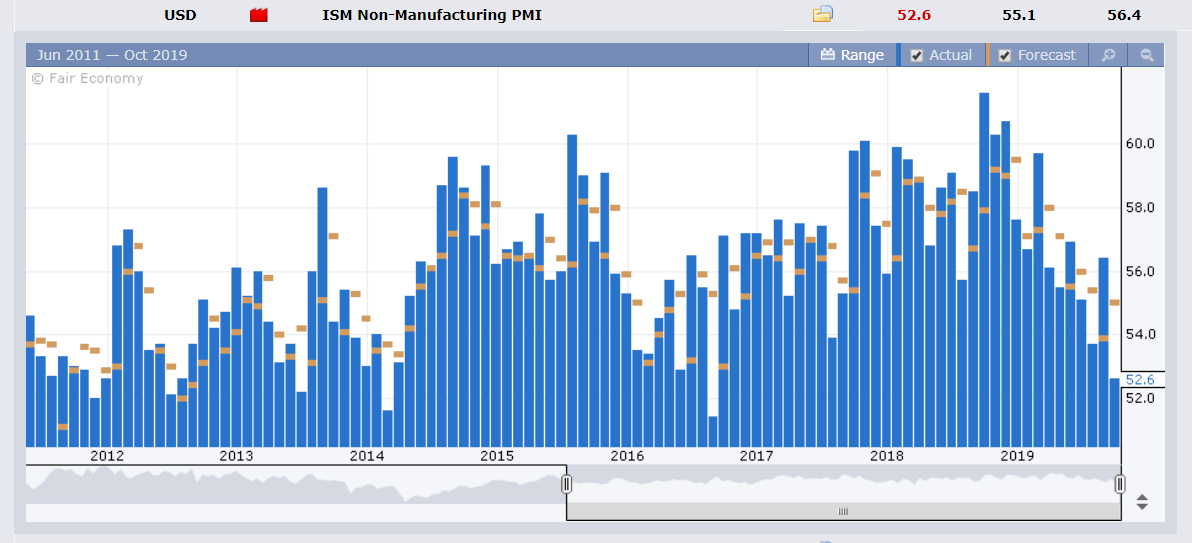

Summary: US Bond yields tumbled anew following another poor set of US data. ISM Services for September fell to 51.6 from August’s 56.4. The Employment Component slumped to 50.4 from 53.1, the lowest read since February 2014. Two-year US treasury yields tumbled 9 basis points to 1.39%. The benchmark 10-year bond yield finished 7 basis points lower to 1.53%. USD/JPY hit a 4-week low at 106.483 before settling at 106.90 (107.20 yesterday). The Euro rose to a one-week high at 1.0999 before closing with a modest gain to 1.0965. The Aussie, up 0.48% to 0.6740 and Kiwi, up 0.5% to 0.6300 finished as best performers on short covering ahead of today’s US Payrolls report. The Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of 6 major currencies, dipped to 98.952 from 99.032 yesterday. Wall Street stocks rallied on expectations of further stimulus measures from the US Federal Reserve given the run of poor economic data. The DOW finished up 0.63% to 26,217 (26,050). The S&P 500 rose 1.02% to 2,915 (2,885 yesterday).

Euro area Services data mostly missed forecasts. Germany’s Services PMI in September fell to 51.4 from August’s 52.5. The Eurozone Final Services PMI (September) slipped to 49.5 from 50.6.

US Weekly Unemployment Claims rose to 219,000 from the previous week’s 213,000.

- EUR/USD – The Euro rallied to an overnight and one-week high at 1.09993 before easing back to settle at 1.0965, up 0.02% from 1.0960 yesterday. While Euro area Services data missed expectations, the fall in the US report highlights the fact that the US economic downturn is catching up with the rest of the world.

- USD/JPY – always the most sensitive to moves in bond yields, the Dollar slumped to a four- week low at 1.06483 before climbing to settle at 106.90. The narrowing yield gap between US and Japanese yields will keep this currency pair heavy.

