Summary: Markets shrugged off the growing threat of the coronavirus pandemic spread even as more than 10 million people across the globe have tested positive. A rebound in contracts to purchase previously owned homes in the US by the most on record in May and an improvement in manufacturing activity in Texas in June gave rise to renewed optimism about a US economic recovery. World Health Organisation Director-General Tedros Ghebreyesus told reporters yesterday that “Globally, the pandemic is actually speeding up.” The Dollar Index (USD/DXY) a favoured gauge of the US currency’s value against a basket of six major foreign currencies, ended flat at 97.473. FX volatility slowed into today’s June 30 month, quarter, and half-year end. The Euro climbed to 1.1240 from yesterday’s 1.1218, up 0.32%. Sterling slipped to 1.2295 from 1.2337, pressurised by Brexit tensions where a resumption of talks between the EU and UK saw no real progress. Against the Yen, the Dollar rallied 0.44% to 107.60 (107.22). The Greenback advanced 0.34% against the Swiss Franc to 0.9512 from 0.9482. Risk and resource currencies finished little-changed. The Australian Dollar was trading at 0.6867 in late New York (0.6864 yesterday) while the Kiwi (New Zealand Dollar) settled at 0.6420 (0.6422 Monday). Wall Street stocks rebounded, erasing losses from yesterday. The DOW finished up 2.14% to 25,635 (25,040) while the S&P 500 added 1.29% to 3,060 (3,015). Global bond yields were static, US 10-year rate was at 0.62% (0.64%).

Data released yesterday saw Japanese May Retail Sales fall to -12.3%, missing forecasts at -11.6%.

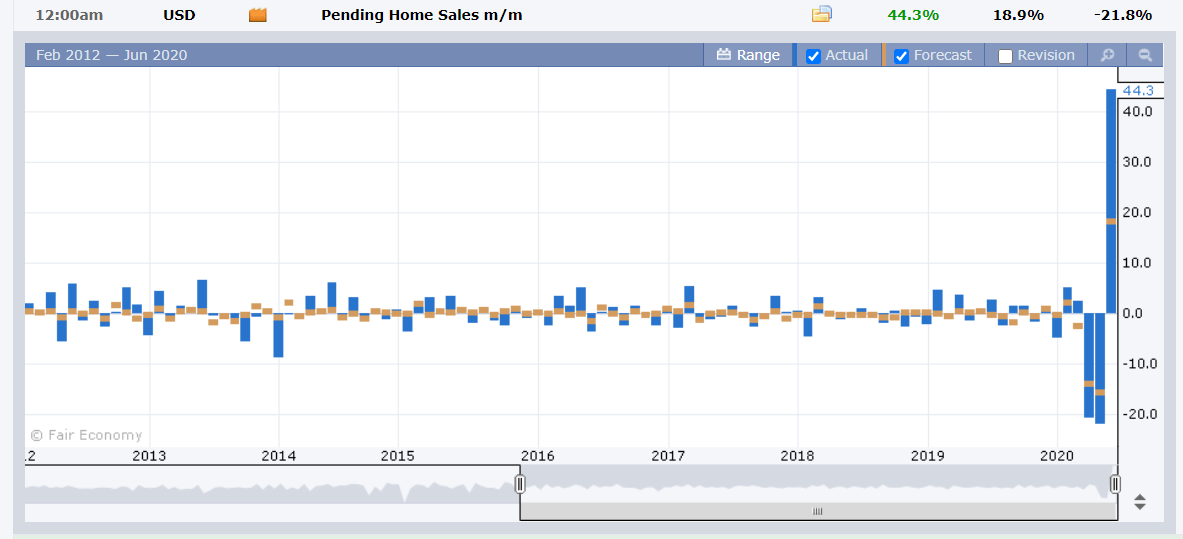

Germany’s Preliminary CPI climbed to 0.6%, beating expectations of 0.3%. Spanish Flash CPI was at -0.3%, beating forecasts at -0.9%. The UK Mortgage Approvals dipped to 9,000 (against forecasts of 25,000). Canada’s Building Permits in May rose to 20.2%, beating expectations of 10.3%. US Pending Home Sales in May surged 44.3%, beating forecasts of 18.9%. It was the largest gain since the series began in 2,000. According to a Reuters report, contracts remained below February levels, before businesses were shuttered in a bid to slow the coronavirus. US Dallas Fed Manufacturing Index climbed to 13.6, overwhelming forecasts at -28.0.

