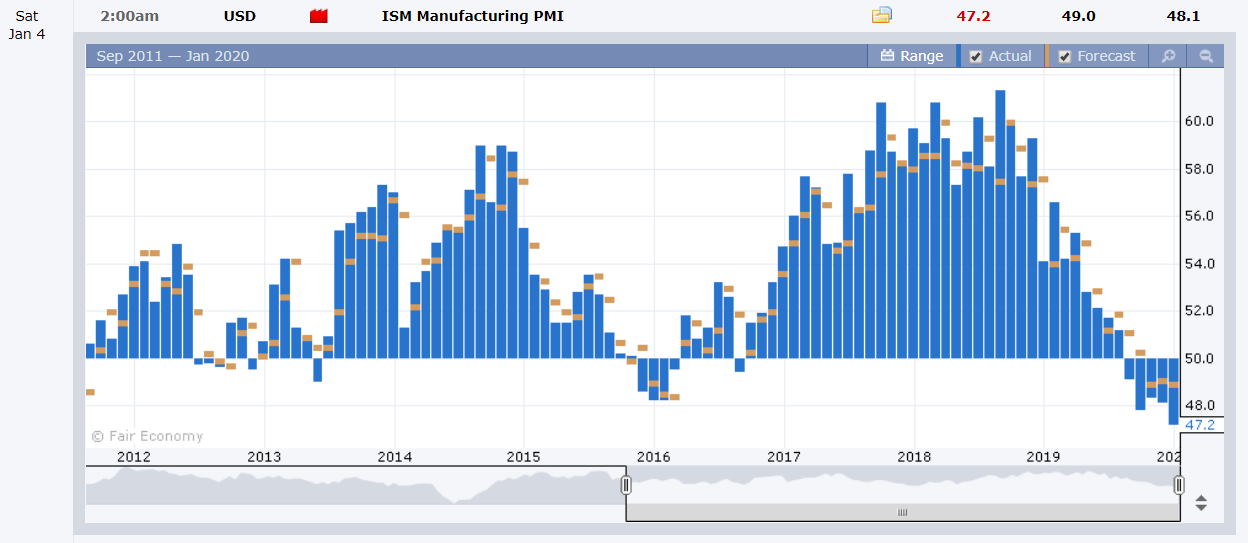

Summary: The Japanese Yen rose 0.54% to 108.12 (108.55) against the Dollar after President Trump ordered a drone attack which killed Qassem Soleimani, head of Iran’s elite Quds Force. Over the weekend, Iran promised to retaliate following three days of mourning. Yesterday, Gulf stocks were sharply lower led by Saudi and Kuwaiti equities. The Aussie and Kiwi both slumped 0.56% to 0.6945 (0.6985) and 0.6665 (0.6692) as risk-off hit all asset classes. Sterling fell to 1.3075 from 1.3135 while the Euro retreated 0.17% to 1.1157 (1.1167). The Dollar Index (USD/DXY) was little changed at 96.896 (96.844), the Greenback put in a mixed performance. Oil, gold and treasuries rallied while Wall Street stocks fell. The DOW finished 0.91% lower at 28,625 (28,772). The S&P 500 lost 0.8% to 3,235 (3,248). US bond yields were lower. The benchmark US 10-year rate dropped 8 basis points to 1.79%. Two-year US treasuries yielded 1.52% from 1.57%. The US ISM Manufacturing PMI plunged to 47.2 in December from 48.1 the previous month, missing forecasts of 49.0. It was the worst reading in over a decade. Euro-area Manufacturing PMI’s were mixed. UK Construction PMI fell to 44.4 in December from 45.3.

- USD/JPY – The Dollar slumped against the haven sought Yen to 108.12 from 108.57 on heightened geopolitical tensions following Iran’s threat to retaliate against the US after the drone attack terminated Soleimani, a key figure in Iran. Risk-off saw demand for the Japanese currency. A Tokyo holiday on Friday made for thinner conditions.

