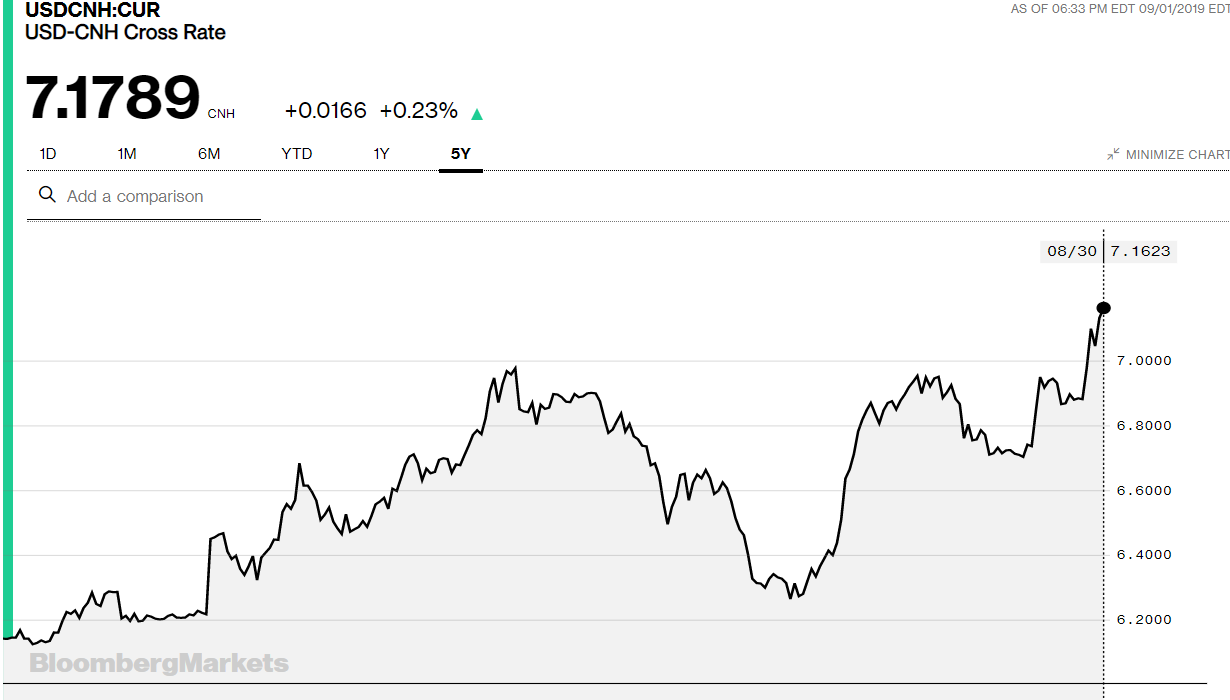

Summary: China’s offshore Yuan slumped to 7.1780 US Dollars, a drop of 4% in August, which boosted the Dollar Index (USD/DXY) to 99.02 (May 2017 high) before settling at 98.81. Fresh tariffs implemented on Sunday by both China and the US made for a volatile start in September exacerbated by a long US Labour holiday weekend. On Sunday, US tariffs of 15% on Chinese imports went into effect. China’s tariff lift on US$ 75 billion worth of US goods goes into effect today. The Euro broke through the 1.10 support area, plummeting to 1.0965, its weakest since May 2017 before settling at 1.0990. Trading was thin and choppy driven by thin liquidity on a Friday month-end ahead of the US Labour Day holiday today. The Dollar fell against the safe-haven Yen to 105.92 in early Sydney before bouncing to settle at 106.13. The Aussie fell to 0.6717 lows, settling currently at 0.6731.

US Treasury Yields were steady with the benchmark 10-year rate unchanged at 1.50%.

Wall Street stocks were little changed in thin volume dominated by month end trade. The DOW was at 26,370 while the S&P 500 closed at 2,922.

Australia’s Building Approvals slumped 9.7% against a forecast of flat from the previous month.

