Summary: Haven trades were unwound after US President Trump delayed 10% tariffs on some Chinese products scheduled to begin next month. The move resulted in a massive squeeze on long Yen and Swiss Franc trades built up in the past few days. USD/JPY soared to 106.72 (105.28) at the NY close, up 1.28% while the Dollar gained 0.73% against the Swiss Franc to 0.9765 (0.9693 yesterday). The Euro slid to 1.1172 from 1.1215 after a big miss on Germany’s ZEW Economic Sentiment Index last month. USD/DXY (Dollar Index), usually a mirror of the Euro, rose to 97.837 from 97.420, up 0.47%. Despite a robust UK Wages report, Sterling dipped to 1.2057 (1.2075) with Brexit still weighing on sentiment. Resource and Emerging Market currencies led by the resurgent Aussie Battler, up 0.47% to 0.6795 (0.6752 yesterday), rebounded. Flight-to-safety Treasuries fell while stocks rallied, and yields climbed. The US 10-year bond rate was up 5 basis points to 1.70%. Wall Street stocks soared led by the S&P 500, up 1.72% to 2,933.00.

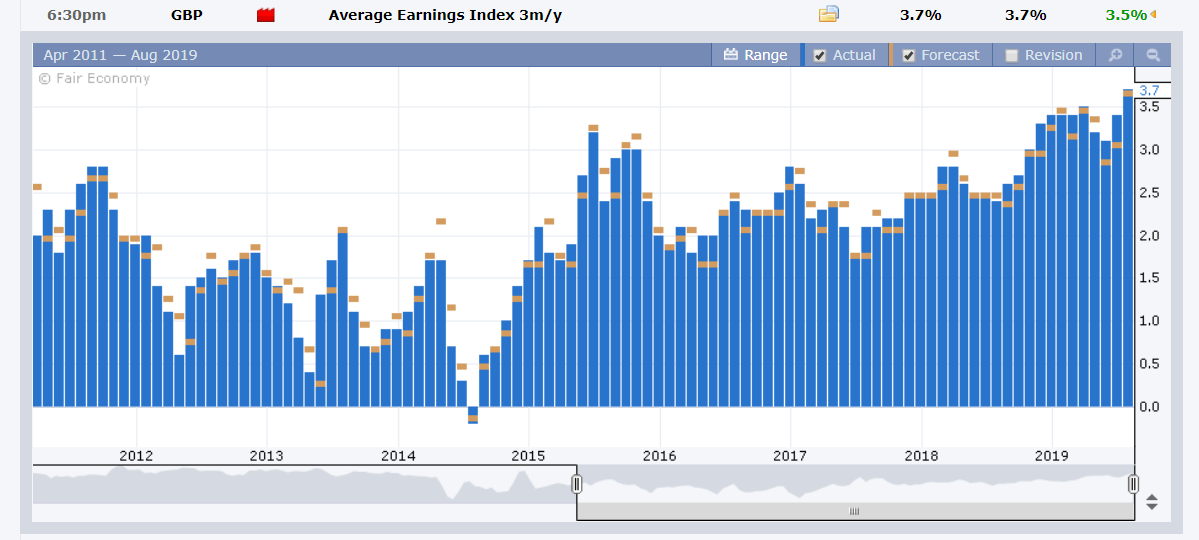

The Dollar was also supported by a rise in US Consumer Prices. US July Core CPI was up 0.3% against forecasts of 0.2%. Headline CPI matched expectations at 0.2%. Germany’s ZEW Economic Sentiment Index slumped to -43.6 against a forecast of -21.7. UK July Average Earnings (Wage growth) climbed to 3.7%, (3.5% in June) the strongest in 11 years.

- USD/JPY – reversed on the return of risk appetite as Yen longs ran for cover. The Dollar soared to 106.977 before settling at 106.72 in late New York. USD/JPY traded to a low at 105.05 yesterday.

- AUD/USD – The Aussie rallied with risk to close at 0.6795 from 0.6752 yesterday. RBA Assistant Governor Kent said in a breakfast speech yesterday that the central bank is not targeting unemployment, pouring cold water on the possibility of negative interest rates.

- EUR/USD – The Euro dipped to 1.1172 from 1.1215 yesterday. The climb in the US 10-year bond yield contrasted with that of Germany’s which fell 2 basis points to -0.61%. EUR/USD topped out around the 1.1230 (1.12285) area again.

- GBP/USD – Sterling eased back to close at 1.2057 from 1.2075 yesterday despite the robust Wage report. The Bank of England will put off any interest rate moves until the Brexit deadline which limits the Pound’s topside.

On the Lookout: The trade concession by President Trump is significant in that it is the first positive move in the trade conflict between Washington and Beijing. The US Trade Representative said it would delay 10% tariffs on some Chinese products (laptops and cellphones) scheduled to begin next month. Whether this leads to anything more substantial, or this becomes the new normal in today’s tariff world remains to be seen.

Meantime economic data releases resume today. Australia’s Wage Price Index and the Westpac Consumer Sentiment Index start off today’s report. China’s trifecta report of Industrial Production, Retail Sales and Fixed Asset Investment, including China’s Jobless rate follow. Euro area data see German Preliminary GDP (Q2), French Final CPI (July), Eurozone Flash Employment Change, Flash Q2 GDP, and July Industrial Production. The UK reports on its Headline and Core CPI, PPI Input and Output. US Import Prices round up the day’s reports.

Trading Perspective: The reverse move in the asset and haven markets are the result of a large unwind of trades in low volume August trading. While the trade concessions are significant, the headlines may be a case of I’ve seen that scene before. What happens next will be closely monitored.

Market positioning from last week has not changed much among the IMM currencies except for Sterling. The latest COT/CFTC report (week ended 6 August) saw net speculative short GBP bets have increased significantly over the past week. We take look at a breakdown of the individual currencies in tomorrow’s report.

- USD/JPY – The Dollar saw a big short-covering move in low volume to 106.977 overnight highs before settling at 106.72 in late New York. Yesterday, USD/JPY slumped to a low of 105.05 before settling. Haven trades were unwound which was the biggest factor in the Dollar’s strong bounce. The US 10-year bond yield bounced to 1.70% from 1.65% yesterday while Japan’s 10-year JGB rate was down two basis points to -0.25%. Which also supported the Greenback. It seems like the USD/JPY 105.00 psychological support level is the BOJ’s line-in-the-sand for now. Immediate support today lies at 106.40 followed by 106.00. Immediate resistance can be found at 107.00 and 107.30. Look to trade a likely range today of 106.20-106.90.

- EUR/USD – The single currency failed once again at the 1.1230 level, topping out at 1.12288. The Euro slid to an overnight low at 1.11702 before settling at 1.1174 at the New York close. Immediate support for the Euro lies at 1.1160 (3-week low) followed by 1.1130. Immediate resistance can be found at 1.1200 and 1.1230. Look to trade a likely range today of 1.1160-1.1220. Prefer to buy dips from current levels.

- AUD/USD – The Aussie got a further boost on the US trade concessions for some Chinese goods. AUD/USD closed at 0.6795 after trading to an overnight high at 0.68183. Yesterday the comments of RBA Assistant Governor Kent, who heads the Finance committee of the central bank, supported the currency. Kent saw no immediate need for negative interest rates, something that the local press has been highlighting this week. We reported that the Australian Dollar TWI is at multi-year lows. The RBA is aware of that and will not put the currency under more pressure with negative interest rates. AUD/USD has immediate resistance at 0.6820 and 0.6850. Immediate support lies at 0.6770 and 0.6740. Look to buy dips with a likely range today of 0.6775-0.6825.

Happy trading all.