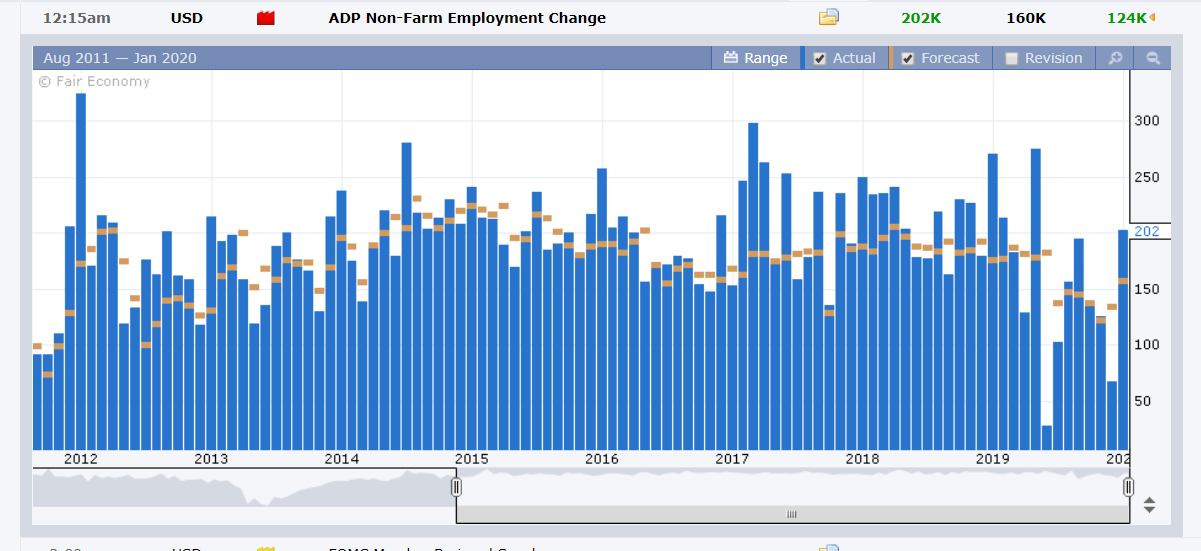

Summary: After Iran launched a missile attack on US military bases in Iraq, President Trump sought to play down the ongoing conflict. Trump said that Iran appears to be standing down and the US would impose sanctions rather than another military strike. Markets quickly reversed speculative bets that piled into safe-haven FX and assets and sold risk. The Dollar Index (USD/DXY) was up 0.3% to 97.31 (97.00) after the ADP reported that US Private Payrolls climbed by 202,000 in December following an upwardly revised rise in November to 124,000 (67,000). It was the largest gain since April. Against the haven sought Yen, the Dollar jumped 1.1% to 109.25 (108.55).

The Euro retreated to 1.1105 from 1.1145, down 0.38%. December German Factory Orders fell 1.3%, widely missing forecasts of a 0.2% gain. Sterling dipped 0.1% to 1.3100 (1.3125) against the advancing Greenback. Against the trend, the Australian Dollar steadied to 0.6870 (0.6867) after December Building Approvals jumped 11.8%, beating expectations of 2.1% and reversing November’s 7.9% fall. Emerging Market currencies bucked the trend with the South African Rand, Turkish Lira, Russian Rouble and Mexican Peso all recording gains of over 1% against the US Dollar.

At the close of trading in New York, Brent Crude Oil was down 4% to 65.30. Wall Street stocks lifted after falling initially. The DOW closed at 28,800 (28,605), up 0.78%, while the S&P 500 added 0.67% to 3,259 (3,240).

- EUR/USD – The Euro retreated against the advancing Dollar to close at 1.1105 in New York. German Factory Orders in December underwhelmed while US ADP private employment outperformed, a double-whammy negative for the shared currency.

- USD/JPY – Because of its haven status, the Yen can be a live by the sword, die by the sword currency. Sometimes the sword can be a samurai which cuts deeply. The Dollar jumped back against the Yen to close at 109.25 from 108.55, a gain of 1.1%. Overnight, USD/JPY traded to a low of 107.651.

