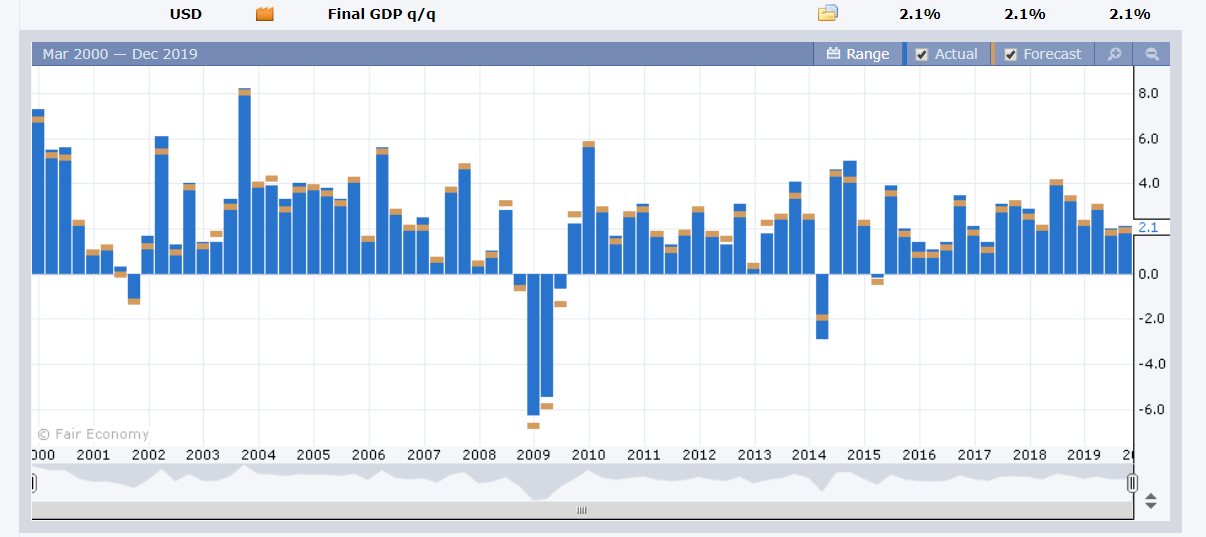

Summary: US GDP growth maintained a steady pace in the third quarter as 2019 comes to an end, supported by strong consumer spending. The final estimate of Q3 GDP matched forecasts with a 2.1% annualised rate, the US Commerce Department reported. Two and ten-year US bond yields climbed one basis points to 1.63% and 1.92% respectively. The Dollar Index (USD/DXY) lifted 0.31% to 97.68 from 97.38, for its highest finish in a week. The Euro which carries almost 60% of the weight in the Dollar Index, slid 0.42% to 1.1075 (1.1125), ending as worst performing currency. Sterling steadied to 1.3002 from 1.3008 after the UK Parliament passed Boris Johnson’s Brexit bill which will see the UK exit the European Union in 2020. The Australian Dollar maintained its bid tone, climbing 0.17% to 0.6902 (0.6882) after last week’s upbeat employment data and a report that said that the phase one trade deal between China and the US would be signed soon. China News Asia reported on Saturday that President Trump said that the US and China would shortly sign their so-called phase one trade pact. Trump was speaking at a Turning Point USA event in Florida. The Dollar rallied to 109.45 from 109.27 against the Yen in pre-holiday trade.

Other data released on Friday saw Germany’s GFK Consumer Climate dip to 9.6 in November from 9.7 previously. Eurozone Consumer Confidence fell to -8, missing forecasts at -7. UK Final Q3 GDP rose to 0.4% from the previous quarter’s 0.3%. US November Personal Spending matched forecasts at 0.4% while Personal Income rose to 0.5%, beating estimates at 0.3%. Wall Street stocks extended their gains. The DOW was up 0.25% to 28,473. (28,373.) while the S&P 500 gained 0.4% to 3,222.

Germany’s 10-year Bund Yield dipped to -0.26% from -0.24%. Japanese 10-year JGB’s yielded 0.00% from -0.01%. Australia’s 10-year bond rate climbed to 1.28% from 1.27%.

