Asian indices finished lower today as the China-U.S. trade dispute continues and a Chinese official hinted yesterday that Beijing could use its strength in rare earth minerals as leverage in its trade dispute with the United States. A rally in US 10-year treasuries saw yields slump to multi-year lows resulting in the inversion of the yield curve for the second time this year. It’s a repeat of the warning shot first fired in March this year.

The Nikkei225 finished 1.21 percent lower to 21,003 below its 100-day moving average the Hang Seng benchmark in Hong Kong finished 0.40 percent lower at 27,285. The Shanghai Composite finished 0.18 percent higher to 2,914 below the 100-day MA, while in Singapore the FTSE Straits Times index finished 0.16 percent lower to 3,154. Australian equities closed down 44 points or 0.7% to 6,440, giving up yesterday’s gains.

European session started lower today as risk aversion has been on the rise following news that EU is preparing to launch EDP against Italy in June, the DAX30 is 0.88 percent lower to 11,921 and CAC40 is 1.27 percent lower at 5,245 while the FTSE MIB in Milan is trading 0.99 percent lower at 20,057. The London Stock Exchange is giving up 0.84 percent to 7,208 as traders increasingly concerned over the impact that the ongoing trade dispute is having on the global economy.

In commodities markets, crude oil gives up 1.29 percent to 58.38 after American Petroleum Institute data showed that U.S. crude stockpiles rose unexpectedly the previous week. Brent oil trades also lower at $69,38 per barrel as major oil producers have yet to agree on adjustments on output. Gold is trading around 1283 zone in a quiet session. The precious metal is trading between 50 and 200-hour moving average turning the technical picture to neutral. Gold will find support at 1272 the low from the previous week while more bids will emerge at 200-day moving average at 1255 on the upside resistance stands at 1296 the 100-day moving average.

In cryptocurrencies market, bitcoin (BTCUSD) retreats today to 8,525, the daily low for BTC was at 8,410 and the daily high at 8,735. Immediate support for BTC stands now at $8,000 round figure, on the upside strong resistance stands at 8,845 the recent high. eToro’s, Mati Greenspan, says Bitcoin’s increasingly limited supply is the number one reason for the leading cryptocurrency’s 2019 rally. Ethereum (ETHUSD) also gives up 6 dollars to 263, on the upside the immediate resistance stands at 273 the high from yesterday while the support stands at 258 and the 100 hour SMA, Litecoin (LTCUSD) trades lower at 111.10. The crypto market cap holds above $175.0B.

On the Lookout: Donald Trump said yesterday that his administration was “not ready” to make a trade deal with China, adding tariffs on the country’s imports could go up “substantially.” Huawei filed a motion in USA court challenging the constitutionality of a law that limits its sales of telecom equipment.

In European macro news the France Gross Domestic Product (QoQ) matched economist’s forecasts (0.3%) in 1Q and in Switzerland the KOF Leading Indicator came in at 94.4, below expectations (95.9) in May. Fears of a coming battle between Italy and EU returned this week as reports emerged stating the EU is considering disciplinary action over the Italian government’s failure to rein in debt.

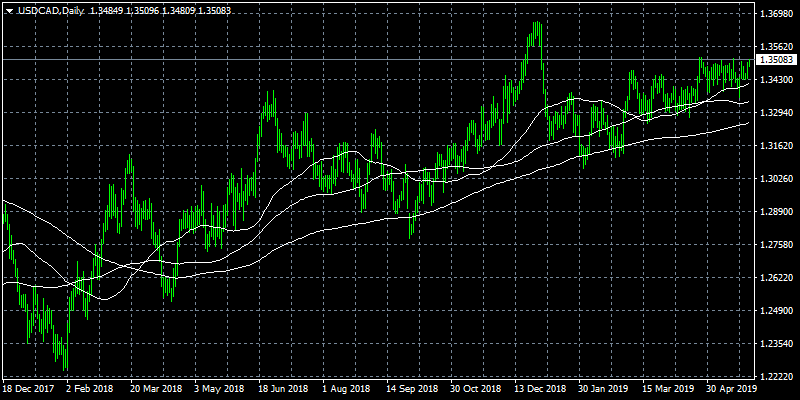

The monetary policy meeting by the Bank of Canada (BOC) will gain also market focus. The Canadian central bank is likely not to alter present monetary policy with 1.75% overnight rate.

In the America economic calendar, we await the Richmond Federal Reserve manufacturing index will be released, along with weekly mortgage finance data.

Trading Perspective: In fx markets, major currencies are little changed, the US dollar trades higher to 97.95, the Aussie dollar trades flat at 0.6918 supported by better Australian consumer confidence data and the rally in iron ore prices. Kiwi gives up 20 cents to 0.6528 level.

GBPUSD trades flat at 1.2655 as the bearish momentum for Cable is still intact amid growing concerns over Brexit. The pair hit the daily low at 1.2641 and the daily high at 1.2664. On the upside immediate resistance now stands at 1.27 the high from Asian session while more sellers will emerge at the 200-hour moving average at 1.2713. Sterling shows persistent weakness amid UK political uncertainty and also on the back of risk aversion.

In Pound futures markets open interest rose by 7.2K contracts volume, shrunk by more than 9K contracts.

EURUSD also trades flat today to 1.1160 on trade tensions, patient Fed and EU weakness. The pair is losing the bullish momentum build last Friday and now looks neutral. On the upside, the immediate resistance stands at 1.12 the high from yesterday, while more offers will emerge at 1.1245 the 50-day moving average. We are following news from Italy as their budget deficit dispute with the European Commission continues.

In Euro futures markets, traders added 2.7K contracts to their open interest positions on Tuesday from Friday’s final 535,859 contracts, volume increased by around 62.7K contracts.

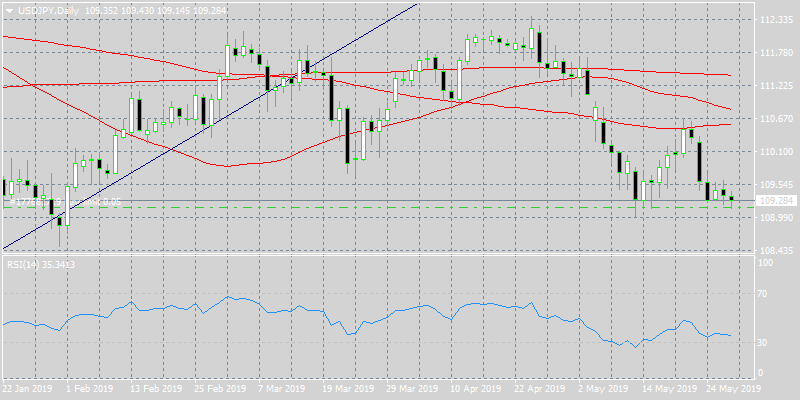

USDJPY is down for one more day giving up 0.13 percent to 109.20. Today the pair hit the low at 109.14 and the high at 109.43. The pair will find support at 109.14 the low from Asian session, on the upside immediate resistance for the pair now stands at 110 and then at 110.54 the 100-day moving.

In Yen futures markets open interest rose by just 920 contracts on Tuesday extending the erratic activity seen as of late, volume increased by around 49.1K contracts.

USDCAD managed to break above the 1.35. The pair will find immediate support at the 50-day moving average around 1.3392 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at the 1.36 zone before an attempt to YTD high.