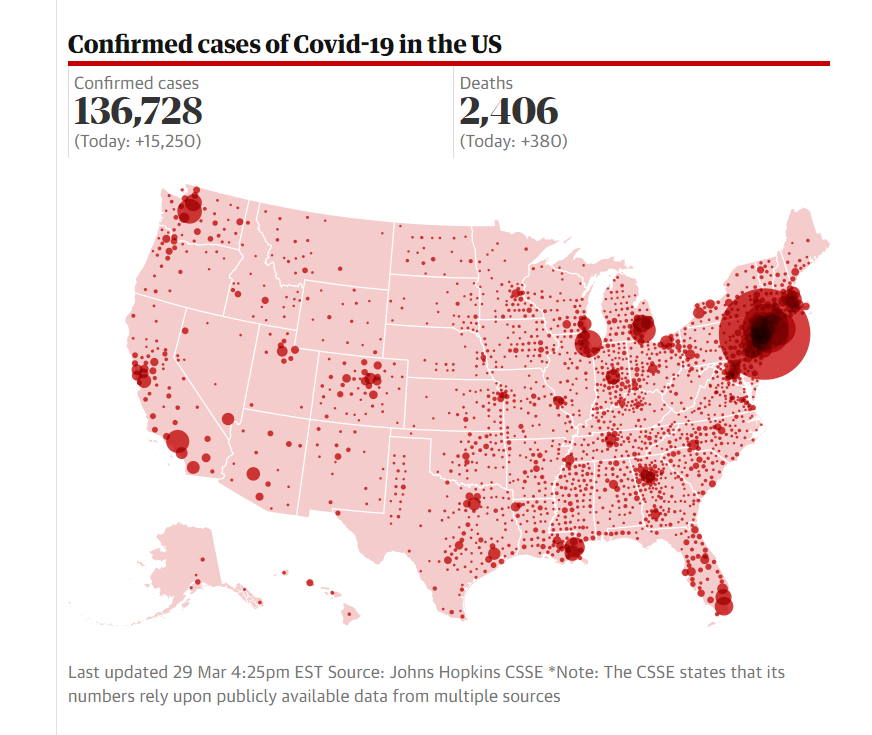

Summary: The Dollar extended its dramatic drop as coronavirus cases in the US soared past the 100,000 mark to 236,728 (as at 29 March). Following Thursday’s unprecedented climb in US Jobless Claims, the spotlight turned to this week’s (Friday) March Payrolls number. While the Greenback was lower against the Majors, the Dollar soared against Emerging Market currencies in the wildest moves since the 2008 GFC. The British Pound led all gainers, jumping 2 % to 1.2480 in late New York from 1.2285. Against the Yen, the US Dollar slumped 1.23% to close at 108.00, touching an overnight and near 2-week low at 107.718. Early Sydney saw USD/JPY slip to 107.60 as risk aversion rose following weekend news of separate missile launchings near Saudi Arabia and North Korea. The Euro extended its climb, up 0.8% to 1.1145 in late New York, easing to its current 1.1120. The rampaging Australian Dollar hit 0.6200 overnight and 16 March highs from 0.6065 Friday, closing at 0.6165 before dipping to 0.6149. On Friday, the Bank of Canada unexpectedly cut its overnight cash rate by 0.50% to 0.25%. The USD/CAD pair climbed in choppy trade to 1.4000 after hitting a low of 1.39218 from 1.4050. US stocks reversed the impressive gains made on Thursday. The DOW slipped 4.3% to 21,555 (22,485). The S&P 500 was 3.66% lower to 2,537 (2,635). Bond yields plunged with the key US 10-year rate finishing at 0.67% from Friday’s 0.84%. Germany’s 10-year Bund yielded -0.48% from -0.37%.

Data released were mostly second tier and had little effect on FX. Japan’s Tokyo Core CPI rose 0.4%, matching forecasts. US March Personal Income rose 0.6%, beating expectations of 0.4%.

