Summary: The Dollar dropped against the Yen while the Euro rallied as US bond yields and stocks tumbled. A US Private Sector Payrolls report (ADP) showed less than expected figures (135,000 against 140,000) for September while August’s figure was sharply revised lower to 157,000 hires from an initial 195,000. The report came on the heels of yesterday’s dismal US ISM Manufacturing report which had the worst read in a decade, and ignited fears of a US recession. USD/JPY fell 0.53% to 107.17 (107.70) while the Euro rallied 0.25% to 1.0960 (1.0937). Growth currency leader, the Australian Dollar was little changed, hovering at 0.6708 from 0.6705 after plunging to 10-year lows at 0.66706 overnight. The Canadian Dollar, also considered a “growth” currency, was 0.8% lower against its US counterpart, at 1.3325 (1.3220). The Dollar Index (USD/DXY), which is a popular measure of the Greenback’s value against a basket of 6 major currencies dipped 0.10% to 99.032 (99.166 yesterday).

Wall Street stocks and US bond yields tumbled. The DOW finished 2.1% lower at 26,050. (26,570. yesterday). The S&P 500 plunged to 2,885 from 2,940, down 1.98%. Ten-year US Treasury yields were 4 basis points lower to 1.60%. The US 2-year bond yield slumped 7 basis points to 1.48%, its lowest since August 19.

- USD/JPY – The Dollar fell against the Yen to 107.046 overnight lows before settling at 107.17 in New York, down 0.53%. US 10-year yields dropped 4 basis points to 1.60%. In contrast, Japan’s 10-year JGB yield was down one basis point to -0.17%.

- EUR/USD – The Euro rallied to close at 1.0959, up 0.25% (1.0937) on the back of the generally weaker US Dollar. Which was the shared currency’s highest finish in 3 days. German 10-year Bund yields were up 2 basis points to -0.55%.

- AUD/USD – The Aussie closed little changed at 0.6707 after falling to a fresh 10-year low at 0.66706 overnight. While global growth fears weighed on the antipodean currency, the other side of the coin is the generally weaker Greenback.

- GBP/USD – Sterling dipped to 1.2298 from 1.2311. Uncertainty on whether Boris Johnson’s Brexit offer to the European Union would be well-received kept the British currency pegged.

On the Lookout: The US ADP Private Employment report showed that private payroll growth in August was much less than initially estimated. With business turning more cautious in their hiring, this added to the fears sparked by the dismal US factory report which had the lowest read in a decade. Wall Street stocks tumbled together with US bond yields.

Tomorrow’s US Non-Farms Payrolls report will be critical for further clues to the US economy.

