Asia stocks advanced in the last trading day of the week as traders spy a possible light at the end of the tunnel in talks between the UK and EU and China’s suggestion of an official state visit by President Xi linked to a trade deal will see the meeting take place in late April, a delay to the much-anticipated March finish. In Japan, the Nikkei225 main index rose 0.77 percent to 21,450, and the Hang Seng benchmark in Hong Kong finished 0.90 percent higher at 29,109. The Shanghai Composite finished 0.91 percent higher at 3,017, while stocks in Australia slipped into negative territory in the final minutes of the session, weighed down by losses in the financial, materials and healthcare sectors. The ASX 200 lost 4 points or 0.1% to 6,175. Over the week, the benchmark index fell 0.5%, and that is the first weekly loss in a month.

In commodities markets Light Crude Oil keeps the positive momentum at the four-month high, trading at 58.78, Brent oil also trading higher at $67.44/barrel a few cents lower from yesterdays high at 68 supported by global production cuts and supply disruptions in Venezuela. Gold started a solid rebound in Asian session from the lows at 1293 to the highs at 1301 zone. XAUUSD may find support at $1297 where the 50-day moving average crosses, ahead of testing 100-day simple moving average down to $1293.

Positive start for equities in early European trading with investors watching the developments surrounding Brexit, DAX30 is adding up 0.07 percent to 11,595, CAC40 is 0.34 percent higher at 5,367 while FTSE100 in London is 0.52 higher at 7,222. On Thursday UK ministers voted by 413 to 202 in favour of delaying Brexit. Any delay to the process will now need to be agreed by the other 27 EU members, with talks about possible conditions for an extension to be held before next week’s EU summit.

On the Lookout: The BOJ left monetary policy unchanged but moved to downgrade its assessment of the country’s outlook on exports, output as well as its take on the global economy.

Germany’s Ifo institute yesterday slashed its growth forecast of the economy this for 2019 to 0.6 percent. The think tank previously still saw the German economy expanding by 1.1% in January 2019. However, Ifo analysts predict the weakness as being short-lived and expect a rebound to 1.8% growth in 2020.

In the US economic calendar today we wait for the Canadian manufacturing sales report at 12:30GMT, followed by the US industrial output and capacity utilization data at 13:15GMT. The US JOLTS job openings, and UoM consumer sentiment releases will be released at 14:00GMT. The oil traders will look forward to the US Baker Hughes oil rigs count data at 17:00GMT for clues on the sustainability of the recent oil rally.

Trading Perspective: The Aussie dollar is trading on the green and continues to edge toward the 0.71 zone supported by positive Sino US trade news. The Kiwi is also higher to daily highs at 0.6858. The US dollar index stabilizes around 96 after a failed attempt at 96.25.

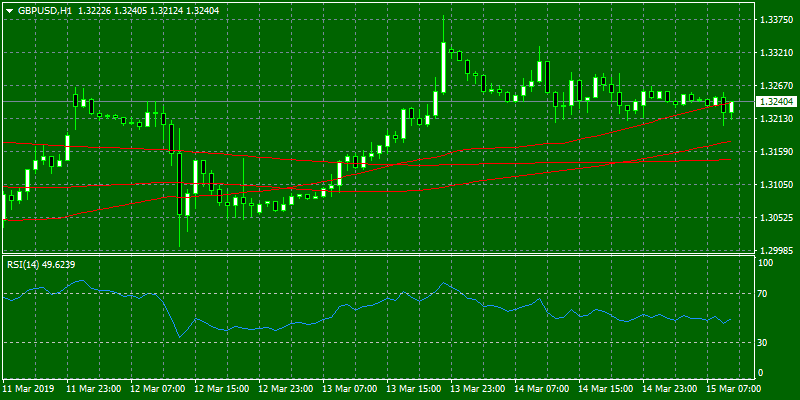

GBPUSD has recently challenged the 1.3363 July 2018 high, reaching 1.3382 before falling back to 1.32 in expected correction. The bull trend is still intact even the high volatility scaring the traders as are closely watching the developments around Brexit votes and rumors. The technical picture is bullish for GBPUSD even today lost the 50-hour moving average at 1.3233. On the downside, major support will be found at 1.2990 where the 50 and 200-day moving averages are crossing. On the flip side, major resistance can be found at 1.3382 the yearly high.

In Pound futures markets the open interest shrunk by nearly 2K contracts on Thursday from the previous session and following three consecutive daily builds. In the same direction, volume retreated for the second straight session, this time by around 5.5K contracts.

EURUSD keeps the bullish tone above 1.13 that started this week in an attempt to regain some of the previous week losses. The pair is trading above 1.13 for the second day and is looking to break above 1.1342 the high from March 13th in order to establish a new bullish trend targeting 1.14. The low from yesterday session at 1.1277 provides solid support if the pair manages to break the 1.13 round figure.

On the EU political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, traders added around 6.5K contracts to their open interest positions on Thursday from Wednesday’s final 533,046 contracts, reverting two consecutive drops. Volume, instead, shrunk by almost 69K contracts after three builds in a row.

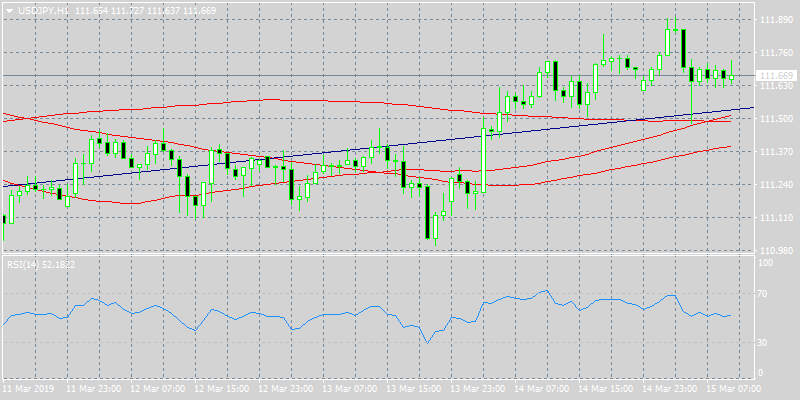

USDJPY rallied to 111.89 following the latest BoJ monetary policy update but soon corrected at 111.67 as it balances out the BOJ weakening economic outlook on exports and production and a report that North Korea is considering to suspend talks with the US on denuclearisation. Resistance stands at 112 round figure while support can be found at the low from yesterday at 111.27.

In Yen futures markets, open interest rose for the second consecutive session on Thursday, this time by around 8.5K contracts. Volume, in the meantime, extended the uptrend and rose by nearly 25K contracts.