On the Lookout: Market attention remains fixed on developments of Covid-19 global cases. Today sees the release of several first-tier economic reports from around the globe. Several central bank heads are scheduled to speak today. This morning, RBA Deputy Governor Guy DeBelle speaks on the RBA’s policy actions and balance sheet at the Economic Society of Australia’s webinar where questions are expected (12.30 pm Sydney). Early tomorrow morning (2.30 am Sydney, July 1) Federal Reserve Chairman Jerome Powell together with US Treasury Secretary Steven Mnuchin testify before the US House Financial Services Committee in Washington DC.

Japan kicks off today’s reports with its Unemployment Rate, Jobs/Applicants Ratio for May, Preliminary Industrial Production (May) and Housing Starts, released later on. New Zealand follows next with its ANZ Business Confidence Index. China reports its NBS June Manufacturing and Non-Manufacturing PMI. Australia’s Private Sector Credit (May) follows. The UK reports on its Current Account, Final Q1 GDP and Revised Business Sentiment. Switzerland’s KOF Economic Barometer and Retail Sales follow. European reports see French Consumer Spending and Preliminary CPI data as well as the Eurozone Flash Estimate Headline and Core CPI data. Canada reports its GDP (May). The US rounds up today’s reports with its Chicago PMI, S&P/Case Shiller Composite 20-year House Price Index, and Conference Board Consumer Confidence (June).

Trading Perspective: FX volatility eased yesterday with the currencies trading in relatively narrow ranges. Today we could see volatility pick up on any portfolio rebalancing, which would be different for various currencies. Despite the rally in risk assets due to the upbeat US data, resource currencies were not impressed and finished little changed. The warnings from the World Health Organisation on the second wave of rising new Covid-19 cases as well as the halt in re-opening plans in Texas, the 30-day closure of bars, clubs and gyms in Arizona will keep a bid on the US Dollar. The risk-on tone will be challenged. We should see some good trading opportunities as we close the month, quarter and half of the year. We take a look at some of the currencies.

