Summary: A surprise add to US May Payrolls of 2.509 million jobs instead of losing another 8 million jobs saw the benchmark 10-year bond yield surge 8 basis points to 0.902%, its highest in almost 3 months. The rise in the benchmark rate totalled a whopping 25 basis points. The US Unemployment rate improved to 13.3% against median expectations of 19.5%. The US Dollar managed to climb off its lows, finishing Friday’s New York session mixed against its rivals. Against the Japanese Yen, the most sensitive currency to the US 10-year yield, the Dollar extended its climb to 109.58 from 109.16. The Euro reversed lower to 1.1287 from 1.1335 while Sterling rose to 1.2667 (1.2597). The Australian Dollar edged lower to close at 0.6967 (0.6955) after trading above 0.70 cents for the first time since January 3 to 0.7013 on Friday. Canada also surprised the market with its own Payrolls growth surprise. Instead of losing another 500,000 jobs, the Canadian economy added 289,000 jobs in May. Canada’s Unemployment rate also bettered forecasts to 13.7% against 15.0%. Against the Canadian Loonie, the US Dollar slumped to 1.33914 lows before climbing to settle at 1.3425 (1.3490 Friday). Wall Street stocks rose buoyed by the upbeat data, rose to close higher. The DOW finished at 27,095 (26,319), up 2.99%. The S&P 500 gained 2.35% to 3,190 (3,119).

Other data released Friday saw Germany’s May Factory Orders slump to -25.8%, worse than the –20% forecast. Yesterday China reported that its Trade Surplus in May soared to +CNY 443 billion (+USD 62.9 billion) from +CNY 318 billion (+USD 45.3 billion) the previous month. China’s exports fell 33% in Dollar terms while imports tumbled 16.7%.

On the Lookout: Today, Australian banks are closed in observance of the Queen’s holiday while the economic calendar is light. Japan kicks off the day’s reports with its Bank Lending, Current Account, Q1 Final GDP, and Economy Watchers sentiment data. Europe sees Germany’s May Industrial Production and Eurozone Sentix Investor Confidence Index. ECB President Christine Lagarde is due to speak to the European Parliament on Economic and Monetary Affairs Committee.

This week’s big event is the US Federal Reserve monetary policy meeting (early Thursday morning, June 11, Sydney time). The Fed is widely expected to leave its monetary policy unchanged. After Friday’s stellar Payrolls report, the US central bank will continue to resist negative interest rates. And its outlook could be considerably brighter. This could be the game-changer for the beleaguered Greenback.

Trading Perspective: Despite the surprise rise in the US Payrolls where not one of the many economists predicted, the Dollar finished little-changed. Although the Dollar pulled higher from its depths reached on Friday, the US currency finished mixed against its Rivals. Much of this is being attributed to the market’s elevated risk appetite. At another time, the Greenback would have surged against the currencies.

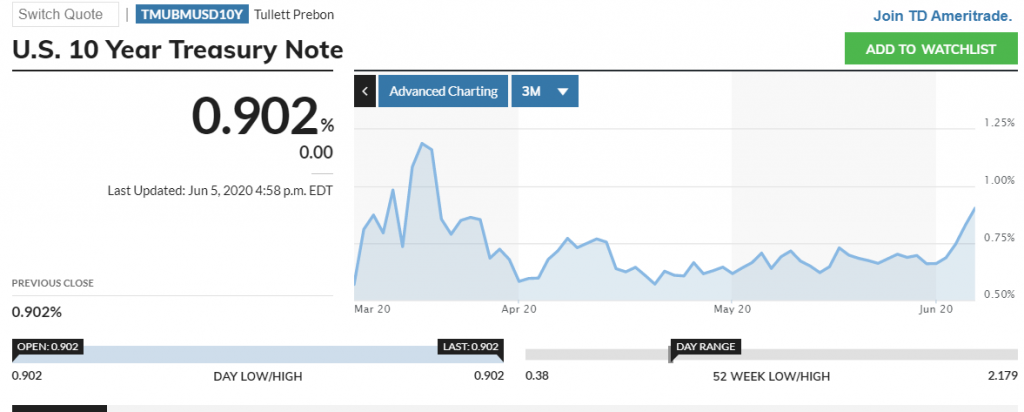

The benchmark US 10-year bond yield surged 8 basis points to close at 0.902%, its highest since early March. The ten-year rate has climbed 25 basis points this week. While other rival bond yields were also up, they were outpaced by their US counterpart. As yield differentials widen back in favour of the US, the Dollar will follow. FX 101 – higher yields result in a stronger currency. And a more upbeat assessment from the Federal Reserve at the outcome of their meeting this week will see renewed gains for the Greenback.

