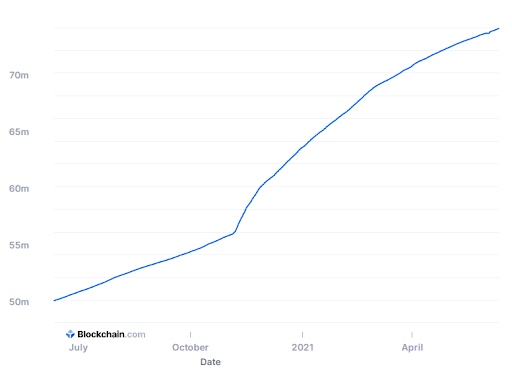

Cryptocurrencies look set to become a new financial reality in the near future. Despite the recent market collapse, digital assets are still gaining popularity worldwide. As of June 2021, the overall number of blockchain wallets has surpassed the mark of 73 million users (15.87% growth within 6 months).

Crypto holders prefer exchanges to keep their funds. According to statistics, more than 60% of investors/traders holding digital assets trust their crypto capitals on exchanges. According to Coinmarketcap.com, the total number of launched crypto exchanges now exceeds 380 platforms that are categorized into spot, derivatives, and DEX groups.

The market still welcomes newer players and the sector continues to be very promising. Beginners start on their way with an understanding of how does Bitcoin exchange work to learn about the mechanisms and pitfalls.

What is a crypto exchange: types of trading platforms

First of all, beginner players should understand what a crypto exchange is, and which functions such platforms include. In simple terms, an exchange offers users to buy, sell, and exchange digital currencies.

What are the most widespread types of crypto exchanges?

- Bitcoin or altcoin exchanges. Such platforms support digital currencies only, without fiat options.

- Exchanges that enable investors and traders to convert digital assets into fiat and vice versa.

- Centralized exchanges that have licenses and act in accordance with legislative norms.

- Decentralized exchanges provide an exceptional level of security and anonymity.

- Margin platforms where traders get leverage to receive more profits. On the other hand, risks augment as well.

A crypto exchange may combine several characteristics.

Initial steps to enter the market

The step-by-step guide of how to start a crypto exchange includes the following stages:

- License and legal issues:

One of the primary concerns is the necessity to obtain a license and the associated legalities that align your platform to the existing regulation. Decentralized exchanges are the exception as the market is moving towards regulation.

- Liquidity provider:

Liquidity is a key aspect of a successful trading platform. Your order book should immediately execute bid and ask orders. This is why it is important to apply to leading crypto liquidity providers.

- Appropriate software:

Business owners can purchase custom software that corresponds to personal demands which cost about $100-150 000. The second option offers newer players to leverage WL solutions that are less expensive, whereby the platform is controlled by a provider company. An exchange is deployed on a provider’s servers.

The process includes a number of important aspects to keep in mind:

- Financial (set up deposits and withdrawals, use cold storage, etc.);

- Marketing (advertising should increase your brand recognition);

- Technological (connect APIs, matching engines, and other integral components).

The process contains many potential pitfalls and is why it is better for beginners to work with professional and experienced companies that offer turnkey solutions. B2Broker is a company that combines high quality and cutting-edge technologies. A turnkey crypto exchange is one of the recommended options.