Summary: The Australian Dollar sank 1.22% to 0.70043 (0.7103) after an extremely frail Q1 CPI report heightened the prospect of an interest rate cut. New Zealand’s Kiwi dropped in tandem, falling 0.95% to 0.6590. Elsewhere, the Euro slumped to June 2017 lows (1.11406) following a drop in Germany’s Business Climate Index. The Dollar Index (USD/DXY) soared 0.47% to 98.096 (97.58), fresh 2019 highs. Sterling, under pressure from broad-based USD strength and fading hopes for a breakthrough in talks between the ruling party and opposition on Brexit, settled to 2-month low at 1.2900. The Bank of Canada kept its overnight rate unchanged at 1.75% but dropped its hiking bias and lowered economic forecasts. USD/CAD rallied 0.40% to 1.3495 (1.3430 yesterday). In Asia, USD/JPY rose 0.22% to settle at 112.18 ahead of today’s BOJ’s interest rate decision. The robust Greenback pressured Emerging Market currencies lower.

While there was nothing dramatic in terms of fundamentals to support the Dollar, it’s the “best among the rest”, and the path of least resistance for traders is to own Greenbacks.

Wall Street stocks slipped to close flat after hitting record highs. Global yields dropped. The benchmark US 10-year bond yield fell 4 basis points to 2.52%.

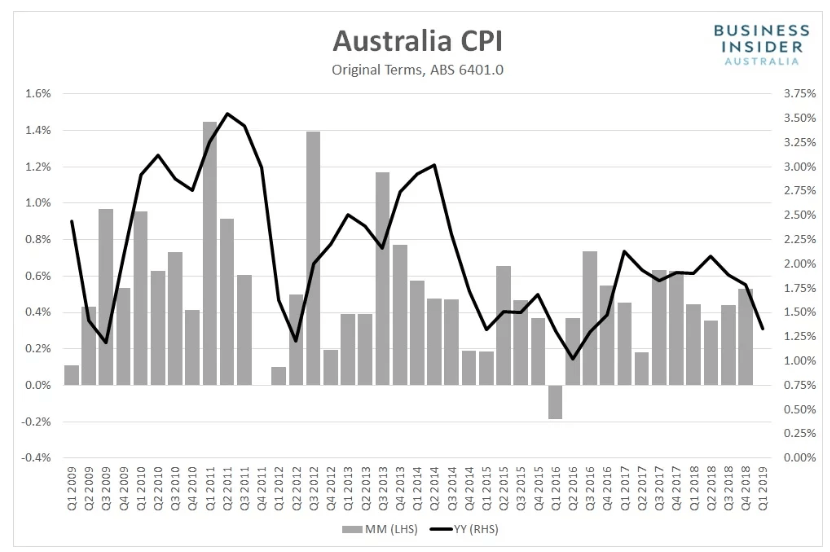

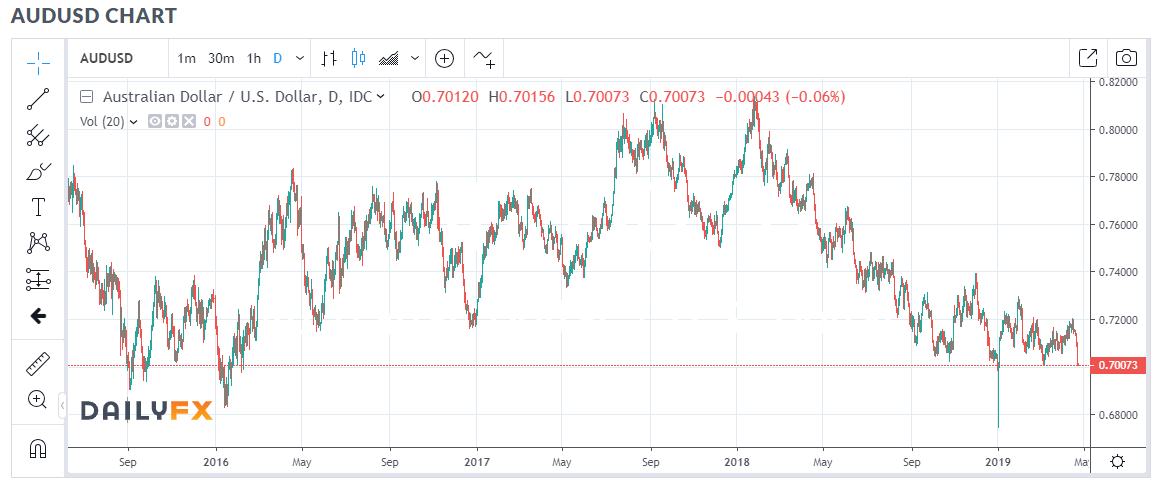

- AUD/USD –The Aussie Battler was smacked lower after the Australian Bureau of Statistics revealed Q1 CPI was flat instead of rising 0.2%. AUD/USD sank to an overnight and near 2019 low of 0.70043 before settling at 0.7015. Odds now favour an RBA rate cut in the months ahead, some as early as next month.