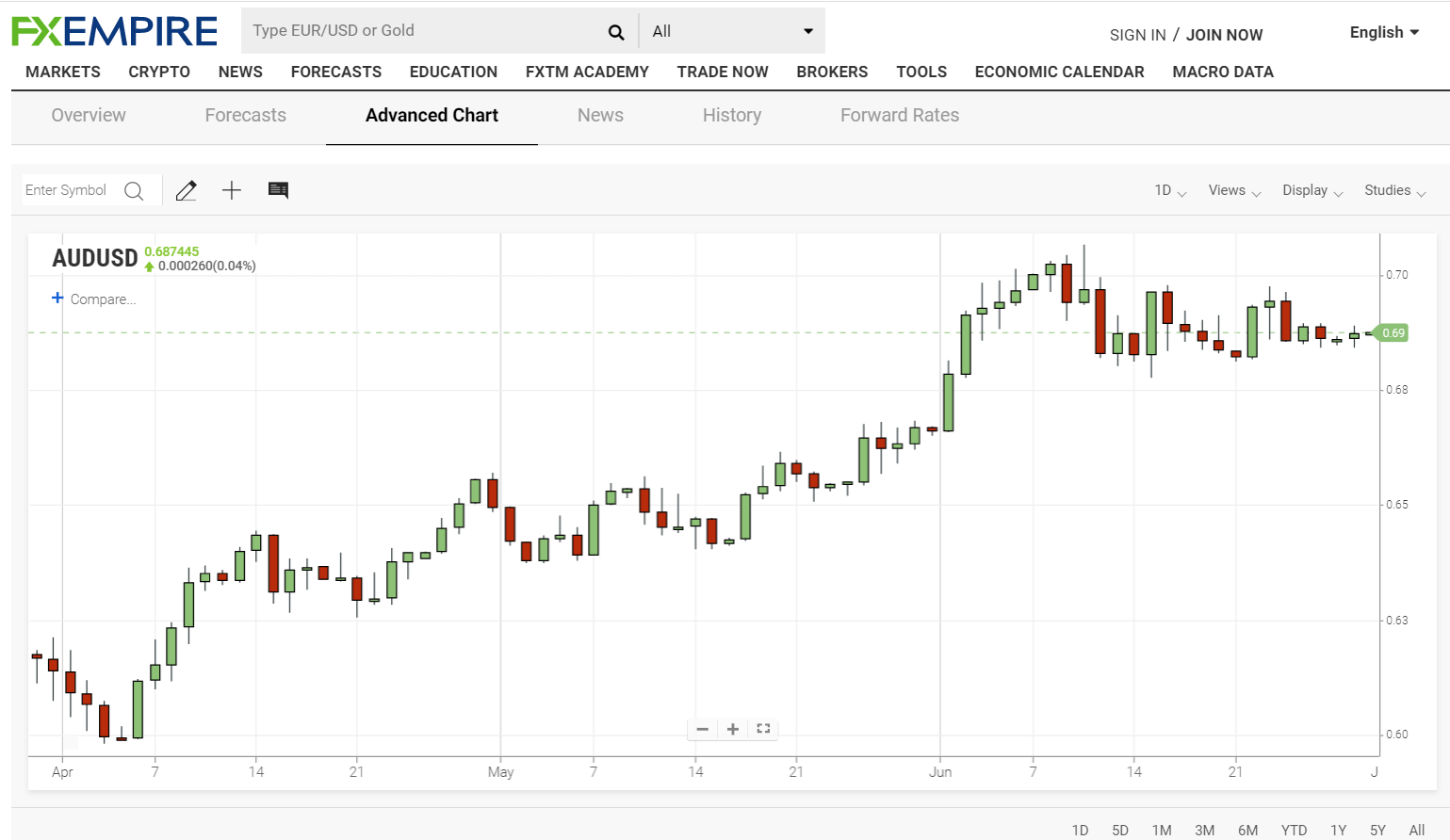

AUD/USD – Steadies, Victoria Gov’t Moves to Counter Virus Spike, China Data Next

The Australian Dollar finished little changed at 0.6868 (0.6864) despite worries about a second wave of Covid-19 infections. The country’s second most populous state of Victoria recently saw a spike of Covid-19 infections in several hotspot suburbs. The state’s chief health officer Brett Sutton indicated that it was “absolutely an option” to put some hotspot suburbs into a secondary lockdown. Total global coronavirus cases rose to 10.38 million while deaths climbed to 507,203 at the latest count. Better than expected US economic data lifted equities and supported the Australian Battler.

AUD/USD traded to an overnight high at 0.68909 before easing to its New York close. Overnight low traded was at 0.68417 as volatility eased. Today sees the release of Chinese Manufacturing and Non-Manufacturing PMI’s. On Thursday, Australia reports its latest Employment report. RBA Deputy Governor Guy DeBelle is due to speak on the Reserve Bank’s policy actions and balance sheet at the Economic Society of Australia’s webinar where questions are expected.

Look for consolidation in a likely trading range today of 0.6830-0.6910. Prefer to sell into any rally around the 0.6900 cent mark.

EUR/USD – Climbs Amidst Lack of Volatility, Spec Longs Build Risk Pullback

The Euro advanced against the US Dollar in subdued trade where volatility was sorely lacking. Speculative long Euro bets are at their largest since early 2018. And we have not seen a decent shakeout of these speculative longs yet. In order for the Euro to have a healthy rally, a pullback is sorely needed. What’s the catalyst? Perhaps today’s month, quarter and year-end rebalancing flows could be the trigger. On the other hand, rebalancing could see demand for the shared currency which would result in a slow grind higher.

The Euro finished at 1.1240 from yesterday’s 1.1217. The overnight low traded was at 1.1217. Overnight peak in the shared currency was at 1.12878. Immediate resistance today lies at 1.1285 followed by 1.1305 and then 1.1340. Immediate support can be found at 1.1210 followed by 1.1170. The market’s speculative positioning needs a decent pullback which could be in the making soon. Look to sell rallies in a likely 1.1210-1.1290 range today.