- AUD/USD – The Aussie rallied 0.48% to close at 0.6741 after trading to an overnight high at 0.67529. Short Aussie bets ran to cover ahead of tonight’s US Payrolls report.

- GBP/USD – Sterling rallied, finishing with gains to 1.2335 (1.2300). UK Services PMI also missed forecasts printing 49.5 against 50.3. The overall weaker US Dollar buoyed the British currency. Sterling jumped to a high at 1.2413 earlier on reports that the head of a group of Eurosceptic lawmakers said the government’s latest Brexit proposals offered the prospects of a tolerable deal. GBP/USD slid back to 1.2335 at the NY close.

On the Lookout: Today’s US Non-Farms Payrolls report could be pivotal. A weak number would confirm that the US economic downturn is now catching up with the rest of the world. And could be the start of a downward correction in the US Dollar.

Further falls in US bond yields will erode Greenback strength. Without yield support the Dollar has little legs to stand on. Last night the 10-year bond yield tumbled 7 basis points to 1.53%. While global rival yields dipped, their falls did not match that of the US. Chinese markets are still out, celebrating their week-long National Holiday.

Data released today start off with Australia’s September Retail Sales report and the RBA’s Financial Stability Review. Canada follows with its Trade Balance for September. Next up, US Payrolls. Analysts are forecasting a modest gain in US Non-Farms Employment to 145,000 in September from August’s 130,000. The Unemployment Rate is expected to remain unchanged at 3.7%. US Wages (Average Hourly Earnings) are forecast to dip to 0.3% from 0.4%. It’s all about the Payrolls. A gain of 170,000 to 200,000 will see the Dollar climb first. A bad figure would be 110,000 or less which would see the Dollar plunge first up. Watch for revisions to NFP and the Wages report too.

Fed Chair Jerome Powell will speak at a Fed event in Washington DC following the Payrolls release.

Trading Perspective: Market positioning is long US Dollars. On Tuesday we highlighted a Saxo Bank report which saw net speculative US Dollar long bets hit June highs. If the report comes out as forecast, the Dollar will grind lower into next week. A weak NFP report will see further US Dollar weakness as the Dollar longs begin an unwind.

- EUR/USD – There are no major Euro area reports due today. The shared currency probed lower territory this week due to the perception that the US economy would continue to outperform other major economies, including Europe’s. The poor US reports released this week will put pressure on the Fed to quicken its interest rate cutting cycle. Germany’s 10-year Bund yield was down 4 basis points to -0.59%. EUR/USD has immediate resistance at 1.1000 followed by 1.1030. Immediate support can be found at 1.0960 and 1.0930. Look to trade a likely range today of 1.0950-1.1000 until the release of the Payrolls report. A poor NFP number will see the Euro climb above 1.100.

- USD/JPY – The Dollar extended its losses versus the Yen as US bond yields tumbled. The yield on the US 10-year bond dropped for the sixth straight day to 1.53% (1.60% yesterday). Japan’s 10-year JGB yield dipped 3 basis points to -0.20%. USD/JPY plunged to an overnight and fresh 4-week low at 106.483 before rallying to settle at 106.90, down 0.25%. USD/JPY has immediate support at 106.50 followed by 106.20 and then 105.80. Immediate resistance can be found at 107.10 and 107.30 (overnight high 107.30). Look for a likely trading range between 106.70-107.70 prior to the Payrolls report. With market positioning still a tad long JPY would rather buy dips to 105.80.

- AUD/USD – The Aussie finished with a 0.48% gain to 0.6740 climbing further away from its 10-year low earlier this week (0.66706). Australian Retail Sales report is due today (11.30 am Sydney) which is expected to improve to 0.5% in September from August’s -0.1%. Barring any big surprises there, the US Payrolls report will determine the next big move for the Aussie Battler. A poor NFP number of around 110,000 or less will see more short covering on the Aussie. Immediate resistance lies at 0.6755 (overnight high 0.67529) followed by 0.6780. Immediate support can be found at 0.6710 followed by 0.6690. Look for a likely trading range pre-NFP of 0.6730-0.6770. Prefer to buy dips.

Happy Payrolls Friday. Top weekend to all.