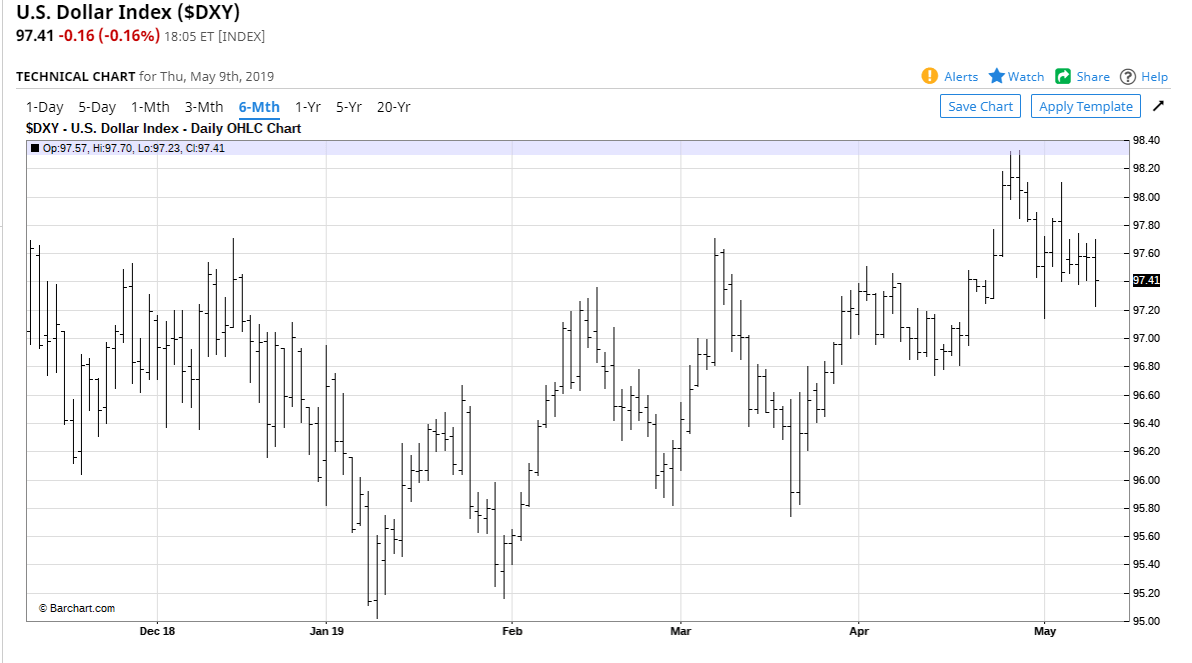

Summary: A more conciliatory President Trump towards China in their ongoing trade negotiations brightened a darkening outlook. After accusing China of backtracking on previous commitments of their trade agreement, Trump said he would speak soon with Xi Jinping over the phone. The Dollar eased modestly against its rivals even as the safe-haven Yen and Swiss Franc outperformed anew. USD/JPY slid to 109.472, 3-month lows, before settling at 109.70, down 03%. The Dollar was 06% lower against the Swiss Franc at 1.0155 (1.0205 yesterday). The Aussie and Kiwi steadied. AUD/USD settled at 0.6987 after slumping to 0.69648 overnight. The Dollar Index (USD/DXY), a popular measure of the Greenback’s value against a basket of currencies, eased to 97.486 from 97.624. The Dollar rallied against the offshore Chinese Yuan (USD/CNH), up at 6.8380 (6.8090). EM Currencies were mixed.

Wall Street stocks pared losses but still finished in the red. The DOW closed 0.79% lower at 25,825. The S&P 500 lost 0.43% at 2,872 (2,885). Treasury yields fell with the benchmark US 10-year down 4 basis points to 2.44%.

Economic data releases were mostly in line with expectations. The overall US trade deficit in April beat forecasts at -USD 50.8 billion against -USD 51.4 billion. The fragile trade deficit with China slumped to a 5-year low, down 16.2%. The report came as the two top world economies started their trade talks.

- USD/JPY – The Dollar extended losses against the haven sought Yen, tumbling to 109.472 overnight and 3-month lows. USD/JPY rebounded to close at 109.75. Lower US bond yields will keep the Greenback under pressure against this puppy.

- EUR/USD – The Euro maintained its range trade, closing modestly higher at 1.1212 (1.1192). The Euro jumped to 1.1250 overnight as equities rallied before easing at the close.

