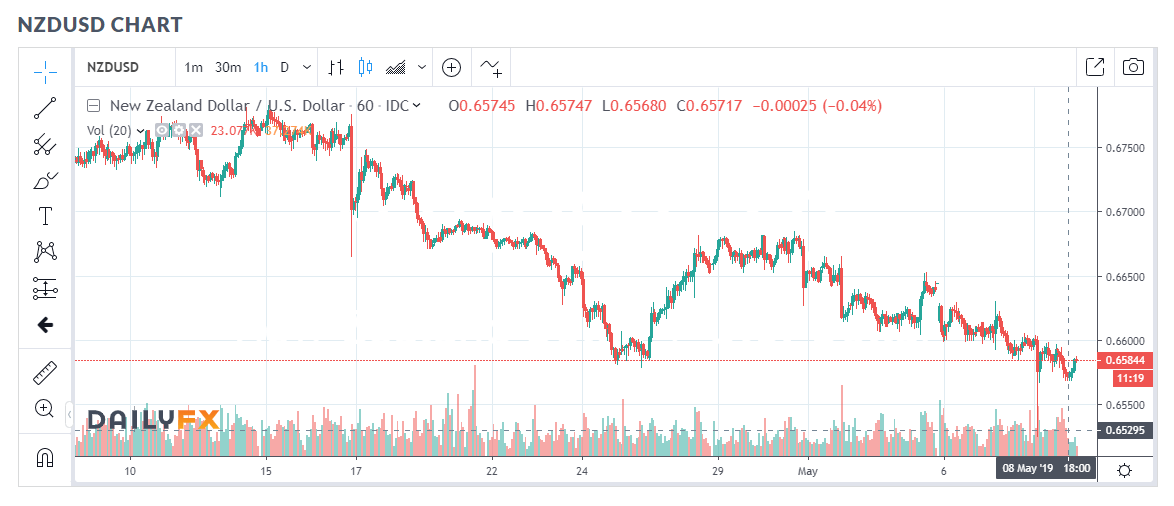

Summary: The Kiwi slumped to 0.6575 (0.6603) after the RBNZ cut rates .025% to 1.5%, the lowest on record, surprising most traders. Elsewhere, Brexit talks between the UK Conservative and Labour broke down. Sterling was pounded to close 0.45% lower at 1.3010 (1.3075). The Dollar Index (USD/DXY) finished little-changed at 97.624 (97.557). USD/JPY extended its fall to 110.10 (110.27) as markets awaited news on the China-US trade front and the risk-off stance prevailed. The South China Morning Post reported that while the Chinese trade team was on their way to Washington, the trip would be cut short. EUR/USD ended flat at 1.1192. Emerging Market currencies were mixed. South Africa’s Rand rallied ahead of today’s national elections. The Turkish Lira extended its slide with the USD/TRY closing at 6.1650 from 6.1500 yesterday.

Wall Street stocks closed flat following their 2-day fall. The DOW finished at 26,025. Global yields steadied. The US 10-year bond yield closed at 2.48% from 2.46%.

China’s April trade surplus shrank considerably as imports rose and exports fell. In Yuan terms, the trade surplus fell to CNY 94 billion in April from March’s CNY 221 billion. Germany’s Industrial Production output unexpectedly advanced in April to 0.5% against an expected fall of 0.5%. It was the second consecutive monthly rise.

- GBP/USD – Brexit talks between the British government and opposition Labour party appeared to be breaking down. Little success has been reported which puts pressure on PM May’s leadership. Sterling traded to n 8-day low at 1.2987, settling at 1.3010.

- NZD/USD – The Kiwi plummeted to 0.6526 from 0.6595 immediately after the RBNZ cut rates by 25 basis points. The flightless bird then sprouted wings and flew back to 0.6590 in choppy trade, settling at 0.6580. Love that Kiwi!

- AUD/USD – the Aussie initially rose following the RBNZ announcement but slipped back on the rising China-US trade tensions. AUD/USD closed at 0.6990 (0.7012 yesterday).

- USD/JPY – extended its slide to 110.10, down 0.17% from 110.27 yesterday. Demand for the haven Yen was still evident as risk-off stance continues from the China-US trade war. The Dollar traded to an overnight and 6-week low of 109.904.

On the Lookout: Markets will closely monitor the trade negotiations between China’s Liu He and the US trade team which begin today. Trade sources suggest there will be time for only one meeting. Friday sees the official implementation of fresh US tariffs which are still on. We’re in for a lively two days ahead.

Economic releases today will also be closely watched beginning with China’s inflation numbers (11.30 am Sydney). China’s April Annual CPI is forecast to rise to 2.5% from March’s 2.3% while Producer Prices (annual) are also expected to climb to 0.6% from 0.4%. Japanese Consumer Confidence (April) round off data from Asia.

Canada reports its Trade Balance for April. US data releases include Headline and Core PPI (both forecast to ease) and April Trade Balance. The US trade deficit is expected to have increased to -USD 51.4 billion from -USD 49.4 billion.

Trading Perspective: The Dollar Index (USD/DXY), a popular measure of the Greenback’s value relative to 6 of its rivals closed little changed at 97.624. With the market’s focus on the trade war between China and the US, the pattern for various currencies should continue. Inflation numbers from China and the US will have some impact on the markets.

The haven Yen will continue to attract capital unless some positive progress is made on the trade talks. The Aussie and Kiwi will remain under pressure together with many of the Asian EM currencies. The Euro should maintain its recent trading range.

- USD/JPY – slip-sliding away. The Dollar will continue to drift lower. The immediate support at 109.80/90 should hold given the rise in US 10-year yields to 2.48%. Japan’s 10-year JGB yield was stuck at -0.06%. Immediate resistance lies at 110.30 followed by 110.60. Look for a likely range today of 109.85-110.35.

- AUD/USD – The Aussie Battler finished just under the 0.70 cent mark. The pressure from the heat generated by the US-China trade war weighs on the Australian Dollar. AUD/USD has immediate support at 0.6980 and 0.6960. The 0.6960 level is strong and should hold any aggressive selling. Immediate resistance can be found at 0.7030 followed by 0.7050. Look to trade a likely range of 0.6980-0.7030. Prefer to buy on dips.

- EUR/USD – The Euro finished virtually flat at 1.1192 after trading in a relatively narrow 1.1183-1.1213 range last night. The surprise advance in Germany’s Industrial Production failed to lift the Single Currency. Immediate support lies at 1.1180 (overnight low 1.11827). The next support level is found at 1.1160. Immediate resistance can be found at 1.1220 followed by 1.1250. Look to buy dips with a likely range today of 1.1185-1.1225. Prefer to buy dips, the specs are still short Euro bets.

- GBP/USD – slip-sliding away. The risk of Theresa May being replaced as PM of Britain is rising. The deeply divided Parliament has rejected May’s EU deal three times and the postponement of an exit date has weighed on Sterling. The political uncertainty will continue to pressurise Sterling. Immediate support lies at 1.2990 followed by 1.2950. Immediate resistance can be found at 1.3030, 1.3060 and 1.3090. Look for a likely trading range today of 1.2990-1.3060. Just trade the range shag on this one.

Happy trading all.