AUD/USD – Air Above 0.70 Cents is Thin, Topside Momentum Waning

The Australian Dollar’s 7-day rally saw the Battler surge 4.5% last week, peaking at 0.70130 on Friday afternoon, its highest since January 3. Overnight, the Aussie Battler slumped to an overnight low at 0.69307 before rallying back to close at 0.6767 in New York. Better than forecast Chinese Trade data released yesterday saw the AUD/USD trade to 0.70035 this morning in Sydney before settling at its current 0.6992.

The rise in China’s trade surplus was due to a less than expected fall in exports, down 3.3% in USD terms from a year earlier, helped by an increase in medical related sales. Imports plunged 16.7% due mainly to a fall in import prices. Which shows that the Chinese economy is recovering slowly from May’s coronavirus slump. The rising risk of an escalation in US-China trade relations threatens the outlook for China’s trade.

The yield differential between US and Australian 10-year bonds have narrowed in favour of US rates. Which also sees the AUD/USD upside momentum waning. AUD/USD has immediate resistance at 0.7020 followed by 0.7050. Immediate support can be found at 0.6960 followed by 0.6930. Look to sell rallies in a likely range today of 0.6920-0.7020.

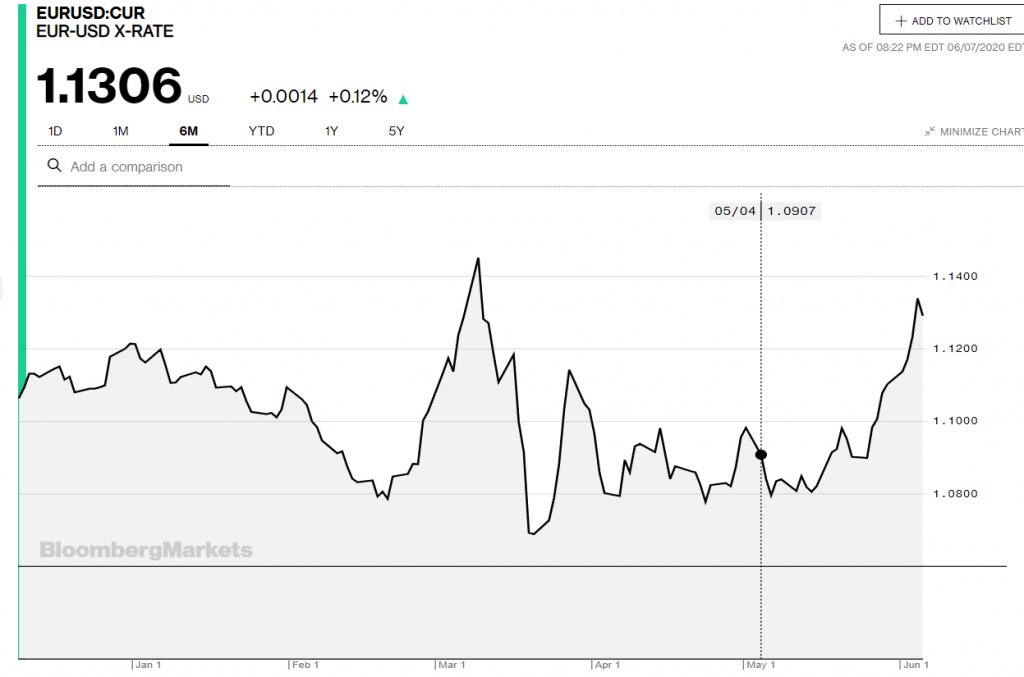

EUR/USD – Rally Overstretched, Pullback Post-US Jobs Surprise to Continue

After 8 straight days of gains, the Euro finally pulled back, slipping to 1.1286 from 1.1336 Friday. Germany’s Factory Orders slumped to -25.8% in May from -15.6% April, and worse than median forecasts of -20.0%. This coupled with the surprise gain in US Jobs pulled back the shared currency. EUR/USD hit an overnight high at 1.13838 before dropping to its New York close. Today sees German Industrial Production data which is expected to fall to -16.0% in May from April’s -9.2%.

Germany’s 10-year Bund yield was up 7 basis points to -0.28%, just one basis point lower than the climb in the US 10-year rate. However, the difference in the climb in both rates last week was 17 basis point higher in favour of the US. This will result a further pullback for the EUR/USD pair.

EUR/USD has immediate support at 1.1270 (overnight low at 1.12785) followed by 1.1230. Immediate resistance can be found at 1.1330 and then 1.1380. Look to sell rallies in a likely 1.1220-1.1320 range today.