Summary: FX markets shunned recent economic data, eyeing trade negotiations amid looming signs of a global recession. Uncertainty prevailed on China signalled its willingness to deal on parts of the negotiations but were reluctant to agree to President Trump’s broader trade package. With top level talks scheduled to resume Thursday and Friday, the Dollar Index (USD/DXY) rose modestly to 98.985 (98.84), up 0.17%. Traders chose to return to the Greenback, which has remained steady despite chances of a more aggressive Fed loosening monetary policy. FX will look to the Fed’s September FOMC meeting minutes (early Thursday) for further clues as to whether the Fed will trim rates this later this month. USD/JPY rallied 0.38% to 107.30 (106.92) on the resumption of trade talks and higher US bond yields. The Euro hit 1.10006 yet again but retreated in New York, closing at 1.0974, little changed from 1.0977 yesterday. Germany Factory Orders dipped to -0.6% missing forecasts at -0.4%. Sterling edged lower against the Greenback to 1.2295 (1.2335) with signs of any Brexit deal between the UK and EU no closer. The Australian Dollar retreated 0.48% to 0.6733 from 0.6767 on the uncertainty surrounding the trade negotiations. Emerging Market currencies slumped against the Dollar, reversing gains made yesterday. USD/ZAR (Dollar- South African Rand) soared 1.28% to 15.1838 (0590). USD/TRY (Dollar-Turkish Lira) jumped 2.62% to 5.84 from 5.70 yesterday.

US treasury yields rebounded. Two-year bond yields climbed 6 basis points to 1.46%. The US 10-year rate was up 3 basis points to 1.56%. Wall Street stocks fell. The DOW closed 0.35% lower at 26,487. (26,555) while the S&P 500 fell 0.47% to 2,936. (2,952 yesterday).

Japan’s Leading Economic Indicators for September printed at 91.7 against forecasts of 91.8.

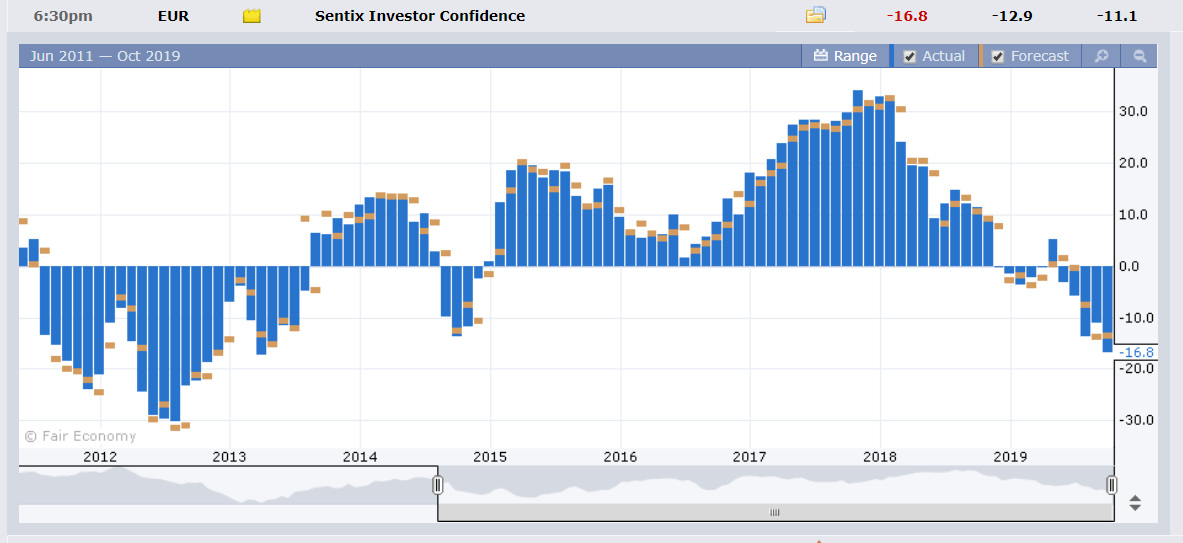

The Eurozone Sentix Investor Confidence Index slipped to -16.8, missing median expectations of -12.9. US Consumer Credit was up slightly at 17.9 billion versus forecasts of 14.9 bio.

