Institutional crypto exchange, LMAX Digital is seeing strong volumes as interest in crypto-based trading continues to soar. However, the platform reported a 5 percent drop in aggregated monthly volumes on its spot market compared to the previous month.

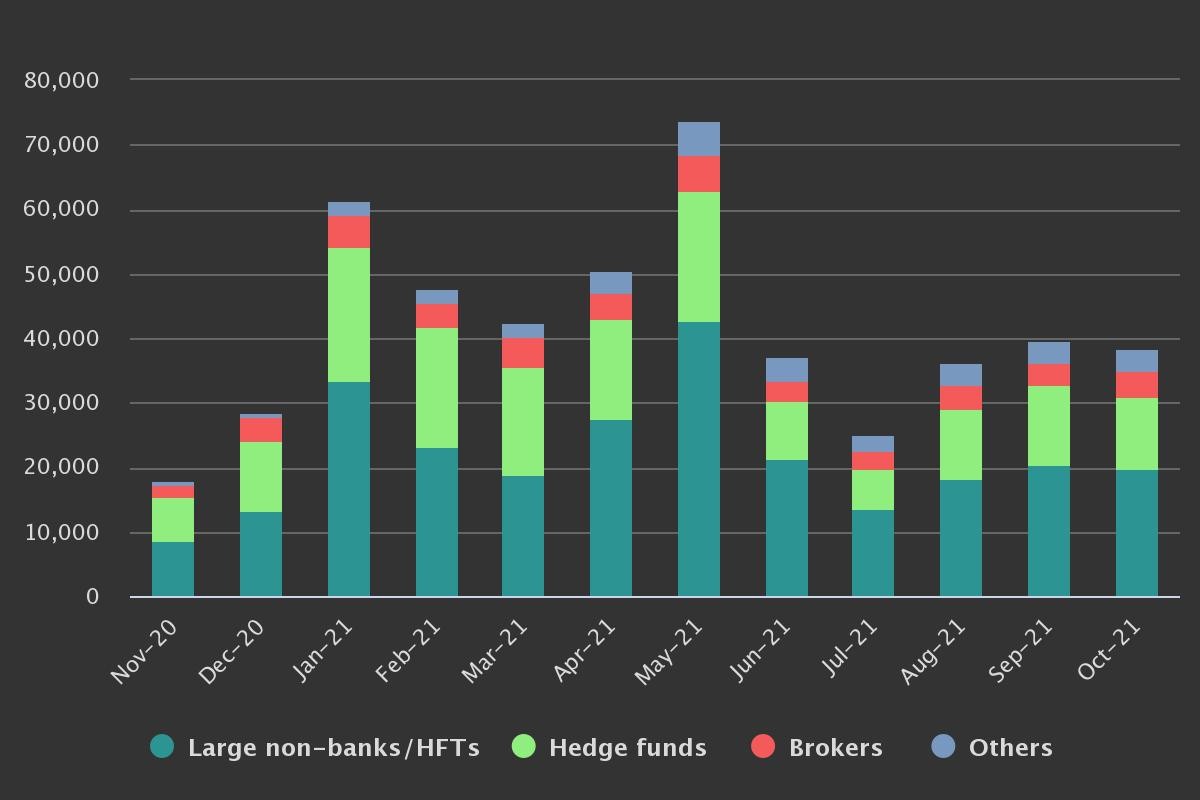

The turnover figure stood at $38 billion in October 2021, which is down from September’s $40 billion. However, that was a gain of 257 percent from a year earlier.

The context of this was that bitcoin had touched an all-time high over $66,000 as recently as mid-October, having nearly doubled from July lows.

A record high of over $73 billion in total monthly volumes was achieved back in July. Taking a year-to-date perspective, LMAX Digital disclosed a record $453 billion that exchanged hands in the Jan-Oct period.

Overall, crypto volumes enjoyed fantastic performance over the last two months. According to the latest report from Blockchain research firm, CryptoCompare, crypto spot volumes rose to $2.5 trillion in September.

But looking out, LMAX Digital says it expects to see some more consolidation and correction ahead, before crypto markets try get going with any meaningful bullish continuations.

“We believe a healthy round of profit taking is due, where shorter-term traders with less conviction will get washed out. We also believe there are still risks associated with regulatory headwinds in China and the US that need to be considered. Finally, while there has been impressive evidence to suggest crypto assets as compelling portfolio diversification investments given uncorrelated properties with other major assets, on a short-term basis, we’re still not there yet. This means any shakeup in very extended US equities, could result in a massive bout of risk liquidation that ultimately translates to downside pressure on the crypto space,” the statement further reads.

The latest metrics are part of LMAX Digital’s initiative to publish its daily trading spot volumes, potentially enhancing the quality of market information available to investors and enabling a credible overview of the spot crypto currency market.

LMAX Digital is part of LMAX Group, which operates institutional FX execution venues such as LMAX Exchange (FCA regulated MTF) and LMAX Global (FCA regulated broker).

LMAX Digital is built on proven LMAX Group trading technology and operates under similar rules and governance of its parent’s FCA-regulated multilateral facility (MTF), and its functionality is based on the venue’s existing technology stack. It offers to trade digital assets at the request of its existing institutional client base.

Simply matching buyers with sellers within an anonymous execution venue, LMAX Digital offers its users better price discovery and conflict-free execution in major cryptocurrencies like Bitcoin, Litecoin, Ethereum, Ripple and Bitcoin Cash.

Furthermore, LMAX Digital offers cryptocurrency custodian services to clients who trade on its exchange, which solves one of the major problems that have prevented institutional investors from dabbling in the virtual asset class.