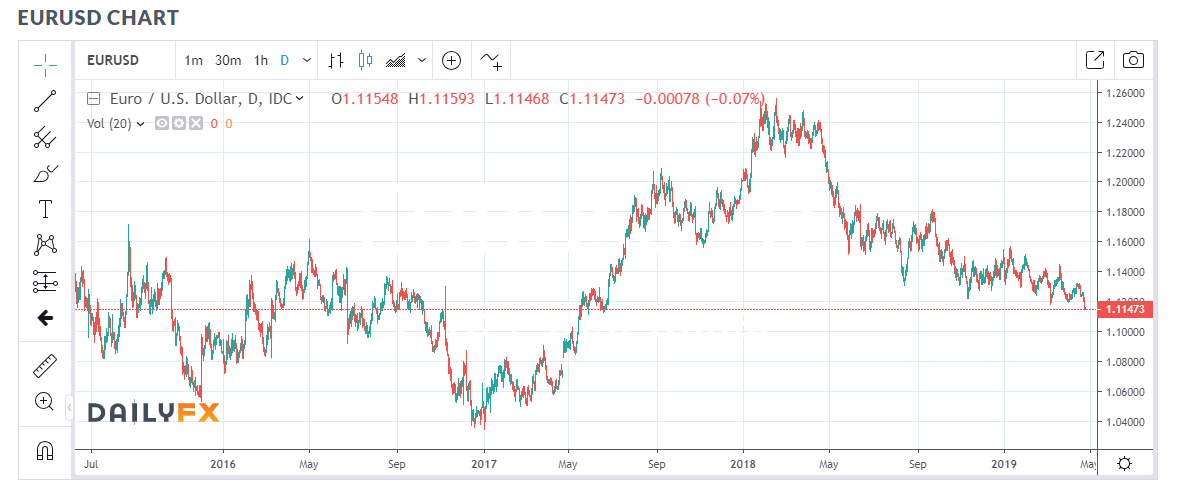

- EUR/USD – The Single Currency broke through the 1.1185-1.1200 support level after Germany’s IFO Business Climate slipped against expectations of a small improvement. The Euro traded to a July 2017 low of 1.11406 before settling at 1.1155.

- USD/JPY – The Dollar rallied to 112.399 against the Yen, fresh highs for 2019 ahead of the BOJ’s interest rate decision today. USD/JPY closed at 112.18, up 0.22%.

- GBP/USD – The British Pound fell to a 2-month low at 1.2889, settling just above 1.2900 as fading hopes for a breakthrough in Brexit talks between the UK’s two major parties weighed. The overall stronger Greenback also pressured Sterling lower.

On the Lookout: Volumes will remain low with Australia and New Zealand closed to remember their countrymen who served and sacrificed in the past wars. Traders will await today’s Bank of Japan’s interest rate decision and monetary policy statement (due at 12 noon Sydney). The Japanese central bank is expected to keep policy unchanged but may downgrade growth and inflation forecasts.

Other date releases today are Spain’s Unemployment Rate as well as US Weekly Jobless Claims.

US April Headline and Core Durable Goods Orders, both of which are expecting better data, round off the today’s data releases. The US Treasury is expected to release its twice annual Currency Report.

Trading Perspective: The technical breaks following weakness on all the Major currencies have favoured the US Dollar. With no real dramatic advantage in the fundamentals, the US economy is still relatively the best place to park your money. The problem for this writer lies in the fact that most are already parked in the Dollar bandwagon. Market positioning heavily favours the Dollar and may be a headwind to further gains.

US bond yields fell overnight with the ten-year yield dropping 4 basis points to 2.52%. Germany’s 10-year Bund yield fell 5 basis points to -0.01% while Japan’s JGB 10-year yield was 1 basis point lower at -0.05%. Australian 10-year bond yields had the biggest fall, down 11 basis points to 1.78%, understandably. The differentials in favour of US yields will have to widen further for significant Greenback gains.

- EUR/USD – The technical break of strong supports between 1.1180-1.1200 will see further pressure on the Single Currency. The overnight (and June 2017 lows) of 1.1140 should off immediate support on the day. The next support level can be found at 1.1100. A break of 1.1100 will see 1.1050/60 tested. A break back above 1.1200 could see a short squeeze. With no Euro area data releases this week, traders will focus on tomorrow’s US Advance GDP report. Look for a likely trading range of 1.1140-1.1190. Prefer to buy dips.

- AUD/USD – The Australian Dollar slipped to 0.70043 overnight and fresh lows since the early January flash crash (where the official recorded low for the Aussie was 0.6993). We can expect immediate support at the 0.7000 psychological level. The next support level lies at 0.6940 followed by 0.6880. Immediate resistance can be found at 0.7040 followed by 0.7070. Will the RBA cut rates next month? While 70% of the futures market believe so, the RBA will wait for more data with any rate cut likely in August. Look for a likely trading range today of 0.7000-40, prefer to buy dips.

- USD/JPY – The Dollar rose to fresh 2019 highs of 112.399 before easing to settle at 112.18 in New York. With the BOJ expected to keep its policy unchanged, traders are looking for a possible downgrade in growth and inflation in their outlook. This is already built into today’s rate. With the lower US 10-year yield (2.52%), USD/JPY should struggle higher with 112.50 immediate resistance. Immediate support can be found at 111.90. Look for a likely range today of 111.80-112.30. Prefer to sell rallies

Happy trading all.