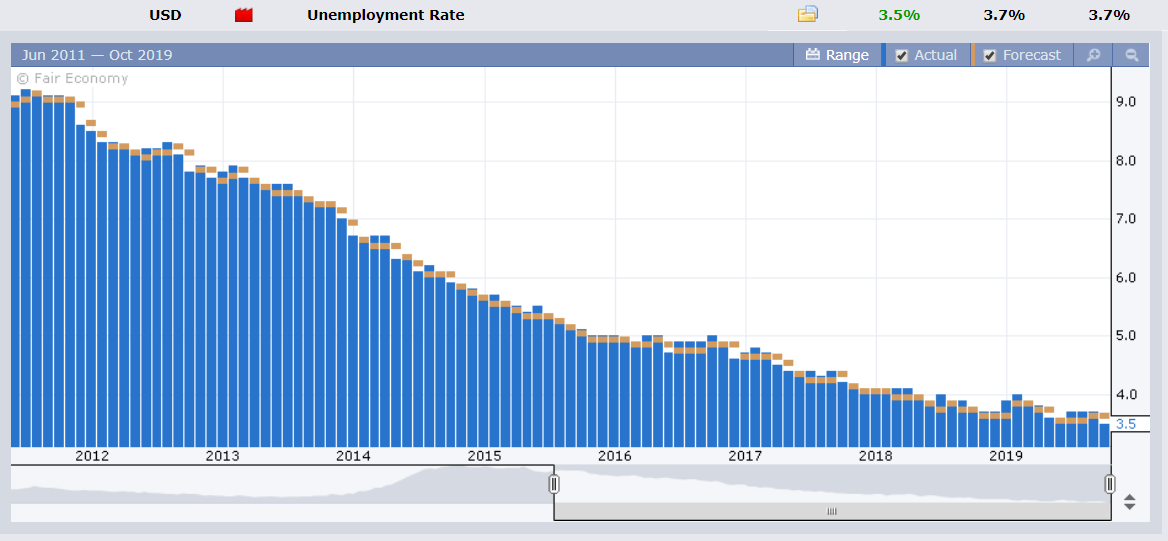

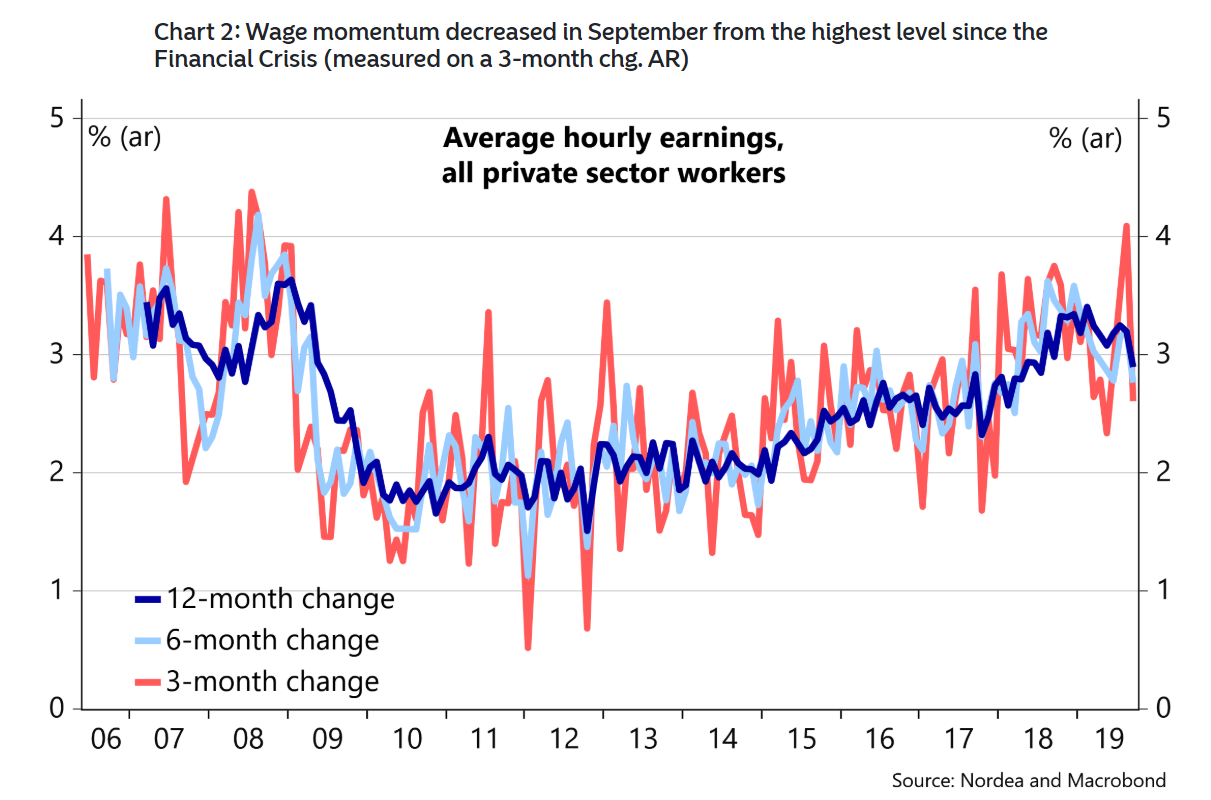

Summary: The Dollar finished mixed against it’s rivals after an initial rally following a US Payrolls report which was considered “solid”. A total of 136,000 Jobs were created in September, missing median forecasts of 145,000. The Unemployment rate dropped to a 50-year low of 3.5% (forecast 3.7%). Wages declined on a monthly basis to 0.0% from 0.4%, which corresponded to an annual rate of 2.9% from August’s 3.2%. The Euro was up slightly at 1.0977 from 1.0967. Sterling dipped to 1.2320 from 1.2335 with Brexit preventing any gains. The Guardian reported on Sunday that EU Brexit negotiator Michel Barnier said that Boris Johnson’s government would have to bear the blame for a no-deal Brexit. The Australian Dollar was best performing currency, extending its gains to 0.6767 from 0.6743. Shorts continued to cover after the antipodean currency hit 10-year lows last week at 0.6670. Wall Street stocks rallied on the Jobs report. Odds for a Fed rate cut in their October meeting rose to 85%. The benchmark US ten-year bond yield was flat at 1.53%.

Other data released Friday: Australian Retail Sales dipped to 0.4% against forecasts of 0.5% in September. Canada’s IVEY PMI slumped to 48.7 in September from August’s 60.6 and forecasts of 62.6.

- EUR/USD – The Euro dipped initially to 1.09571 following the US Payrolls report which highlighted the fall in the Unemployment rate to 3.5%, a 50-year low. The shared currency then rallied to finish at 1.0978 (1.0967) after the US Dollar’s rally ran out of steam.

- USD/JPY – The Greenback rallied to 107.134 initially as the US Jobs report came as a relief to Dollar bulls worried following last week’s slump in US factory and services plunge. US political tensions increased over the weekend with fresh allegations from a second whistle blower on President Trump’s dealings with the Ukraine. USD/JPY dipped to 106.75 in early Sydney after closing at 106.91 in New York Friday.

- AUD/USD – The Australian Battler saw more shorts run for cover after last week’s plunge to fresh 10-year lows at 0.6670. AUD/USD closed at 0.6767 from 0.6742 Friday morning. The weekend news of a second whistle blower in the case of President Trump’s dealings with the Ukraine has triggered some risk-off at the Sydney open. Trading conditions are thin with most Australian States closed in observance of Labour Day today.

