Summary: The Dollar edged up to close modestly higher against its Rivals as robust services offset a weak US private sector jobs report. US bond yields held steady, the 10-year stabilising at 2.13%. Global rival yields were lower, in contrast. The Euro slipped 0.29% to 1.1223 from 1.1254 as traders prepared for the ECB policy meeting amidst a downturn in Euro area growth. The Dollar settled at 108.28 Yen, up 0.17%, after initially rising to 108.45. Various reports regarding US negotiations on trade and immigration with Mexico were hitting the headlines into the New York close. The Australian Dollar slipped to 0.6968 (0.6994) after failing to clear 0.70 cents. Weaker than expected Chinese Caixin Services PMI and lower commodity prices were a headwind for the Aussie. The Dollar Index (USD/DXY) was 0.24% higher at 97.302 (97.123). Sterling edged lower to 1.2682 from 1.2700, little-changed amidst President Trump’s promise of a phenomenal trade deal.

Wall Street stocks closed higher for the second day running as bets for a Fed rate cut in July grew. The DOW and the S&P 500 both slipped off their highs to settle 0.5% up on the day.

Brent Crude Oil prices slumped 2.21% to $60.25 ($61.20). Data releases yesterday: Australia’s Q1 GDP rose 0.4% on the quarter, matching forecasts. Australia’s economy grew at an annual 1.8% clip.

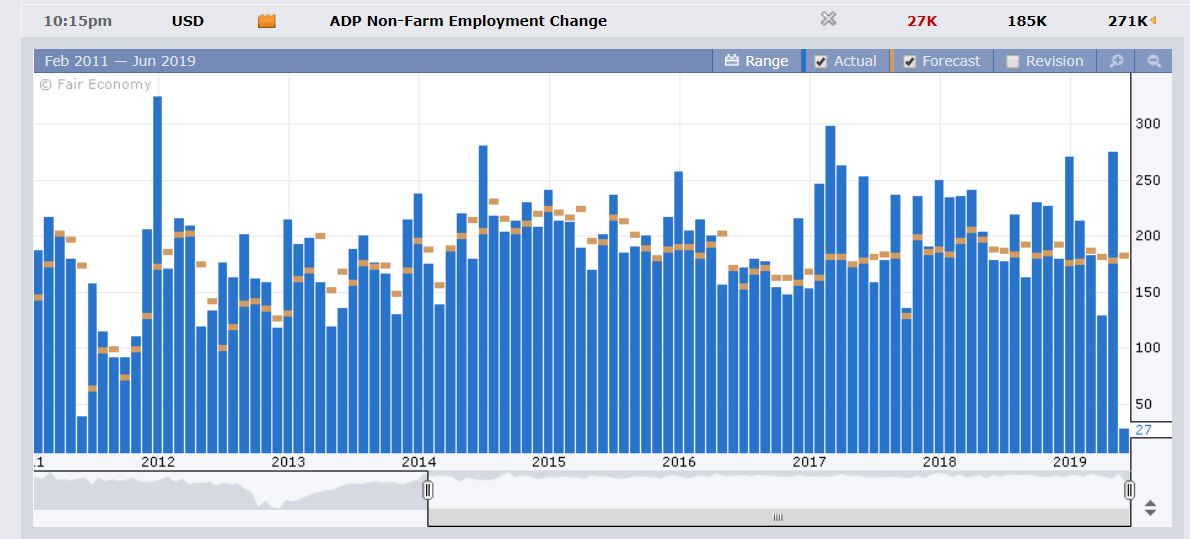

China’s Caixin Services PMI in May fell to 52.7 against a forecast of 54.3 and a previous 54.5. Euro area Services PMI reports mostly matched forecasts. UK Services PMI beat forecasts at 51.0. US ADP Private Employment Change resulted in 27,000 jobs created (against a forecast of 183,000.). This was the lowest increase in over 9 years. US ISM Non-manufacturing PMI outperformed, rising to 56.9 against a forecast of 55.6 and a previous 55.5.