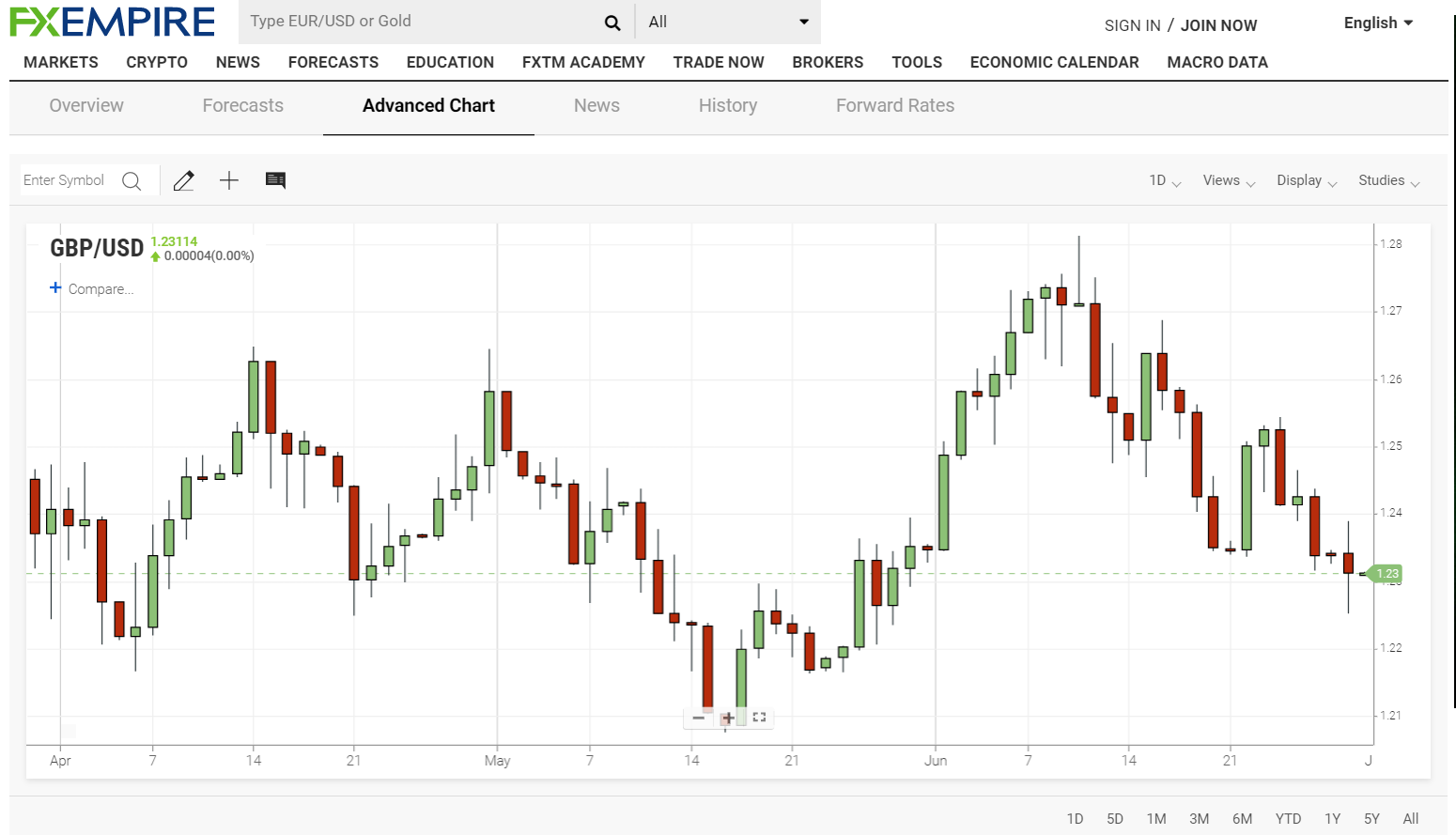

GBP/USD – Pressured by Lack of Progress on Brexit Talks, Mixed Data

Sterling underperformed, slipping to 1.2295 from yesterday’s 1.2335 on Brexit worries resulting from a lack of progress in a new round of talks between the UK and EU. Speculation continues to about negative rates in the UK following last week’s Bank of England policy meeting. Even the Euro benefitted against the beleaguered Pound. The EUR/GBP cross saw the shared currency gain 0.5% to 0.9145 from 0.9095 yesterday. The last Commitment of Traders report which we highlighted saw a decline in speculative GBP shorts to -GBP 15,998 contracts from the previous week’s -GBP 24,048.

GBP/USD traded to an overnight low at 1.22512. Immediate support lies at 1.2250 followed by 1.2220. Immediate resistance can be found at 1.2340 and 1.1390 (overnight high 1.23895). Sterling saw the most volatility amongst the Majors. Look for a likely range today between 1.2250-1.2400. Prefer to buy on dips with the 1.2200 handle on it.