- EUR/USD – The Euro retreated 0.17% to 1.1155 at the New York close from 1.1165 at Friday’s Asian opening. Euro area data were mostly mixed while risk aversion kept the shared currency within a relatively tight range.

- AUD/USD – Risk-off, lower gold and equity prices weighed on the Australian Dollar, which closed at 0.6945 from 0.6985, a loss of 0.56%. Meantime, raging bushfires in 4 states continued to burn. Hundreds of homes have been destroyed, more than 12 million acres have burned (the size of Denmark), 24 people have been killed and an estimated 500 million animals are assumed dead.

On the Lookout: On the first full week back for markets, expect the risk-off sentiment to dominate early Asian trading. Latest headlines saw furious war rhetoric waged between Iran and the US. Traders will keep their eyes on headlines about any geopolitical developments. The latest geopolitical events trumped news on the trade front. And will continue to do so.

A busy economic calendar awaits FX beginning today. The week’s highlight will be US Non-Farms Payrolls on Friday.

Australia kicks off with its AIG Manufacturing Index (December). This is followed by Japanese Final Manufacturing PMI and Chinese Caixin Services PMI. Europe begins with Germany’s Retail Sales followed by Spanish, Italian, French, German and Eurozone Final Services PMI’s. The UK reports its Final Services PMI which is followed by Canadian RPMI. The US Final Services PMI rounds up the day’s reports.

Trading Perspective: Risk aversion on worsening geopolitics will keep the Yen strong against the Dollar and other currencies. The last COT report saw speculators holding Yen shorts which will also provide support for the Japanese currency.

Markets ignored the drop in US ISM Manufacturing which had the lowest print in over a decade. This should cap any US Dollar gains.

- EUR/USD – The Euro traded within a relatively tight 1.1125-1.1180 range with trading in the shared currency subdued. Immediate resistance on the day lies at 1.1180 followed by 1.1210. There is immediate support for the Euro at 1.1145 and 1.1125. Euro area data reports were mostly mixed on Friday. Germany’s 10-year Bund yield closed 6 basis points lower at -0.29%. Look for a likely trading range today of 1.1145-1.1195. Prefer to buy dips.

- USD/JPY – slip sliding away, the Dollar finished at 108.12 in New York (108.57 Friday). In early Sydney this morning, the Dollar was lower, trading around 107.90. Overnight low for USD/JPY traded was 107.842. Immediate support on the day lies at 107.70 followed by 107.40. Immediate resistance can be found at 108.15 followed by 108.45. Look for a likely trading range today of 107.65-108.15. Prefer to sell rallies.

- AUD/USD – The Aussie Battler slid back down to 0.6945 from 0.6985 on Friday. Risk currencies were lower following heightened geopolitical tensions. On the other, hand the dismal US manufacturing PMI will weigh on the Greenback, providing the Aussie Battler with some support. Immediate resistance lies at 0.6985 followed by 0.7000. Immediate support can be found at 0.6920 (overnight low 0.6930) followed by 0.6890. Today sees the release of AIG Australian Manufacturing PMI and China’s Caixin Services PMI. China’s report may impact the Aussie. Look for a likely range today of 0.6930 to 0.6980. Prefer to buy dips.

- GBP/USD – Sterling slid 0.56% to 1.3075 from 1.3135 on Friday. UK Construction PMI fell to 44.4, missing forecasts at 45.8. The British Pound weakened on fears of an Iran-US war. UK Prime Minister Boris Johnson was on the news wires early this morning supporting the US assassination of a top-ranked Iranian general. GBP/USD trades a few points lower to 1.3065 in Sydney on the news. Immediate support lies at 1.3050 (overnight low 1.30535) followed by 1.3020. Immediate resistance lies at 1.3100 followed by 1.3140. Look for a likely range today of 1.3050-1.3150. Prefer to buy dips.

Have a good Monday start, happy trading all.