- EUR/USD – slipped to 1.1225 support after trading to an overnight high at 1.13067. The combination of a weak US private sector jobs and hopes for a breakthrough on trade talks with Mexico had boosted the Euro. Robust US Services sector data and what appeared as failed US-Mexico negotiations pushed the Single currency back. Up next, the ECB.

- USD/JPY – The Dollar jumped against the Yen to a high of 108.484 on the initially risk positive US-Mexico trade talk news. USD/JPY slipped back to 108.27, modestly higher from yesterday’s 108.27. Japanese 10-year JGB bond yields fell 2 basis points to -0.13% which are USD supportive.

- AUD/USD – the Australian Dollar lifted to an overnight and 3-week high at 0.70075 before turning down to 0.6970. Australia’s Q1 GDP rose an annual 1.8% to March, the weakest increase since the global financial crisis.

On the Lookout: Markets will continue to monitor trade talks between Mexico and the US which resume tomorrow. Today sees a data heavy calendar culminating with ECB policy meeting, statement and Press Conference. Australia’s Trade Balance kicks off the data reports. Germany Factory Orders, Eurozone Final Employment Change, Revised Q1 GDP (q/q), start off Europe’s calendar. The ECB is expected to keep policy unchanged although traders will be looking at the level of policy makers concern on the Eurozone’s growth downturn. Canada reports on its Trade Balance and IVEY PMI. US data sees Revised Non-Farm Productivity, Trade Balance, and Weekly Jobless Claims.

Bank of Japan Governor Haruhiko Kuroda and BOE Head Mark Carney are both speaking at the Institute of International Finance in Tokyo. New York Fed President and FOMC John Williams speaks at an international economics meet in New York.

Trading Perspective: The Dollar Index has found a short-term base at 97.00 heading into Friday’s Payrolls report. Ten-Year US bond yields steadied at 2.13% while those of its global rivals fell. Germany’s 10-year Bund yield fell 2 basis points to -0.23%. UK 10-year yields were down 4 basis points to 0.86% while Australian 10-year notes were yielding 1.48% from 1.50% yesterday. The Dollar’s topside will be limited by growing expectations of a Fed rate cut. According to MarketWatch, Fed fund futures markets see a 72% chance of a rate cut at the Fed’s July meeting, with the probability of a June rate cut at 23%. Last, and not least, speculators are still carrying long Dollar bets which still have a long way to correct.

- EUR/USD – The Single Currency faces immediate and strong resistance between 1.12380 and 1.1310 given last night’s rejection (overnight high 1.13067). EUR/USD closed at 1.1222. Immediate support can be found at 1.1220 and 1.1200. The next support lies at 1.1180. Immediate resistance is at 1.1260 followed by 1.1280. The ECB’s statement will be closely monitored given the region’s manufacturing downturn. Look to trade a likely range today of 1.1210-1.1270. Prefer to buy dips, the market is still short of Euro bets.

- USD/JPY – The Dollar has found a strong base at 107.80 which should hold unless the trade outlook deteriorates sharply from here. The US 10-year yield held steady at 2.13% while Japan’s slipped 2 basis points to -0.13%. USD/JPY traded to an overnight high at 108.484, which puts immediate resistance at the 108.50 level. The next resistance level is found at 108.70/80. Immediate support lies at 108.10 and 107.80. Look for Japan Inc to provide support at the 108.00 region. Market positioning, which are short JPY bets will keep a topside to USD/JPY. Look to trade a likely range of 108.15-108.75. Prefer to buy dips.

- AUD/USD – The Aussie Battler failed in its second attempt to clear 0.70 cents. AUD/USD slipped back to 0.69624 overnight lows. Immediate support can be found at 0.6960 followed by 0.6930. The next level of support is found at 0.6900. Immediate resistance lies at 0.7000. The next resistance level can be found at 0.7030. Aussie short bets saw a mild increase in the latest COT/CFTC report. Look to trade a likely range today of 0.6960-0.7020. Prefer to buy dips.

Happy trading all.