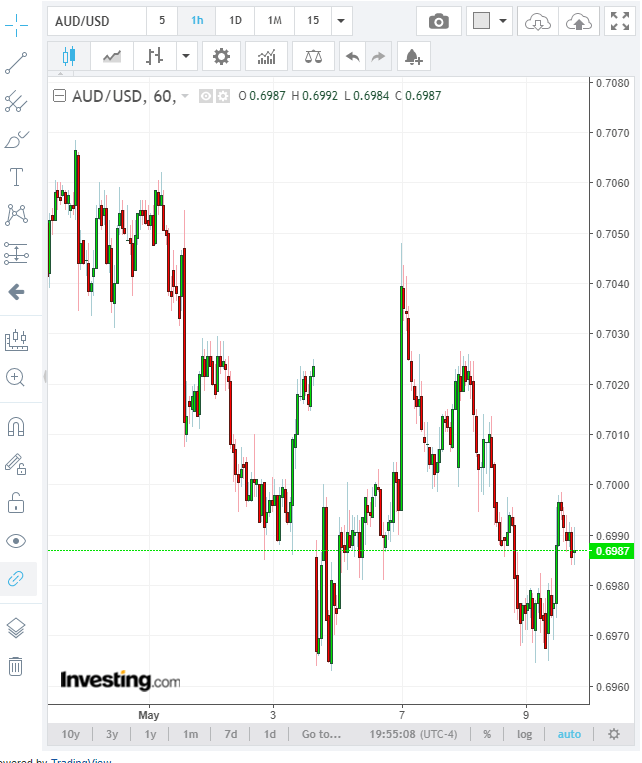

- AUD/USD – The Australian Dollar steadied to finish at 0.6990 as trade talks between the US and China begin today. An overall weaker Greenback lifted the Aussie Battler off its low at 0.6965. Aussie traders will be looking out for today’s release of the RBA’s quarterly monetary policy statement.

On the Lookout: The progress with ongoing China-US trade talks which begin today will be closely monitored by all markets. The currencies have been fairly subdued in all the trade drama with the Yen and Swiss France continuing to outperform. The economic data release calendar is busy today which will also keep the market’s attentive.

Japan starts off with their Annual Average Cash Earnings (April) and Household Spending. The Bank of Japan releases its Summary of Opinions, releases its which is their projection of inflation and economic growth. The RBA’s quarterly monetary policy statement is released shortly after.

European data begin Germany’s Trade Balance, and French and Italian Industrial Production. The UK releases its annual April GDP, Manufacturing and Industrial Production. Reports. Canadian Employment and Unemployment Rate start off North America. US Headline and Core CPI round up the day’s data releases.

Trading Perspective: Despite fairly muted reactions in the currencies, trade negotiations between China and the US will continue to be the main factor for all markets. Volatility has picked up and we can expect more. Happy days!

The fall in US bond yields was not equally matched by those of its rivals. Both the US 10 and 2-year bond yields fell a total of 4 basis points. The US 10-year yield closed at 2.44%. Germany’s 10-year Bund yield was unchanged at -0.05, as was Japan’s 10-year at -0.06%. Australia’s 10-year closed at 1.71% from 1.73%. Without yield support, the Dollar will struggle to gain new ground.

- USD/JPY – This currency pair is slip-sliding away. Lower US bond yields will add extra pressure to the already heavy USD/JPY. USD/JPY has immediate support at 109.50 followed by 109.10. Immediate resistance can be found at 110.10 (overnight high 111.112) and 110.30. If a trade deal is done, we can expect a spike in USD/JPY which could approach 111.00 but look to sell any rallies. Likely range today 109.60-110.60.

- EUR/USD – The Euro’s trading range is intact, constrained by the market’s bearish outlook on the EU economy and lower US yields. Any good news on trade will support the Euro. The pop up to 1.1250 overnight suggests that this currency pair could get volatile on a whim. The other thing we can get from this price action is that the speculative market is still mega short of Euro bets. Immediate resistance can be found at 1.1240 followed by 1.1280 (big). Immediate support lies at 1.1200 followed by 1.1170. Look to buy dips with a likely range today of 1.1180-1.1190.

- AUD/USD – the Aussie Battler is holding up well despite overwhelmingly bearish sentiment toward it. This is because the speculative market is short of the currency. AUD/USD has immediate support at 0.6970 followed by 0.6940. Immediate resistance can be found at 0.7015 and 0.7045. With US bond yields lower, the Aussie should grind its way higher from here. Likely range 0.6975-0.7045. Prefer to buy dips.

- USD/DXY (Dollar Index) – The Dollar Index is struggling to break out of its recent range between 97.20-97.70. Immediate resistance at 97.70 is strong with the next resistance level at 98.00 Immediate support can be found at 97.20 and 97.00. Look for the Dollar Index to drift lower with a likely range of 97.10-60. Prefer to sell rallies.

Happy Friday and trading all.