On the Lookout: The US Unemployment rate dropped to a 50-year low while Job growth moderated. This was a relief to Dollar bulls after two weak reports last week heightened US recession fears. However, as Kathy Lien, Managing Director of Bank Asset Management observed, while the Jobless rate fell to 50-year lows, the US labour market is weakening, not improving. Wage growth stalled which poses a problem.

A Reuters report highlighted that manufacturing payrolls declined for the first time in 6 months. The retail and utility sectors also continued to shed jobs. While the jobs market is still the strongest in a decade, there is no question that the US is in the midst of a slowdown. Lien’s observations are right.

The Dollar is headed lower, not higher.

Today most States in Australia are closed in observance of Labour Day. Chinese markets are still closed as they observe their National Day holiday. Japan reports its Leading Economic Indicators. Euro area data start the Germany’s Factory Orders, and the Eurozone Sentix Investor Confidence Index. UK reports on its Halifax House Price Index. US Consumer Credit (September) rounds up today’s reports.

Trading Perspective: Interest rate differentials between the US and its rivals have been narrowing. Last week US 2-year bond yields plunged to 1.39%, near two-year lows. On Friday it managed to close at 1.4%. While this has not had a marked effect on the US Dollar, and is not always the main driver of FX, it will catch up and weigh on the Greenback.

- EUR/USD – The Euro traded to an overnight high at 1.1000 before easing to settle at 1.0978 at the NY close. The shared currency has immediate resistance at 1.1000. Immediate support can be found at 1.0955 (overnight low traded 1.0957). The next support level lies at 1.0930. On Friday the Euro struggled to break above the 1.1000 resistance level for the second time this week. A break above 1.1000 could see the Euro test the 1.11 level, last seen in the middle of September. Look to trade a likely range today of 1.0955-1.1005. Prefer to buy dips.

