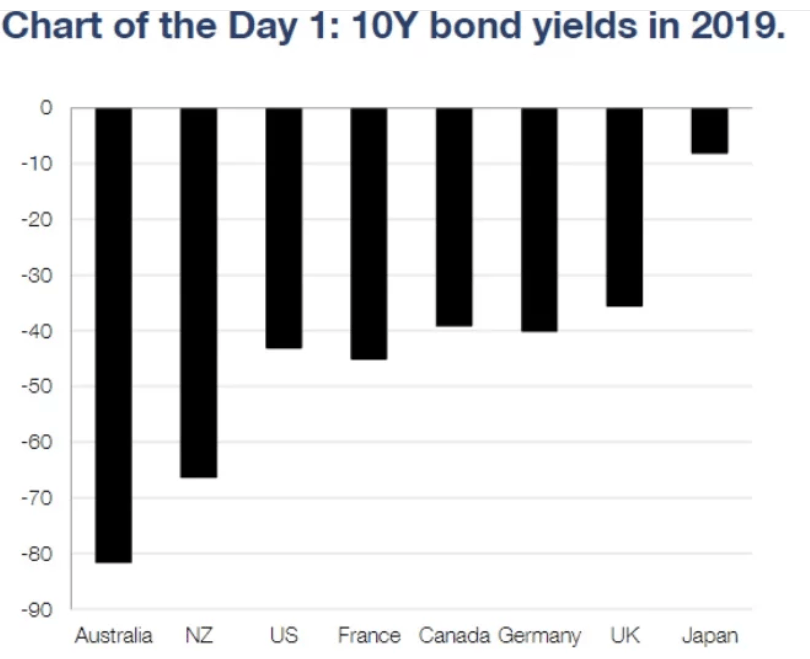

Summary: The Dollar grinded higher as global rivals tumbled, with the trade war effects being felt by their economies. A popular index which tracks the Greenback against the Euro, Sterling, Yen and 3 other rivals climbed 0.22%. The Dollar Index (USD/DXY) closed at 98.166, within striking distance of its 2-year high. Germany’s Jobless Rate climbed to 5.0 against an expected 4.9%, as the manufacturing and services slowdown hit employment. The Euro dropped to 1.1130 from 1.1160. Germany’s 10-year Bund yield slipped 2 basis points to -0.18%. High beta currencies, Aussie, Kiwi and Canadian Dollar, a good gauge of risk aversion, tumbled. New Zealand’s Kiwi was the worst performer, slumping 0.52% as New Zealand’s 10-year yield sunk to a 1985 low of 1.69%. The Bank of Canada left interest rates unchanged (1.75%) but warned that the escalating trade war was a problem for global growth. USD/CAD jumped to 1.35465 (1.3497 yesterday), before settling at 1.3515. Risk-Off waves hit Wall Street stocks anew while bond yields tumbled. The DOW extended its fall to close at 25,141.00 from 25,365 yesterday. The benchmark US 10-Year treasury yield plummeted to 2.2% lows before steadying to finish at 2.26% (2.27% yesterday).

- EUR/USD – slip-sliding away, the Multi-currency eased its way toward 1.1107, 2019 lows which were hit just about a week ago. EUR/USD finished at 1.1130 after trading to 1.11244 overnight lows. Germany saw an increase of 60,000 unemployed, its biggest one month rise in over 10 years. Most of this was due to a reclassification of workers.

- GBP/USD – Sterling extended its slide against the Dollar weighed by the UK’s messy political scene. There was no economic data released from Britain yesterday. GBP/USD slid to 1.2628 from 1.2652 yesterday.

- AUD/USD – The Aussie eased to 0.6918 from 0.6924 yesterday. With no end in sight to trade hostilities between China and the US, the Aussie’s topside was limited. Australia’s 10-year bond yield fell to 1.48% (1.53% yesterday), its record low close and below the RBA cash rate of 1.5%.

- USD/JPY – the Dollar rallied to 109.60 from 109.35 as the US 10-year yield rebounded to 2.26% from 2.22%. Japanese corporate buyers once again showed their hand near the lows at 109.148. Risk aversion limited the topside to 109.70.

On the Lookout: The bounce in the US 10-Year bond yield to 2.26% from its low steadied bond yields and currencies. The Dollar Index eased to 98.13 from 98.166.

Market’s will continue to monitor developments in the escalating trade war between the world’s two largest economies. The economic data calendar springs back to life today after a slow start this week due to the US and UK holidays Monday. Australia starts off with April Building Approvals and Q1 Private Sector Capital Expenditure reports (both at 11.30 am Sydney). New Zealand releases its Annual Federal Budget report.

Germany, France, and Switzerland are closed for their Ascension holiday. Spain releases its annual Flash CPI report. Canada follows with its Q1 Current Account data. The US Preliminary Q1 GDP report will be the major focus for markets today. Other US data are Goods Trade Balance, Weekly Unemployment Claims, US Preliminary GDP Price Index (Q1), and Pending Home Sales (May).

Trading Perspective: The slide in US bond yields from 2.6% to 2.22% (lowest since September 2017) was a result of the rising wave of risk aversion. While the Euro and high beta currencies, Aussie, Kiwi, Loonie weakened, market positioning in these currencies remain short and overextended. Interest rate markets are now pricing a Fed rate cut in September at 80%. Expect more choppy trading with the Dollar’s topside limited. US Q1 GDP data will be closely watched.

- EUR/USD – The Euro eased further to an overnight low at 1.1124 before steadying to close at 1.1130. Europe’s economy remains vulnerable to the manufacturing slowdown and worsening trade hostilities between China and the US. On the other hand, net Euro short bets are the largest in 3 years. The Multi currency is more than 20% undervalued. EUR/USD has immediate support at 1.1120 and 1.1100. A sustained break of 1.1100 could see 1.1000, two-year lows. Expect a likely range today of 1.1125-1.1175. Prefer to buy dips are these lower levels.

- AUD/USD – The Australian Dollar slipped 0.14% to 0.6918 from 0.6924 yesterday. The Battler fared better than other currencies despite the rise in risk aversion. AUD/USD has immediate support at 0.6900 (0.69041 overnight low). The next support level can be found at 0.6870. Immediate resistance lies at 0.6930 (overnight high 0.69315) followed by 0.6960.

Australian Q1 Private Capital Expenditure is due out today. The market remains bearish on the Aussie as 10-year yields fell below the RBA cash rate. Expect a range today of 0.6885-0.6935. Prefer to buy dips after the latest build in Aussie shorts. - USD/JPY – The Dollar edged higher boosted by the rally in the US 10-year yield back to 2.26%. Japanese corporate and importer interest to buy USD/JPY continues to support this currency pair in the low 109 area. Overnight low was 109.148. USD/JPY climbed to 109.60 at the NY close (109.30 yesterday). Immediate support lies at 109.30 followed by 109.10. Immediate resistance can be found at 109.70, overnight high. The next resistance level lies at 110.00. Look to sell rallies today with a likely range of 109.20-109.80.

Happy trading all.