By Giles Coghlan, Chief Market Analyst, HYCM

On Wednesday November 30, Federal Reserve Chairman, Jerome Powell, spoke at the Brookings Institute, providing what he called a progress report on the FOMC’s efforts to restore price stability.

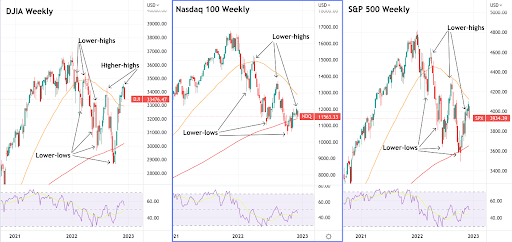

US equity markets rallied on the day, with the S&P 500 up over 3%, the Nasdaq up 4.5%, the Dow up 2.4%, and the Russell 2000 up 2.9% on the day. At the time, markets interpreted Powell’s confirmation that the pace of rate hikes would likely slow in December as a bullish signal, understanding this to mean that the Fed was getting closer to pivoting.

This is an odd reading, as there wasn’t really anything dovish in there to support this view. In fact, you couldn’t even call him less hawkish than usual. At HYCM, we tend to favour a look-before-you-leap approach, which is why we think it’s a good idea to go over what Powell actually said for any of you who are interested.

Chair Powell opened his address by asserting that inflation was still far too high. He focused on core PCE (excluding the volatile items of food and energy), it’s the Fed’s preferred measure of inflation due to it supposedly offering a more accurate picture of where inflation is heading. Core PCE has essentially been sideways from December of last year when the Fed’s tightening initiative was just getting started, through to the estimated readings of October 2022.

Inflation Breakdown

The main part of the address was dedicated to an explanation of inflation as the Federal Reserve views it, breaking it down into the following three categories.

Core goods inflation, which he stated has moved down from very high levels. Core goods inflation was greatly affected by the pandemic as locked-down populations switched their consumption habits primarily to goods rather than services at a time when the supply of these goods was massively hampered. This is also the type of inflation that has eased as reopening has led to consumption habits switching back to services and supply chain issues being corrected. This is the metric that’s leading the decline in inflation and the Fed believes it will “exert downward pressure” on overall inflation readings in the coming months.

Next, we have housing services inflation (rents and owner-occupied equivalent costs), which have risen rapidly and continue to rise. Housing services inflation tends to lag the other metrics due to the gradual manner in which rental leases turn over. The Fed expects this metric to begin falling at some point next year as rising rolled-over leases come back into balance with falling new leases. The latter group spiked during the pandemic, but have been falling sharply since the middle of 2022.

Finally, core services inflation, excluding housing (includes education, healthcare, travel, and hospitality). This category has fluctuated, but shown no clear trend. It’s the most important of the three, comprising more than half the PCE index and is very sensitive to wages. Powell drew attention to the fact that since the pandemic, the demand for workers far exceeds supply, and that there is currently a shortfall of 3.5 million workers. He attributed this to lower-than-expected population growth and lower labour force participation, as well as overall participation still being well below pre-pandemic trends. Powell pointed out that the above are well out of the reach of the Fed’s tools, which work on demand. And without explicitly stating that in order to bring wage inflation in line with the Fed’s broader 2% target it would have to destroy jobs, he did conclude this section by suggesting that in the near term “a moderation of labour demand growth would be required to restore balance to the labour market.

The Bottom Line

So, to recap, inflation is still too high, the Fed will probably have to remain higher for longer, despite a probable slowing of rate increases. The Fed’s most valued inflation gauge is pretty much still flat on the year, the most important part of it is showing no clear trend, and is largely affected by factors that the Fed cannot hope to alleviate other than by “moderating labour demand growth (reducing the need for more jobs).”

You may have heard none of the above in the coverage of the vaunted end-of-year rally many people were focused on early in December. You probably only heard that the Fed was due to moderate the pace of rate increases, as early as the December meeting. But just so there can be no confusion as to what Jerome Powell is saying about the likelihood of a pivot going into this FOMC meeting, we’ll quote the end of his address at length.

Speaking of the slowing in rate hikes likely to come in December in the form of a 50-basis point increase rather than another 75-basis point hike, he said:

“The timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy… We will stay the course until the job is done.”

The Nasdaq is currently back to retesting the support of its 200-week moving average. The S&P 500 failed to reach its 20-week MA in the recent rally and only the Dow seems to be holding up, having set two prominent weekly higher-highs in August and December. When viewing the above chart in the light of Powell’s words, do you think recent price action has anything to do with an imminent Powell pivot, or have we just been in the midst of another bear market bounce?

Indices like S&P500 and Nasdaq, as well as other instruments are available for trading at HYCM.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.