Asian stocks finished higher today as investors await the first interest rate cut in a decade from the Fed and U.S. trade negotiators will likely visit China for their first face-to-face talk with Chinese officials since the G20 meeting.

The Nikkei225 ended 0.36 percent higher at 21,694 as the Bank of Japan left its monetary policy unchanged, as expected. The Hang Seng finished 0.34 percent higher at 28,202. The Shanghai Composite ended 0.63 percent higher to 2,959, while in Singapore, the FTSE Straits Times index finished 0,15 percent higher to 3,351. Australian equities also trading higher, the ASX 200 hit a record high for the first time since 1 November 2007, adding 0.36% to 6,850.

European equities started mixed the day, DAX30 is giving up 0.18 percent to 12,393, CAC40 is 0.01 percent higher at 5,601 while the FTSE MIB in Milan is trading 0.14 percent lower at 21,679. The London Stock Exchange is 0,32% percent higher to 7,711.

In commodities markets, crude oil trades 0.56 percent higher at $57.19 as traders turn cautious on recent tensions in the Middle East. Brent oil is trading 0.57% higher at $63,98 per barrel despite major oil producers have agreed to cut output. Gold is trading higher at 1,424 keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,452.90 high.

In cryptocurrencies, Bitcoin (BTCUSD) consolidates to recent lows and trades at 9,424 hitting the daily low at 9,357 and the daily high at 9,520. Bitcoin breached the 50-day moving average, and now the momentum is bearish for the short term, the previous two times it managed to rebound from that point. Immediate support for BTC stands now at $9,085 yesterday’s low while next support stands at 9,000. On the upside, strong resistance now stands at 13,138 recent high and then at 13,500 round figure. Ethereum (ETHUSD) gives up 5 dollars and trades at 205 with capitalization now to 22.1 billion. On the upside, the immediate resistance stands at 317 Friday’s high while the support stands at 200 round figure, Litecoin (LTCUSD) also trades lower at 88.59. The crypto market cap now stands above $261.5 billion.

On the Lookout: Bank of Japan left its monetary policy unchanged, as expected, and maintained its guidance of extremely low rates at least through spring 2020. The Bank of Japan added it would ease “without hesitation” if the economy loses momentum for achieving the central bank’s 2% inflation target.

Fed begins a two-day policy meeting later on Tuesday, at which it is widely expected to lower interest rates by 25 basis points. If implemented, it would be the central bank’s first rate cut in a decade.

The US-China trade talks resume in Shanghai today, around three months after previous talks collapsed. Investor’s expectations are relatively low, any progress would likely be well received by the market.

Trading Perspective: In forex markets, USD continues 0.10 percent higher at 98.15, the Aussie dollar trades 0.02 percent lower at 0.6899, while Kiwi also trades lower at 0.6629.

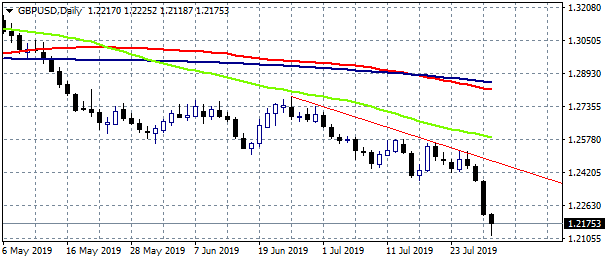

GBPUSD underperforms for one more day and is trading 0.48% lower at 1.2156 making fresh 28 month lows. Major support now stands at 1.2118 today’s low which if broken might accelerate the slide further towards 1.2108 the low from March 1st, 2017. On the upside, immediate resistance now stands at 1.2320 the 50-hour moving average while more offers will emerge at 1.2395, the 100-hour moving average.

In Pound futures markets open interest increased by 13,000 contracts while volume increased by 57,900 futures contracts.

EURUSD consolidates to a recent low around 1.1135, facing the strong support at 1.1101 the yearly low, which if the pair manages to close below will open the way to 1.1050. On the upside, immediate resistance stands at 1.1200 round figure.

Euro futures markets open interest increased by 2,500 contracts while volume decreased by 48,000 futures contracts.

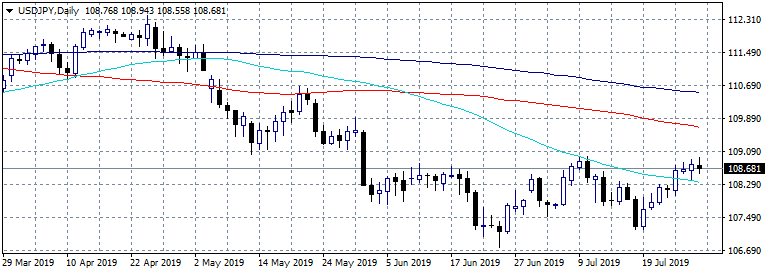

USDJPY is trading 0.16% lower at 108.61 having hit the daily low at 108.55 and the daily high at 108.94. USDJPY pair will find support around 107.50 round figure and then at 107.00. On the upside, immediate resistance for the pair now stands at 108.98 the recent high and then at 109.68 the 100-day moving average.

In Yen futures markets open interest decreased by 550 contracts while volume decreased by 4,300 futures contracts.

USDCAD is trading 0.07 higher at 1.3171 and continues the rebound from the lows around 1.30 amid USD strength, and the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.