On the Lookout: With a plethora of news events hitting markets this morning, uncertainty prevails, and we can expect further wild moves ahead. Just another manic Monday start. Coronavirus strife and fears continue to dominate as seen from today’s risk-off start.

The focus is on Friday’s US Non-farms Payrolls number with economist’s forecasting a median drop of 81,000 jobs in March from February’s 273,000. The US Unemployment rate is expected to climb to 2.8% from 3.5%. These forecasts will be adjusted as the week goes by.

Today’s data calendar is light with the focus on the global responses to the rising global coronavirus cases. World economies are at a standstill, with recession fears in the US rising. Unprecedented stimulus measures have been thrown to lift injured markets. This week will tell us more.

Trading Perspective: The Dollar’s dramatic drop that began on March 20 followed a strong rally (March 9-20). Short term funding demand for the Greenback and rising risk-aversion were seen as factors behind the USD’s strong advance. The introduction of the Fed’s swap lines with a handful of big central banks saw risk appetite reverse. Technical indicators have turned down on the US Dollar against the major currencies. Short term trading is extremely choppy, and we can expect more of this in the week ahead. Experience is a great teacher. Sean Lee from FXWW said in his commentary that ex-institution discretionary traders have had exceptional returns. He cites the love of volatility. And discretion. In other words, systems don’t necessarily work out. Be flexible and choose your levels. Don’t have a strong view in these current markets.

AUD/USD – Impressive Gains Hits Target at 0.6200, Capped Here

The Australian Battler jumped over 5% last week, an impressive feat for a currency that was battered, falling over 13% in the previous two weeks. AUD/USD traded to 0.6200 on Friday, 13 March highs before slipping in late New York to 0.6165. This morning’s risk-off stance has pushed AUD/USD to 0.6115, settling at a current 0.6128.

Immediate resistance for today lies at 0.6170 followed by 0.6200 and 0.6220. Immediate support can be found at 0.6110 and 0.6070 (Friday’s opening). Expect another choppy session on the Aussie with a likely range today of 0.6070-0.6200. No strong views today. Pick your levels, monitor the news releases, and trade your range. In these wild markets, guerrilla tactics work best.

USD/CAD – BOC Surprise Rate Cut Puts a Base at 1.3900, 1.4200 Caps

The Canadian Loonie had its own choppy session, initially dropping to an overnight low at 1.39218 on the broad-based US Dollar weakness. The Bank of Canada surprised with a 50-basis points rate cut late Friday to 0.25% from 0.75% which saw the USD/CAD bounce to 1.4000 in late New York. The Bank of Canada joined other countries and lowering their interest rates toward zero.

This morning’s risk-off start saw USD/CAD climb to 1.4082 before easing to settle at 1.4065. Expect another wild ride in this currency pair today. USD/CAD has immediate resistance at 1.4080 followed by 1.4120. Immediate support can be found at 1.4000 and 1.3950. Look for a likely range today of 1.4000-1.4200. Am neutral, looking to trade the range.

EUR/USD – Sharp Bounce Hits Near 1.1150; 1.0950-1.1200 Likely

The Euro’s sharp bounce from last week’s low at 1.0636 saw the shared currency hit 1.1147 overnight before finishing in New York at 1.1143. In early Sydney, the risk-off stance saw the EUR/USD pair ease to 1.1105 before settling at its current 1.1115. The Dollar’s weak finish on Friday was against the Majors. The EM currencies extended their sharp falls against the Greenback. What this tells this writer is to expect more two-way price action in the Majors.

EUR/USD has immediate resistance at 1.1150 and 1.1165, followed by 1.1200 and 1.1230. The 1.1200 area should prove formidable. A clean break above 1.1200 could pave the way for 1.1500. Immediate support can be found at 1.1100 and 1.1050. Strong support lies at 1.0950. A break below 1.0950 could see this uptrend finish.

Be flexible and look to trade a likely range today of 1.1030-1.1170. Just trade the range shag on this one.