- AUD/USD – The Aussie steadied after its slump yesterday as more analysts saw the bushfire crisis impacting the country’s GDP. Upbeat Australian Building Approvals supported the Battler which closed marginally higher at 0.6870 from 0.6867 and a low traded 0.68491.

On the Lookout: Markets will keep a wary eye on the Middle East conflict and what comes out of President Trump’s mouth and tweets. Meantime the focus goes back on economic data reports where we have seen a few surprises of late. The US ADP Private Employment gain was the largest since April and augers well for tomorrow’s Non-Farms Payrolls. For the first time this year, events focus on several key central bank officials speaking at various events. Bank of England Governor Mark Carney will deliver opening remarks at the Future of Inflation Targeting Conference in London. Fed FOMC members Clarida, Kashkari and Williams speak at various functions, Clarida and Kashkari in the US, and Williams in London. Bank of Canada Governor Stephen Poloz and Bundesbank President Weidmann also address different events in Canada and Germany.

Today sees Australia’s Trade Balance for December where the Surplus is expected to mirror that of the November. China follows next with its annual CPI and PPI data for December.

Europe starts off with Germany’s Industrial Production and Trade Balance for December. Switzerland reports on its Retail Sales and Foreign Currency Reserves. Eurozone Unemployment rate follows. Canada reports its Housing Starts and Building Permits. Finally, the US releases its Weekly Jobless Claims.

Trading Perspective: Adding to the mix of fast and furious events to kick off the first full trading week of 2020 is the final Commitment of Traders/CFTC report for 2019. The COT report for the week ended 31 December 2019 saw speculative US Dollar bets fall to an 18-month low. Indeed, the last few weeks in December, market positioning began to correct itself. Once again, it’s the breakdown where FX interest is keen. Speculators were long GBP, CAD, MXN and RUB at the end of 2019.

- EUR/USD – The Euro retreated to 1.1105 against the overall stronger US Dollar after its failure to clear 1.1200 on the topside on Tuesday. EUR/USD traded to a low at 1.1103 this morning. Immediate support can be found at 1.1100 followed by 1.1070. Immediate resistance lies at 1.1140 and 1.1170. The Euro was the only currency where speculators added to their short bets. Net speculative Euro shorts climbed to -EUR 74,345 from -EUR 72,943. The total net speculative short Euro position is 70% of the year’s maximum. Which is a red flag for further shorts. Look for a likely range of 1.110-1.1160.

- USD/JPY – The Dollar had another see-saw session against the Yen, this time rising to close at 109.25 from 108.55 yesterday. After the news broke of Iran’s retaliation, the Dollar plunged to a low at 107.65. US 10-year yields climbed 5 basis points to 1.87% while Japanese 10-year JGB rates were unchanged at -0.02%, which added to USD support. The latest COT report saw speculative JPY shorts trimmed to -JPY 25,302 bets from -JPY 33,542. The speculators are still short of JPY bets and any reversal in the Dollar will see this currency pair lower. Immediate resistance lies at 109.50 followed by 109.80. Immediate support can be found at 109.00 and 108.60. Look for a likely range today of 108.70-109.20. Prefer to sell rallies.

- AUD/USD – The Aussie Battler steadied following the upbeat Building Approvals report. Today sees Australia’s Trade Balance where the Surplus is forecast to dip to +AUD 4.12 billion in December from +AUD 4.5 billion in November. China’s CPI and PPI will also be looked at. The Commitment of Traders report saw net Aussie Dollar bets close 2019 with a net short position. Speculative shorts trimmed their bets to -AUD 38,339 from the previous week’s -AUD 46,164. Immediate support for the Aussie Battler lies at 0.6850 followed by 0.6820. Immediate resistance can be found at 0.6890 (overnight high 0.6885) and 0.6910. Look for a likely trading range today of 0.6870-0.6920. Prefer to buy dips.

Happy trading all.