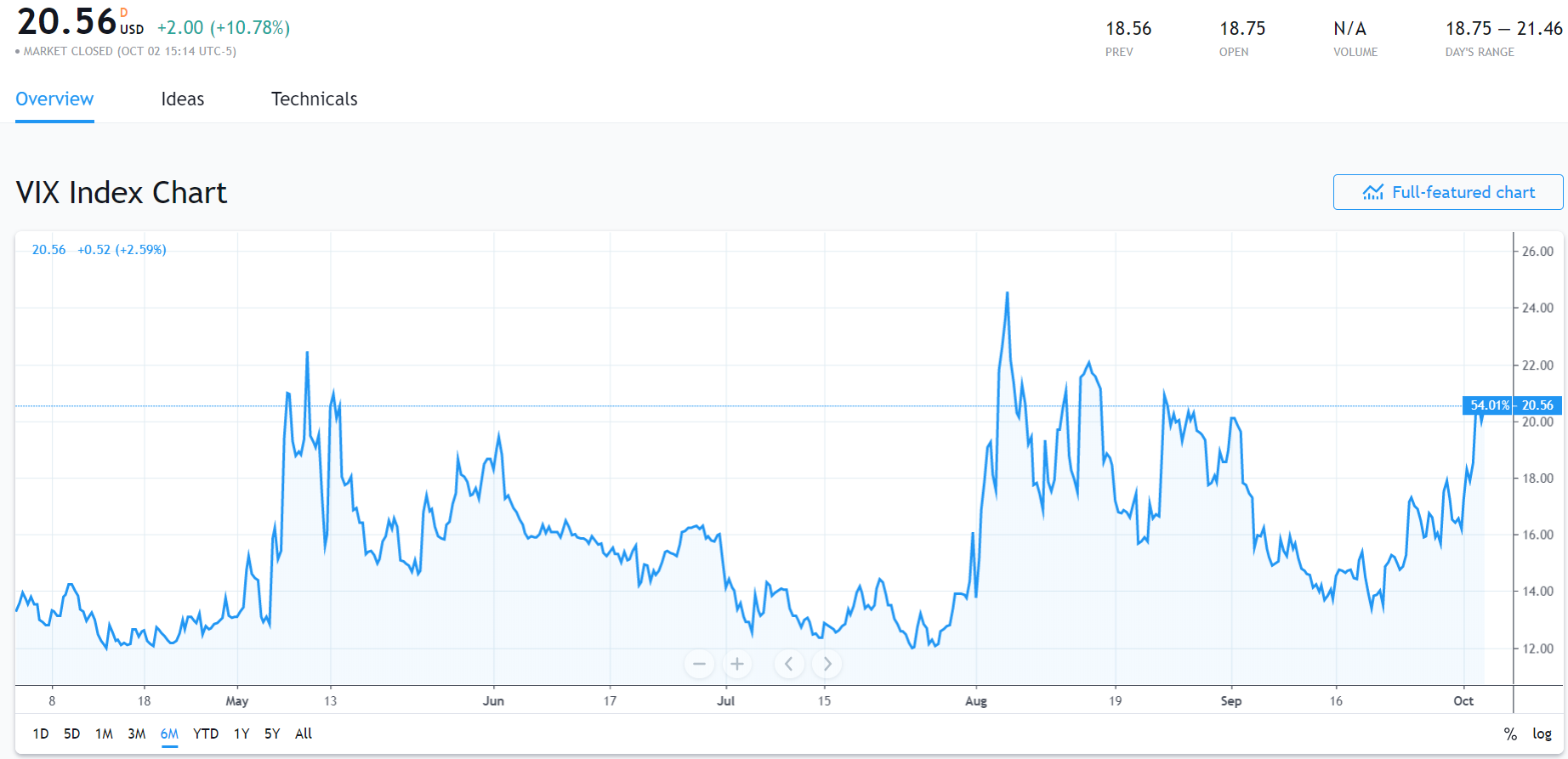

The VIX Volatility Index which measures the expectation of stock market volatility over the next 30 days climbed to 20.56, up 10.78%. The VIX is also known as the fear index.

Tomorrow’s US Non-Farms Payrolls report will be critical for further clues to the US economy.

Economic data reports pick up today. Australia’s AIG -Services Index, just released matched the previous report at 51.5 against 51.4. New Zealand’s ANZ Commodity Prices follow shortly.

China continues its National holiday celebrations today and for the rest of this week.

Australia’s Trade Balance for September rounds up Asia’s reports for today.

Euro area Services PMI reports follow next with Spain, Italy, France, Germany and the Eurozone all reporting their respective PMI’s. The UK Services PMI follows next. Eurozone PPI and Retail Sales (September) round off the Euro area reports. US Challenger Job Cuts, Weekly Unemployment Claims kick-off off North American data. US Final Services PMI and the ISM Non-Manufacturing PMI follows.

Markets will closely monitor the ISM Non-Manufacturing PMI to see if the manufacturing slump has affected the all-important US services sector.

Trading Perspective: Despite the USD/JPY fall and Euro rally, the Dollar Index (USD/DXY) held up reasonably well, closing at 99.032. Analysts point to the Dollar’s higher yield and the relative strength of the US economy as supportive factors. These factors are slowly eroding.

Without yield support, the Dollar will turn back south. Ten-year US bond yields fell to 1-month lows at 1.60% The 2-year treasury rate tumbled to lows not seen since August 19 (1.48%). Yields of global rivals were either flat or their falls were less pronounced.

Market positioning is also long of US Dollar bets. A bad Payrolls number tomorrow could trigger a downward Dollar correction.

- EUR/USD – The shared currency closed to a 3-day high at 1.0959 after testing 1.08792 on Tuesday, lows not seen since May 2017. The overall weaker US Dollar weighed by poor data this week will continue to support the Euro. EUR/USD has immediate resistance today at 1.0970 (overnight high 1.09636). The next resistance level can be found at 1.1000. Immediate support lies at 1.0930 followed by 1.0900. Euro area services PMI’s as well as the US Services and ISM Non-manufacturing PMI’s are due today. Market positioning in the Euro is short. Look to trade a likely range today of 1.0930-1.1030. Prefer to buy dips.

- USD/JPY – slip-sliding away. Softer US bond yields have weighed on this currency pair. The Dollar traded to an overnight low of 107.046 before closing at 107.18. Immediate support lies at 107.00 followed by 106.70. Immediate resistance can be found at 107.50 and 107.80. Expect some consolidation today with a likely range of 106.70-107.70 range today. The USD/JPY downside is the vulnerable side in the short term until the Japanese US Dollar buyers step in. The latest COT report saw net speculative JPY longs trimmed further to +JPY 12,783 contracts, which is not a large number. Prepare to trade both sides of this currency pair with some volatility ahead.

- AUD/USD – The Aussie Dollar clung to 0.6707 after hitting an overnight and 10-year low at 0.66706. Global growth concerns continue to constrain the Aussie Battler. Market sentiment following the RBA’s rate cut earlier this week remains bearish and continues to weigh on the antipodean currency. Market positioning reflects this with net short Aussie bets increasing by 7,073 contracts to total -AUD 47,155. An overall weaker US Dollar will eventually translate into a strong Aussie and the shorts will run for the exits. Friday’s US Payrolls will be critical for the Aussie Battler. AUD/USD has immediate resistance at 0.6720 (overnight high 0.67185). The next resistance level lies at 0.6750. Immediate support can be found at 0.6690 and 0.6670. Look to buy dips with a likely range today of 0.6685-0.6755.