ECB stimulus measures and reduction in deposit facility rate, Trump decision to delay Chinese tariffs boost risk appetite considerably.

Summary: Global market is seeing equities trade positive supported by multiple positive fundamental factors. Asian market today saw equities and benchmark indices scale six-week highs as US-China trade war woes ebbed and optimism surrounding trade deal rose high following US President Donald Trump’s decision to delay additional tariffs on Chinese goods by two weeks. The move comes on request of Chinese Vice Premier Liu He as a gesture of goodwill following China’s decision to relax tariff measures recently. These events have led investors to hope for some solid, groundbreaking progress in upcoming trade talk which is expected to occur in early October.

In the European market, positive developments in the trade war front and healthy risk appetite among global investors along with cues from Asian markets helped major stocks scale six-week highs ahead of ECB meeting. ECB’s decision to cut deposit ate and announcement hinting at restarting bond purchase of 20 billion Euros a month starting from the month of November also added fundamental support to market bulls. On forex market front, major global currencies are trading positive against US Dollar as easing trade war woes and temporary tariff easing measures are expected to help improve global economic activity which underpinned currencies of top global economies.

Precious Metals: Rare metals rose on caution ahead of ECB meeting earlier in the day. But easing trade war woes kept gains in check. While risk appetite boomed post-stimulus update from ECB meeting, weaker USD helped precious metals retain gains made in the early day and continue to trade positive.

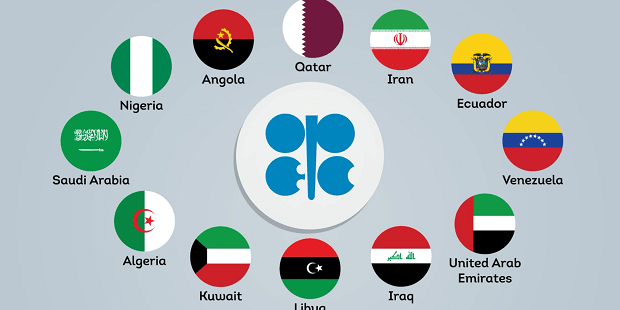

Crude Oil: Crude oil price fell sharply on both major international benchmarks today given unexpected turn in OPEC meeting. Contrary to expectations of extending supply cut agreement, members discussed only on bringing Nigerian and Iraq output to agreed levels which dampened investor mood.

AUD/USD: The pair is trading positive today having experienced a short burst of an upward move towards multi-week highs hit recently as developments in Sino-U.S. trade tariff decisions and weak USD supported AUD bulls. But the surge in US T.Yields underpinned USD to some extent keeping gains in check.

On The Lookout: Today’s market saw considerable positive developments in geopolitical issues while some factors did turn out expectedly. Trump’s decision to delay tariff as a sign of goodwill has got traders to expect some groundbreaking development in upcoming trade talks between two nations. However, the positive influence will only take hold if the date or exact schedule of trade talks between two nations hit the headlines soon failing which the influence from this news similar to cues from events in recent past will evaporate as traders will see it as nothing more than a stop-gap measure.

On European Central Bank’s interest rate policy decision meeting, marginal lending facility and interest rates remained unchanged while the deposit facility rate took a cut back. Further announcement from ECB to renew the bond purchase program to boost the EU economy was viewed as a positive sign as this measure is expected to provide considerable stimulus to the country’s economy.

On the other hand, OPEC meeting in Abu Dhabi failed to provide a much-expected extension to supply and production cut agreement which hurt investor sentiment to some extent. However, things don’t look good in UK following release of operation Yellow hammer papers according to which a no-deal Brexit scenario could cost vast economic loss to the country along with dire impact for day to day lives of UK citizens which took away any ounce of positive hopes gained on positive macro data outcome from earlier this week. Following ECB’s stimulus measures today, traders now expect US Federal Reserve to follow through and provide some easing measures in their decision meeting next week.

Trading Perspective: As USD remains week and risk appetite remains high, the forex market is likely to see major global currencies continue to trade positive against USD during American market hours. US stock and index futures trading in the international market saw positive activity ahead of Wall Street opening on Washington’s decision to delay additional tariff. Further positive cues from Asian and European markets are also likely to underpin US investors which suggest the US market is likely to see positive price action in trading session today.

On the release front, US calendar will see the release of Core CPI data, Initial Jobless Claims and speech by ECB President Draghi in late European/early North American market hours. There is also the release of US Federal budget balance data but activity in Pacific-Asian market hours is likely to be subdued on account of holiday in Chinese market tomorrow.

EUR/USD: The pair reversed most of the previous session losses and is trading positive today as EURO gained support from easing trade war woes and ECB meeting outcome with stimulus updates. Further, weak USD underpinned EURO bulls but a recovery in US T.Yields kept Euro’s gains in check trapping pair below 1.107 handle in European market hours. Traders now await US macro data update and Draghi’s speech for cues to break through 1.107 handle and short term profit opportunities.

GBP/USD: The pair is trading positive despite increased tensions in the UK following the release of operation yellow hammer papers. Hopes that UK parliament suspension will be called off, healthy risk appetite in the global market and weak USD are factors underpinning GBP bulls in trading session today. Traders now await US macro data outcome for short term profit opportunities and directional cues for North American market hours.

USD/CAD: The pair saw some level of positive price action earlier in the day breaching 1.32 handle. But the price declined from intra-day highs and fell below 1.32 handle shortly as USD weakened in the global market following easing trade war woes and Washington’s decision to delay Chinese tariffs. However, USD was underpinned by declining crude oil price and recovering US T.Yields and this helped the pair cap its decline above mid 1.31 handle. Traders now await US macro data outcome for short term profit opportunities.

Please feel free to share your thoughts with us in the comments below.