Summary: The Australian Dollar melted from the heat of ongoing bushfires, slumping 0.97% to 0.6868 (0.6933). More economists predicted that the bushfire crisis will cut GDP growth in the near term and put pressure on the RBA to cut rates next month. The US November trade deficit fell to lows not seen since October 2016, as exports rebounded, and imports slid further. The fall in the trade gap should provide a lift to the US Q4 GDP. Tensions from the US-Iran conflict remained in the background. Yesterday’s two best FX performers, the Euro and Sterling both retreated, to 1.1145 (1.1190), and 1.3125 (1.3161) respectively. The Dollar Index (USD/DXY), a gauge of the Greenback’s strength against a basket of foreign currencies, rallied 0.35% to 97.007 (96.70).

Wall Street stocks slipped as investor fear persisted, awaiting Iran’s response in its conflict with the US. The Dow was 0.46% lower at 28,526 (28, 632). The S&P 500 lost 0.40% to 3,229 (3,240).

The US 10-year bond yield climbed one basis point to 1.80%, while the 2-year rate was unchanged.

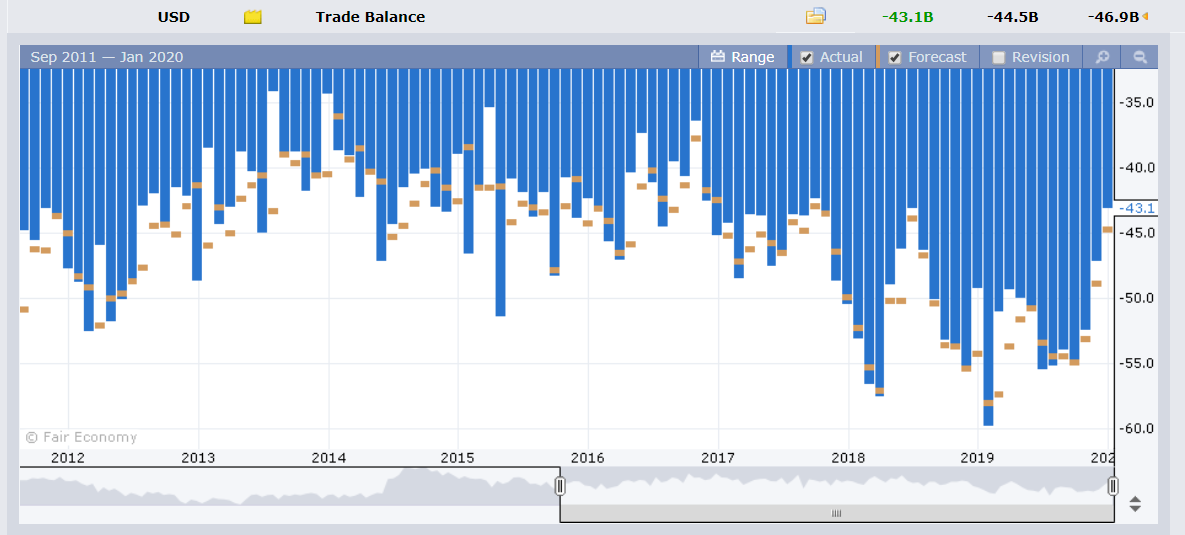

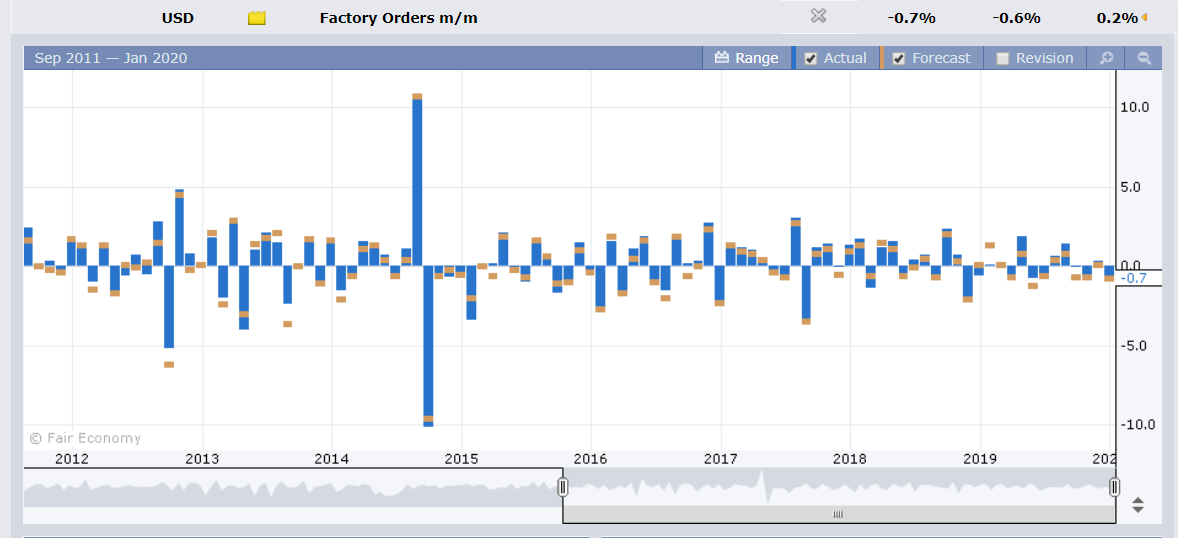

Australia’s ANZ Job Advertisements slumped to -6.7% from -1.7%. Eurozone Final Headline and Core CPI matched forecasts, both readings were at 1.3%. The US Trade Deficit dropped to -USD 43.1 billion in November from the previous month’s deficit of -USD 47.2 billion, bettering forecasts at -USD 44.5 billion. US ISM Non-Manufacturing PMI rose to 55.0 from 53.9, beating forecasts at 54.5. US December Factory Orders dropped to -0.7% from 0.2% in November.

- AUD/USD – finished as worst performing major FX, down 0.97% at 0.6868. The Australian Battler wilted under the heat of the bushfires with more predicting that the outcome would cut GDP. Broad based USD strength also weighed on the Aussie.

- EUR/USD – retreated to close at 1.1145, just under the 1.1150 level after failing to break above 1.1200. The US Dollar advanced on upbeat economic data and prevented the shared currency from climbing further.

- USD/DXY – The Dollar Index rebounded off its finish yesterday at 96.70 to 97.00 for a gain of 0.35%. While the Index is often a mirror of the EUR/USD, the Dollar advanced across the board.

- USD/JPY – Against the Yen, the Greenback saw a modest rise to 108.55 from 108.50. With the Mid-East tensions continuing to affect asset markets, demand for the haven Yen kept a lid on this currency pair.

On the Lookout: In the leadup to Friday’s huge US Payrolls report, economic data will have more impact on FX. Concerns on the US-Iran conflict eased but remain in the background.

Today starts off with Australia’s December Building Approvals, which are expected to improve. Japan follows with its Average Cash Earnings and Consumer Confidence reports.