- EUR/USD – the shared currency got hit by a double whammy of a strong Q3 US GDP report and weak Eurozone Consumer Confidence data. The Euro slid 0.42% to 1.1075, its lowest finish in almost 2-weeks as volumes thinned into the New York close.

- GBP/USD – Sterling steadied after it’s post-UK election slide to just above 1.3000 (1.3003). The UK Parliament overwhelmingly voted to pass Boris Johnson’s Brexit bill which would see the UK exit the EU in January 2020.

- AUD/USD – The Aussie kept its bid, closing at 0.6902, up 0.17%, following last week’s upbeat Australian Employment report saw less chances of any RBA rate cuts in February 2020, their first policy meeting next year.

- USD/DXY – The Dollar Index, a popular gauge of the Greenback’s value against a basket of 5 major currencies, rallied 0.31% to 97.68 from 97.38. The Q3 US GDP report ensured that the US economy maintained its moderate pace of expansion.

On the Lookout: The New York close on Friday saw pre-holiday trading volume drop markedly. The economic calendar is quiet for the week ahead with today the most active.

Australia’s Private Sector Credit for November starts off followed by Japan’s All Industries Activity for Asia’s economic reports. The lone report for Europe is Germany’s Import Prices. North American data start off with Canada’s November GDP followed by US November Headline and Core Durable Goods Orders, and finally New US Home Sales.

Tomorrow most markets will see half-day trading with virtually little data released. The only major report is Japan’s BOJ Core CPI report and the release of its latest meeting minutes. Japan will be the only major financial market open for December 25. While US markets will re-open on December 26, most financial companies will have skeleton staff. Markets re-open on Friday, the 27th but trading will be muted until after the New Year celebrations.

Trading Perspective: With volumes thinning out into the holiday period, its best not to get involved as liquidity dries up. For this time of the year, most FX traders will cover any open positions created by client needs immediately. As for personal trading, its best the echo Huey Lewis’s 1986 hit tune “Hip to be Square” during the period. For today, keep your levels intact, update your charts but get square ahead of tomorrow until we get to Friday, the first real trading day this week after today.

- EUR/USD – The Euro fell 0.42% to finish at 1.1075 from 1.1125 on Friday morning. The weight of an overall-stronger-US Dollar boosted by upbeat US data and higher yields weighed on the shared currency. Per-holiday trading volumes were thin which exaggerated the move. Immediate support can be found at 1.1060 (overnight low 1.10663) followed by 1.1030. The next level of support lies at 1.1000, which should hold. Immediate resistance lies at 1.1100 and 1.1125 (overnight high). Look for a likely range today of 1.1065-1.1105.

- GBP/USD – Sterling traded to an overnight low at 1.2978 before steadying to 1.3005 at the NY close. Immediate support for the British Pound lies at 1.2980 followed by 1.2950. The Pound received some support after the UK Parliament passed Boris Johnson’s Brexit bill. However, this may still lead to a no-Brexit which weighed on British currency. GBP/USD has immediate resistance at 1.3040 followed by 1.3080. Look for a likely trading range today of 1.2970-1.3120.

- USD/JPY – The Dollar climbed back up against the Yen to 109.45 from 109.25 on upbeat US data and higher US bond yields. Risk appetite also rose on the headlines quoting President Trump as saying that the so-called phase one trade pact with China and the US would be signed “very shortly.” Bear in mind that Japanese JGB bond yields have been steadily climbing following last week’s BOJ policy meeting. Ten-year JGB yields closed at 0.00%, up one basis point from Friday and 3 basis points from a week ago. This should keep the USD/JPY topside limited. Immediate resistance lies at 109.55 (overnight high 109.524) followed by 109.80. Immediate support can be found at 109.25 (overnight low 109.255) and 109.00. Look for a likely trading range today of 109.10-109.60.

- AUD/USD – The Australian Dollar was the best performing currency, finishing higher against the US Dollar at 0.6901 from 0.6885 on Friday morning. Overnight high traded was 0.69067. Immediate resistance can be found at 0.6910 followed by 0.6940. Immediate support lies at 0.6885 (overnight low traded was 0.6883). The next support level can be found at 0.6855. Look for a likely trading range today of 0.6890-0.6920.

I would like to use this opportunity to greet everyone a Merry Christmas. Be blessed and stay safe. Back on the 27th.

Happy trading all.