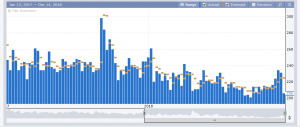

Wall Street stocks were mixed. The DOW rose 0.20 while the S&P 500 slipped 0.10%. The yield on the US 10-Year bond was unchanged at 2.91%. Other global yields were little-changed.

- EUR/USD – traded to a high of 1.13933 after the ECB announced an end to bond purchases. The Euro then dipped to a low of 1.13312 after Mario Draghi said that the balance of risks had shifted to the downside for Euro area. The multi-currency then rallied to close little-changed at 1.1365.

- GBP/USD – After PM May survived the leadership challenge, Sterling slipped back to 1.2605 after it’s strong rally to 1.2670. May’s survival was then seen as allowing her to negotiate more generous terms for Britain in its exit from the EU by traders who lifted the Pound higher to 1.2655.

- Wall Street Stocks were mixed with no fresh developments on US-China trade issues following an optimistic outlook yesterday. The S&P 500 closed at 2645, slightly lower than 2652 yesterday.

- Dollar Index (USD/DXY) – ended flat at 97.065 (97.065 yesterday). The Greenback had mixed fortunes, flat against the Euro, while lower against the Pound. USD/JPY edged higher to 113.59 (113.22 yesterday). The Aussie grinded higher to 0.7225, up 0.26%.

On the Lookout – The market shifts its focus on Chinese data today with the trifecta of Industrial Production, Retail Sales and Fixed Asset Investment. Expectations are for an improvement in Retail Sales and Fixed Asset Investment. Industrial Production is expected to remain steady. If expectations are met, they will alleviate worries on a slowdown in China’s economy and boost risk sentiment. The should also take pressure away from the Chinese Yuan. Japan’s Tankan Manufacturing and Non-Manufacturing Index are also due for release this morning. Though the pace is slowing, Japan’s economy is expected to continue to expand. Data out of Europe see Euro-area and Eurozone Flash Manufacturing and Services PMI’s. US November Headline and Core Retail Sales round up today’s data.

Trading Perspective – While the Dollar Index was mixed, the ability of the Euro to keep its gains coupled with Sterling’s gains should see a weaker Greenback. Speculative market positioning is well long of US Dollar bets and a corrective move lower may be on the cards.

- EUR/USD – this currency pair has held the 1.1300 level well and looks poised to test the 1.1400/30 resistance zone. The overnight high traded was 1.1393, which is initial resistance. Today’s Euro area (Germany, France, Italy) Flash Manufacturing and Services PMI’s are mostly expected unchanged from the previous month. A slight improvement is forecast for the Eurozone data. A break of 1.1430 would see 1.1480-1.1500. On the downside the 1.1330 low should hold, or we could see a downside test first.

- GBP/USD – While Sterling has rallied somewhat, the Pound is not out of the woods yet. PM May faces an uphill climb to get her Brexit bill through Parliament. There were reports that the EU were set to preparing to discuss the Irish backstop which would help May get her deal through. GBP/USD has immediate resistance at 1.2685 (overnight high) followed by 1.2720. Immediate support can be found at 1.2625 and 1.2605.

- AUD/USD – the Aussie extended its grind higher in true Oz fashion touching a high of 0.72465 on optimism built after some progress between China and the US to resolve their trade dispute. Chinese importers resumed buying US soybeans and US President Trump’s comments were upbeat on trade talks. AUD/USD closed at 0.7225, up 0.11% from 0.7214 yesterday. The base is slowly moving higher, a break of 0.7250 could see 0.7300 again. On the downside the support at 0.7200 is formidable.

- USD/DXY (Dollar Index) – ended flat at 97.065 with a high of 97.292 and a low traded of 96.878. The highs have edged lower over the past two trading sessions while the support has held at 96.87. A break of 96.87 could see us back to this week’s low of 96.38 on Tuesday. The topside resistance of 97.30/50 should contain any rallies.