Summary: Growing fears of a trade war between China and the US boosted the Yen while the VIX Volatility Index soared as much as 25%. Risk appetite took a hit when President Trump and announced that the US would ratchet up tariffs on $200 billion of Chinese imports. China’s Commerce Department confirmed that Vice Premier Liu He would still head a trade delegation to Washington as agreed. Yesterday, the South China Morning Post noted that China is not about to give in on Trump’s latest threats.

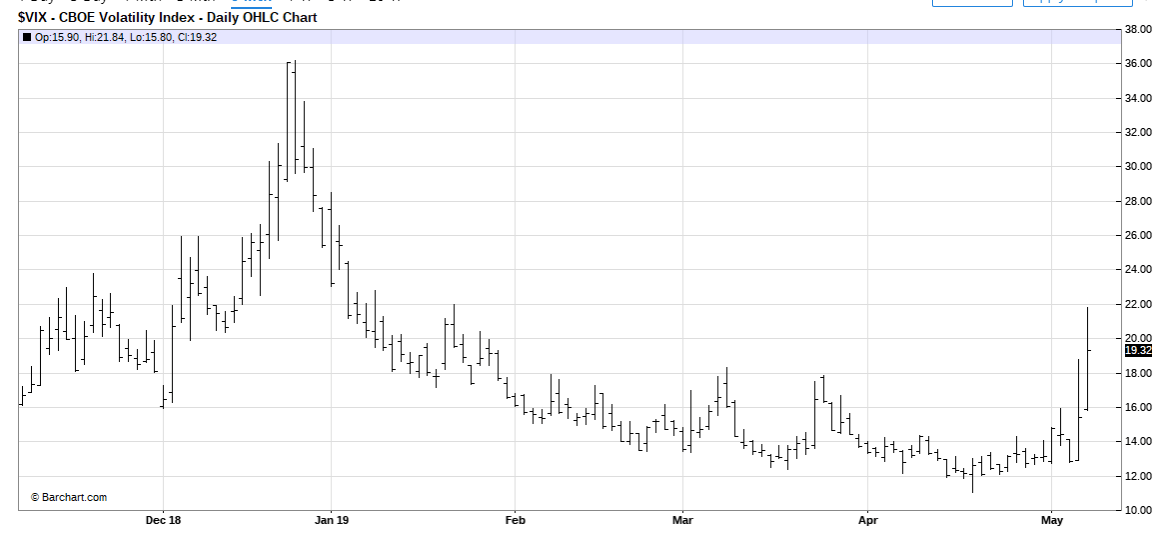

The VIX Volatility Index settled at 19.13 after jumping to 21.85 from 12.9 on Monday. The Dollar slumped 0.53% against the Yen to 110.23 (110.87) lifting the Yen to best performing currency. The Australian Dollar popped to 0.7048 after the RBA left its cash rate unchanged (1.5%), surprising many. AUD/USD slipped back to settle at 0.7015. The Dollar Index (USD/DXY) was little-changed, up 0.04% at 97.557 from 97.537 yesterday. A lower outlook for growth in the Euro area to 1.2% from 1.3% from the Spring EU economic report weighed on the Single currency. EUR/USD closed modestly lower at 1.1192 (1.1202). Ahead of today’s RBNZ rate decision, the Kiwi was little-changed around 0.6600. EM Currencies were mostly weaker. The Turkish Lira (TRY) lost 1% while the Offshore Chinese Yuan (CNH) was down 0.4% around 6.80.

Wall Street stocks extended losses. The S&P 500 was down 0.66% to 2,891 (2,933).

Australia’s Trade Balance and Retail Sales both beat forecasts.

- USD/JPY – The Dollar slid further to an overnight low of 110.169 before settling at 110.25. The Japanese Yen, boosted by risk-aversion demand, ended as best performing currency.

- AUD/USD – Aussie Battler popped to 0.70477 highs immediately after the RBA announced that it would keep rates unchanged. At least half of the market expected a cut. AUD/USD then drifted lower to 0.7015 as the RBA maintained its dovish hold stance.

- EUR/USD – the Euro was unable to maintain its foothold above the 1.1200 support area. The downward revision from the EU economic report on economic growth weighed on the Single currency.

- VIX Volatility Index – The VIX which has settled in calm, low vols trade around the 12-14 range for most of April, sprang to life, soaring to a high of 21.85 before settling at 19.32 at the close. The tense trade situation will keep the VIX elevated.