European data starts off with Germany’s December Factory Orders and the UK Halifax House Price Index (December). The lone US report is the ADP (Automatic Data Processing) Non-Farm Employment Change. This report is the estimated change in the number of people employed in the private sector which excludes the farming industry and government.

Trading Perspective: The Dollar’s advance resulted from the upbeat data which saw the US trade deficit decrease by 8.2% while activity in the services sector picked up.

The breakdown of the trade deficit saw imports plunge on decreased consumer spending as a result of the US trade war with China. US Factory Orders, which are the new purchase orders place with manufacturers dropped. Friday’s Payrolls report remains the focus of FX, and a turn for the worse in the labour market will set the tone for a weaker Dollar trend to re-emerge. For now, expect the ranges to remain intact.

- AUD/USD – The Battler took the heat from the bushfires, wilting under the pressure of a generally stronger Greenback. Today sees Australian December Building Approvals which are forecast to see an improvement from the previous month. While this season’s bushfires will present a headwind to GDP growth in the near term, the main driver for the Aussie Battler will be risk and the US Dollar. AUD/USD has immediate support at 0.6860 (overnight low 0.6859) followed by 0.6830. Immediate resistance lies at 0.6900 followed by 0.6940. The Australian Dollar is known to many local traders as the Battler because of its fightback qualities. The immediate pressure on the Aussie is lower but expect the Battler to hold its own. Look for a likely trading range of 0.6855-0.6905. Prefer to buy dips.

- EUR/USD – The Euro’s failure to clear 1.1200 saw the shared currency retreat to 1.1145 from 1.1190 yesterday. Euro area data released yesterday mostly matched forecasts. Traders will look to today’s US ADP NFP Employment as a guide to the Euro’s next moves. EUR/USD has immediate support at 1.1130 (overnight low of 1.11336) followed by 1.1100. Immediate resistance can be found at 1.1170 followed by 1.1200. Look for consolidation today with a likely range of 1.1135-1.1185. Prefer to buy dips.

- USD/DXY – The Dollar Index held the 96.70 support level well bouncing off the overnight low at 96.62 to close at 97.00. Overnight high traded was 97.091 which puts the immediate resistance level at 97.10. The next resistance level is found at 97.20 and 97.50. The Dollar Index remains in the balance here with Friday’s Payrolls number to determine whether we have seen a base to USD/DXY, or we slide further. For today, look to trade a likely range of 96.70-97.20. Prefer to sell rallies toward 97.20.

Happy trading all.