Summary: Dollar losses accelerated as ongoing protests following the death of a civilian in the hands of a police officer in most major US cities deteriorated, marred by looting and violence. An erosion in its safe-haven status also weighed on the Greenback. Tensions between the US and China remained elevated with the news that China may be halting purchases of US soybeans. Equities and risk currencies discounted the bad news, choosing instead to focus on the global economic recovery, aided by unprecedented stimulus and easy money. The Australian Dollar skyrocketed to an overnight and late January 17 highs at 0.68034, easing to settle at 0.6795 in late New York, a gain of 2.2%. Robust demand from short covering continued to support the Aussie Battler. Sterling was the next best performer against the Greenback, climbing 1.36% at the close to 1.2490 (1.2352). The Euro extended its advance, climbing to an overnight and 17 March peak at 1.1154 before retreating to 1.1130, up 0.46%. Euro area Manufacturing PMI’s on the whole saw modest recoveries in May from April’s lows. The USD/CAD pair slumped 1.3% to 1.3575 (1.3765 yesterday), its lowest close since early March. Against the Japanese Yen, the US Dollar was moderately lower to 107.58 (107.80). Wall Street stocks pared their gains at the close. The DOW was 0.06% lower to 25,502 (25,516). The S&P 500 dipped to 3,056 from 3,059. Bond yields were mixed.

China’s Caixin Manufacturing May PMI rose to 50.7 from 48.4 in April, beating estimates of 49.6.

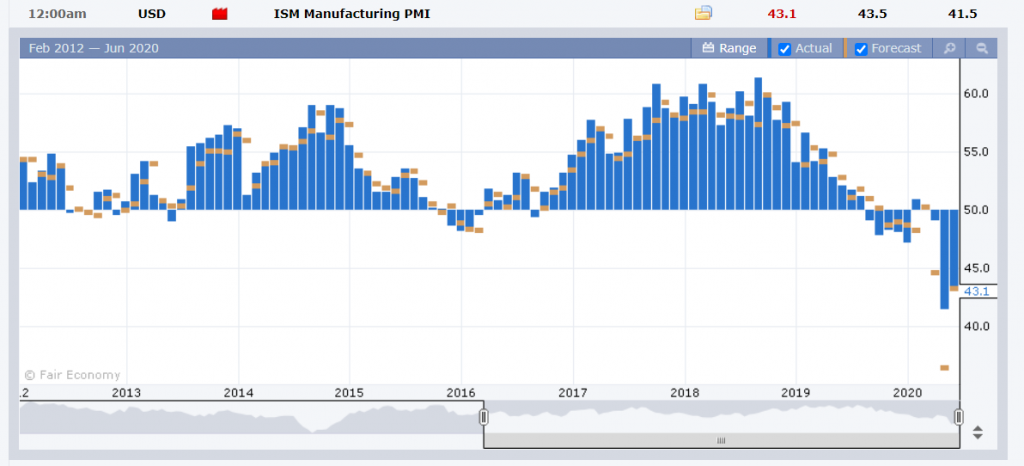

The Eurozone’s Manufacturing PMI steadied to 39.4 in May, virtually matching April’s 39.5, and forecasts at 39.5. US ISM Manufacturing PMI in May rose to 43.1 from April’s 41.5. US Construction Spending slipped to -2.9% in May, bettering forecasts at -6.5%.

On the Lookout: Risk appetite continued to discount all the bad news, instead preferring to pin hopes on a robust resumption in the global economic recovery. Meantime the world’s two largest economies continue to wrestle on trade issues. The geopolitical risk from a potential trade war between China and the US would set any global recovery back.

Today’s main event sees the RBA Policy Rate meeting announcement and statement (2.30 pm Sydney). The RBA is expected to keep its Overnight Cash rate unchanged. FX expects Governor Philip Lowe and his colleagues to remain cautiously optimistic in their outlook even as Australia ends its lockdown. Earlier New Zealand releases its Building Consents and Overseas Trade Index (Q1). Australia reports its Current Account and Q1 Company Operating Profits. European data kicks off with Swiss Retail Sales, Manufacturing PMI’s, and Spanish Unemployment Change. The UK follows with its Nationwide House Price Index, Mortgage Approvals, and Net Lending to Individuals. There are no major US data releases.

Trading Perspective: The Dollar fell across the board with the risk currencies led by the Australian Dollar benefiting most. Negative sentiment has been building against the Greenback since the Euro and Aussie began their recoveries. Traders have ignored geopolitical risks with shrugging off the increasingly unruly and violent US protests as well as the escalating US-China tensions. Meantime, US economic data has stabilised. The ISM Manufacturing report saw a steadying in factory output. The Dollar’s slump has been technically driven, and this looks to be overdone. Geopolitical tensions should see a move back into the Greenback.

AUD/USD – Skyrockets, “Blinded by the Light”, 0.6820 Caps Resilience

The Aussie Battler stayed extremely resilient to the ongoing geopolitical turmoil, skyrocketing to 0.68034 overnight and January 17 highs before easing to settle at 0.6795. Trade tensions between Australia and China increased with speculation that China is planning to impose an import ban on Australian coal. The elevated confrontation between Washington and Beijing will cap the Aussie’s resilience. The recovery in the Aussie has been remarkable, the currency was trading near 0.64 cents in mid-May. Earlier gains in the currency were due to speculative short covering as the AUD/USD pair soared above the 0.66 cent level. Above 0.68 cents will be difficult to justify with anything beyond likened to being “blinded by the light.”

The RBA today is widely expected to keep its current monetary policy unchanged.

AUD/USD has immediate resistance at 0.6820 followed by 0.6550. Immediate support lies at 0.6740 followed by 0.6690. Look for a likely trading range today between 0.6680 and 0.6820. Shut your eyes and sell rallies, don’t allow yourself to be “blinded by the light.”

EUR/USD – Extends Advance, Retreats Off 1.1150, Risks Correction Lower

The Euro extended its advance against the broad-based US Dollar sell-off, trading to 1.1154 overnight and 17 March highs before easing to 1.1132. Euro area Manufacturing PMI’s were mostly within forecasts but were below preliminary readings in May. The shared currency faces strong resistance at the 1.1150-1.1200 area ahead of Thursday’s ECB rate policy meeting.

Brexit worries have returned to the spotlight and will be a major headache not only for the British Pound but for the Euro too. The UK and the EU sit down for another round of virtual talks this week. While meaningful progress is unlikely until the Northern Hemisphere Autumn, the chances of a free trade agreement are fading.

Speculative net long Euro bets continue to be at elevated levels which is another drag to further gains from current levels.

EUR/USD has immediate resistance at the 1.1150 and a clean break above 1.1154 highs could see 1.1186. The 1.1200 resistance level remains strong. Immediate support can be found at 1.1100 followed by 1.1060. Expect a trading range today between 1.1020-1.1150. Prefer to sell any rallies.