- USD/JPY – With US bond yields steadying at their lows, the Dollar will stay under pressure against the Yen. The latest political drama in Washington on the news of a second whistle blower on Trump’s dealing with the Ukraine saw a mild risk-off in Asia. USD/JPY dipped to 106.65 low in Sydney this morning from its 106.91 NY close. USD/JPY has immediate support at 106.50 followed by 106.20. Immediate resistance can be found at 107.10 (overnight high traded 107.13). The next resistance level lies at 107.30. Look to trade a likely range today of 106.55-107.15. Just trade the range shag on this one.

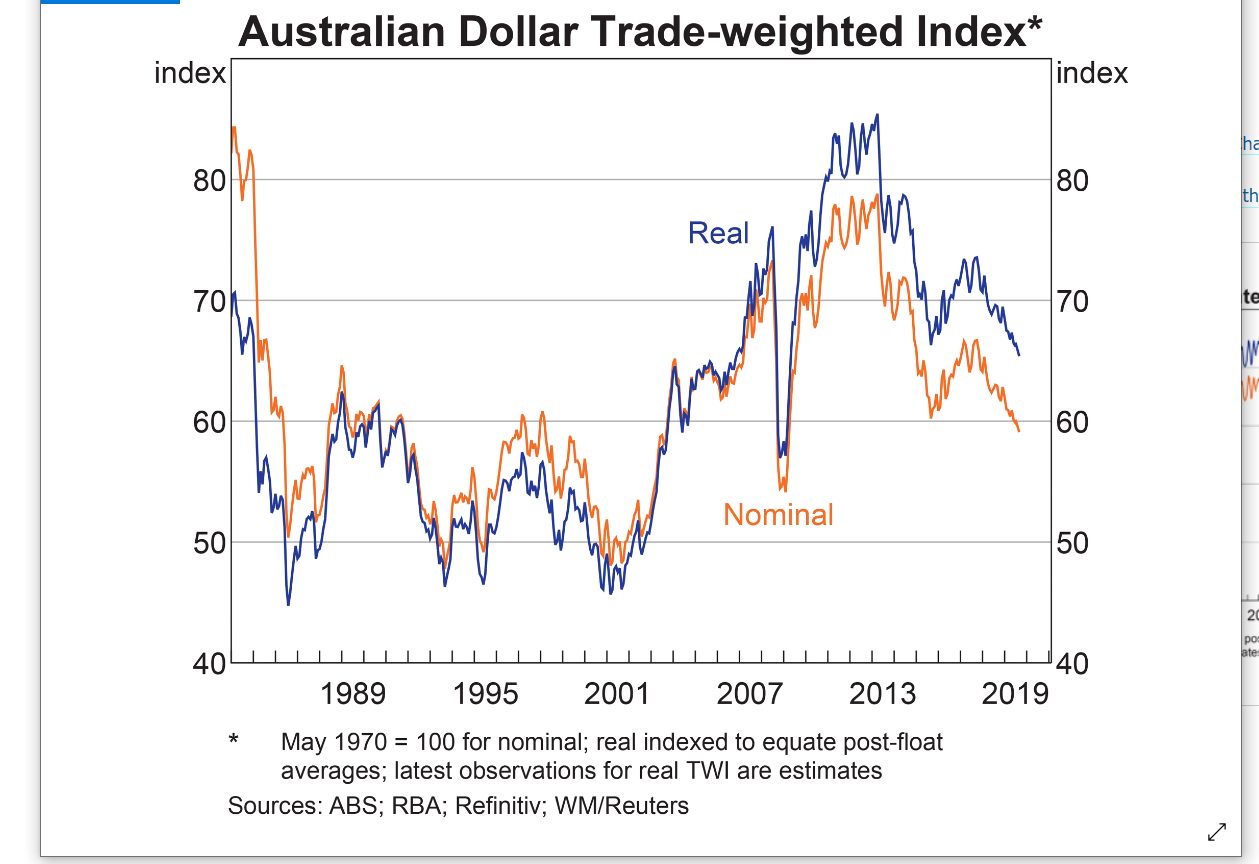

- AUD/USD – The Australian Battler continued to force short bets to cover, trading to an overnight high at 0.6774, settling in NY to close at 0.6767. This morning, with Australian markets closed for Labour Day, volumes were light and conditions thin, the Aussie dipped to 0.6755. The Aussie has managed a decent bounce off it’s 10-year lows at 0.6670 which held a couple of attempts to break it. Last week we saw that net speculative Aussie short bets increased to total -AUD 47,155. We also highlighted that the RBA’s Australian Dollar TWI (Trade Weighted Index) was at lows not seen since 2007/2008. This is still the case and the RBA will be less inclined to trim interest rates. AUD/USD has immediate resistance at 0.6780 followed by 0.6810. Immediate support can be found at 0.6750 followed by 0.6720. Look to buy dips with a likely trading range today at 0.6750-0.6800.

Have a good week ahead all, happy trading.