- EUR/USD – The Euro failed to break above 1.1000 again after climbing for 5 straight day against the Greenback. Weaker-than-forecast German factory orders and Eurozone Sentix Investor Confidence weighed on the shared currency. EUR/USD closed at 1.0978.

- USD/JPY – the Dollar lifted against the Yen despite a dip in the market’s risk appetite. Higher US bond yields and a climb in speculative JPY long bets in the latest Commitment of Traders/CFTC report also restrained the Japanese currency. The US Dollar hit a high at 107.464 before retreating to 107.30 at the NY close.

- AUD/USD – The Australian Dollar retreated as uncertainty prevailed over the upcoming trade negotiations between China and the US. The weaker Emerging Market currencies also weighed on the Aussie and other trade sensitive FX. AUD/USD fell to 0.67298 before settling a tad higher at 0.6732 in New York.

On the Lookout: With the focus on trade, markets in Asia will watch for any news releases out of China today. Chinese markets return from their week-long National Day celebrations. Today also sees a data dump with more reports released.

Japan starts of the day with its Average Cash Earnings, Household Spending, and Current Account reports. Japan will also release its Economic Watcher’s Sentiment Diffusion Index (Sydney afternoon)

Australia’s National Australia Bank Business Confidence Index and ANZ Job Ads follow. China returns with its Caixin Services Index for September.

Bank of England Governor Mark Carney speaks at a Climate Related Financial Summit Task Force in Tokyo. Bank of England MPC members Tenreyro speaks at an ECB Conference in Frankfurt. MPC member Haldane speaks at a Financial Stability Conference in Lisbon.

Euro area reports start off with Switzerland’s Unemployment Rate, German Industrial Production, French Trade Balance, and Italian Retail Sales.

Canadian data sees the release of Housing Starts and Building Permits. US Headline and Core Producer Price Index round up the day’s reports.

Fed Chairman Jerome Powell speaks at a Business Association meeting in Denver. The FOMC’s Evans speaks at a function in Chicago.

Trading Perspective: The Dollar kept its bid tone overall despite last week’s weak US economic reports. The Greenback’s safe-haven status in the midst of uncertain trade negotiations is still alive. Meantime China returns to the markets after its long National Day holiday celebrations. US bond yields rebounded off their lows which is also providing the Greenback support.

Meantime the latest Commitment of Traders/CFTC report (week ended Oct 1) saw an increase in net speculative Dollar long bets to 9-week highs. The breakdown in the 9 IMM currencies show an increase in net short Euro, Aussie and Swiss Franc bets. Net speculative NZD shorts increased to hit another record.

- EUR/USD – the Euro retreated after trading to 1.1000 resistance level once again. The overnight high was 1.10006. The shared currency retreated against the overall stronger Greenback to 1.0975. Euro area data was also weaker with German Factory Orders and the Eurozone Sentix Investor Confidence Index both missing forecasts. Meantime, the latest COT/CFTC report saw net speculative Euro short bets increase to -EUR 65,978 contracts (week ended Oct 1) from the previous week’s -EUR 60,722. Immediate resistance remains at the 1.1000 level followed by 1.1030. Immediate support can be found at 1.0960 (overnight low 1.0962) followed by 1.0930. Look to buy dips in a likely 1.0955-1.1005 range today.

- USD/JPY – The Dollar rallied against the Yen to an overnight high at 107.464 before settling lower to close at 107.30 in New York. Higher US bond yields boosted the Greenback versus the Yen. USD/JPY traded to an overnight low at 106.65 before fresh buying boosted this currency pair. The latest COT/CFTC report saw net speculative JPY longs increase slightly to +JPY 13,917 contracts from +JPY 12,783 the previous week. Immediate support can be found at 107.00 followed by 106.70. Immediate resistance lies at 107.50 and 107.80. From these levels, it looks like a trading range will emerge between 106.70 and 107.70 for now.

- AUD/USD – The Aussie retreated following 4 straight days of gain at the expense of the Greenback. AUD/USD traded to an overnight high at 0.6765. The next resistance level is 6780 followed by 0.6810. Immediate support can be found at 0.6730 (overnight low 0.67298) followed by 0.6710. The latest Commitment of Traders report (week ended Oct 1) saw an increase in net speculative Aussie short bets to -AUD 52,302 from the previous week’s -AUD 47,155. Which is currently at 71% of the year’s maximum. Look to buy dips with a likely range today of 0.6725-0.6775.

Happy trading all.