On the Lookout: Trade tensions will keep markets occupied today. The Chinese trade delegation headed by Vice Premier Liu He flies to Washington DC on Thursday and Friday. The fresh trade tariffs take effect on Friday if no agreement is reached.

China reports their Trade Balance today with an expected increase in their massive trade surplus, both in Yuan and USD terms. The US trade balance is due for release tomorrow. We could be in for further fireworks.

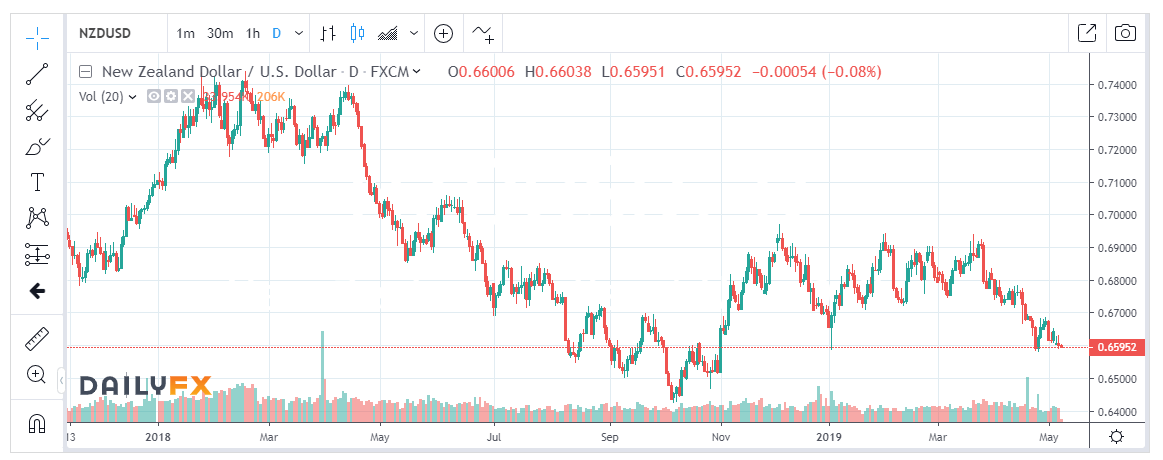

Currency markets will shift their attention to the RBNZ’s rate decision later today. The RBNZ is expected to follow the RBA’s lead, maintaining rates in a dovish hold.

Other data releases today include German Industrial Production, UK Halifax House Price Index and RICS House Prices. The ECB releases its monetary policy meeting accounts.

Trading Perspective: With the focus on the trade tensions between the US and China, the Japanese Yen will continue to outperform. The Dollar Index (USD/DXY) finished little-changed but should stay supported. Overnight US bond yields slipped. Those of its Rivals fell further. US 10-year yields were down to 2.46% from 2.47%. Germany’s 10-year Bund yielded -0.04% from 0.00%. UK 10-year yields were 6 basis points lower at 1.16%.

- EUR/USD – The Euro slipped further but looks likely to maintain its recent range. EUR/USD traded to an overnight high of 1.12179. Immediate resistance lies at 1.1220 and 1.1250. Immediate support can be found at 1.1170 (overnight low 1.11667). The next support level lies at 1.1140. Look for a likely trading range today of 1.1170-1.1220. Look to buy dips near the lows.

- AUD/USD – The Australian Dollar could lose some support but expect buying interest to emerge around the psychological 0.70 cent area. The Aussie has immediate support at 0.6980 followed by 0.6960 (strong). Resistance can be found at 0.7030 followed by 0.7050. Look for a likely trading range today of 0.6990-0.7040. Prefer to buy dips.

- NZD/USD – Expect the Kiwi to pop should the RBNZ keep rates on hold. The New Zealand economy is in a slightly better place than its larger cousin. NZD/USD has immediate support at 0.6590 (overnight low 0.6588). Immediate resistance can be found at 0.6630 and 0.6660. If the RBNZ cuts rates, this would be a shock surprise and the Kiwi will tank to 0.65 cents. Which is highly unlikely, but anything is possible in the FX markets. Look for a likely trading range of 0.6585-0.7035 until the RBNZ decision (12 pm Sydney time).

- USD/JPY – The Dollar still looks soft against the Yen and a potential test of 110.00 is likely given the tense trade situation. USD/JPY has immediate support at 110.10 followed by 109.80. Immediate resistance can be found at 110.50 and 110.80. Look for a likely trading range today of 110.10-110.60 with the preference still to sell USD/JPY rallies.

Happy trading all.