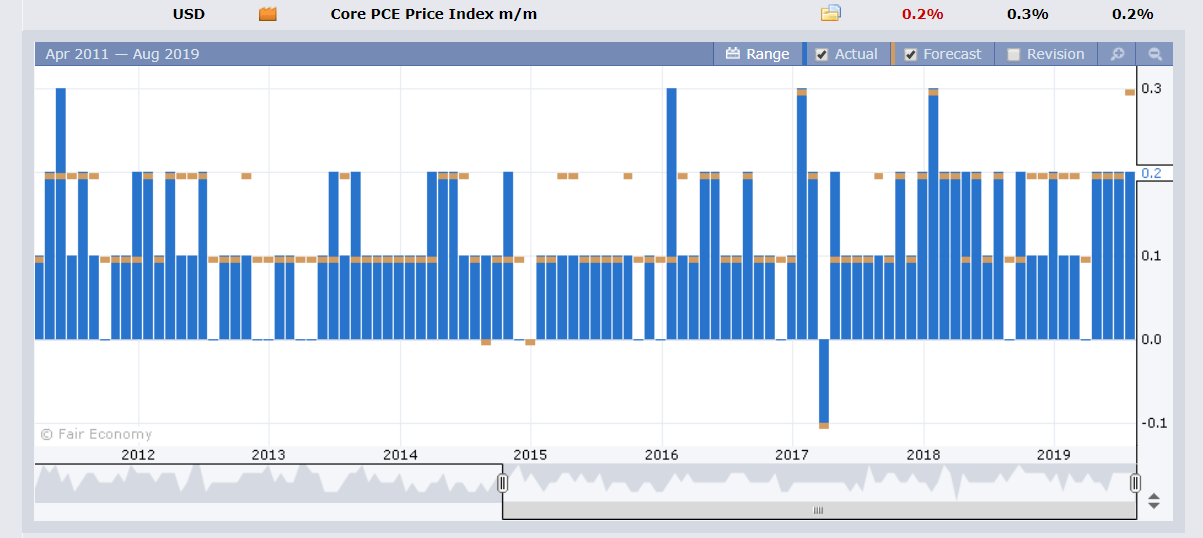

US Chicago PMI beat forecasts, climbing to 50.4 against expectations of 48.1. US Core PCE Index fell to 0.2% against median forecasts of 0.3%.

China’s Caixin Manufacturing August PMI fell to 49.5 from 49.7 in July.

- EUR/USD – The multi-currency has been under pressure for most of August on the back of a generally stronger Greenback. The Euro plummeted to 1.0965 before steadying at 1.9090. The break of the psychological 1.10 level in typical thin month end trading saw a big gap created.

- AUD/USD – The Aussie, under pressure from the fallout in the Australian economy from the Chinese-US trade war fell further to 0.6717 before steadying to 0.6732. Lower copper and iron ore prices also weighed on the Battler.

- USD/JPY – The safe-haven Yen climbed against the Greenback with USD/JPY closing at 106.05, before steadying at 106.10. The Japanese currency’s strength on heightened volatility in equity markets and lower US yields is balanced out by the vigilance of Japanese authorities.

On the Lookout: The implementation of fresh tariffs from both sides in the ongoing trade war had been announced earlier and expected by markets. The volatility was due more to the August month end falling on a Friday ahead of a long US weekend (due to today’s US and Canada Labour Day holidays). Thin liquidity dominated FX with the rise in the offshore USD/CNH triggering stops in the Majors (Euro) and some of the EM currencies.

Data releases were more supportive of the US with Chicago’s PMI and US Spending reports beating forecasts. However, the US Core PCE Index (which is considered the Fed’s favourite inflation measure) underwhelmed.

China’s Manufacturing PMI released Saturday slipped to 49.5 from 49.7.

Today sees Chinese Caixin Manufacturing and Non-Manufacturing PMI’s and Australia’s ANZ Job Ads from Asia. Euro area, the Eurozone and UK PMI’s are released in European time. The US and Canada are closed for their Labour Day holiday celebration.

On the trade front, talks between China and the US are still planned for September.

Trading Perspective: The August month-end thin trading conditions led to technical breaks in some currencies favouring the US Dollar. Global interest rates were steady. Data releases were mixed. Markets will focus on how China will address the slump in its Yuan. Expect more stable trading conditions to prevail today as we start a new month. The week ahead sees some big events and data releases. Tomorrow the RBA holds its interest rate policy meeting. The US Payrolls report is due on Friday. September is traditionally a volatile month for FX.

Market positioning this week will be crucial as speculators reinstated Dollar bets which were already long. This makes me wary of false breaks.

- EUR/USD – the shared currency, also a mirror of the Dollar Index, broke through the 1.100 support area hitting an overnight and May 2017 low of 1.0965 before climbing to settle at 1.0990 in early Sydney. The break at 1.1000 saw stops triggered in thin conditions. Today immediate resistance can be found at 1.1000 followed by 1.1030. Immediate support lies at 1.0980 and 1.0960. Sentiment is decidedly bearish on the Euro and we would need a break above 1.1050 (overnight high 1.1042) to trade up. The latest market positioning saw a small increase in speculative EUR shorts. I expect this to have risen in the latest report, which will be released Wednesday due to the US market holiday today. Meantime look to trade a likely 1.0970-1.1020 range today. Prefer to buy dips.

- AUD/USD – The Australian Dollar continued to grind lower pressurised by the implementation of fresh tariffs between China and the US. AUD/USD finished in New York at 0.6725. The slump in China’s Yuan also weighed on the Battler. The RBA meets on policy tomorrow and while markets do not expect a rate cut from policymakers, traders are bearish on the Aussie. Net speculative Aussie shorts continue to build. This has kept the currency from plummeting below 0.67 cents. Any bounce in the Yuan or general US Dollar weakness will see the Battler jump. Immediate support lies at 0.6710 followed by 0.6690. Immediate resistance can be found at 0.6740 and 0.6770. Look for a likely trading range today of 0.6715-0.6755. Prefer to buy dips.

- USD/JPY – The Dollar closed a touch lower at 106.05 after trading to a low of 105.92 in early Sydney. USD/JPY traded in a 105-107 range for most of August. With Japanese authorities ever vigilant, we can expect more of the same for this month’s start. Net speculative JPY longs increased at last week’s COT/CFTC report. Immediate resistance lies at 106.30. Immediate support can be found at 105.90 followed by 105.60. Look for a likely range today of 105.90-106.30. For today, look to trade this range.

Have a good week ahead, happy trading all.