Summary: The Dollar Index (USD/DXY), a measure of the Greenback’s value against a basket of foreign currencies, lifted to 22-month highs in low volume trading overnight. While ranges remained restricted, the Dollar’s relative yield advantage, maintained sway over its Rivals. The Swiss Franc, lowest yielder of the Majors underwhelmed. Canada’s Dollar slid against its US counterpart (USD/CAD = 1.3428 from 1.3348) despite higher oil and energy prices as traders await the Bank of Canada’s interest rate decision later today. The Aussie slipped to 0.7103 (0.7135) ahead of today’s Australian CPI release. Sterling fell to February 19 lows at 1.29279 from 1.2980 as hopes for a Brexit breakthrough agreement between the Opposition Labour and Ruling Party faded. The Euro slipped 0.29% to 1.1227 (1.1260 yesterday) on broad-based Dollar strength. US New Home Sales bettered forecasts, rising to 692,000 units against 647,000. The Richmond Manufacturing Index fell to 3 from 10. Stocks and bonds rose while yields fell. The DOW was up 0.5% (26,655) while the S&P 500 gained 0.87%. The yield on the US 10-year bond fell 3 basis points to 2.56%.

- EUR/USD – The Euro slid to 1.11921 overnight lows weighed by overall US Dollar strength. EUR/USD rallied back to close at 1.1227 as overall trading volumes stayed low.

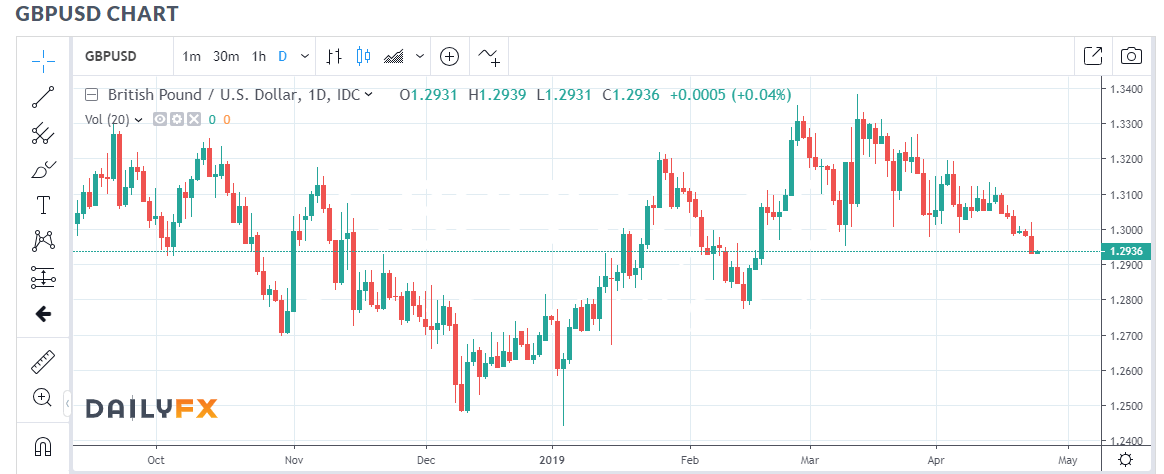

- GBP/USD – Sterling is slip-sliding away once again as hopes for any Brexit agreement between PM May’s Party and the opposition Labour faded. Growing calls for May’s resignation also weighed on the Pound. GBP/USD closed at 1.2932, not far from February 19 lows.

- AUD/USD – the Australian Dollar failed to gain any advantage from higher oil or energy prices, falling to 0.7103 from 0.7135 yesterday. Australia’s 10-year bond yield dropped 6 basis points to 1.89%, keeping the pressure on the Battler. Traders are skittish ahead of today’s release of Australian CPI data.

- USD/JPY – The Dollar finished a tad lower against the Japanese Yen. The Bank of Japan’s rate policy meeting is on Thursday and traders were wary to move the currency too much. The Yen was the only major currency to gain versus the Greenback. USD/JPY closed at 111.87 (111.97 yesterday).

On the Lookout: While there were no clear external forces to mover the currencies, the low volumes kept the search for yield advantage very much in favour of the US Dollar. Data releases were few and second tier. Today is a different story with the release of Australia’s Q1 Headline and Trimmed Mean CPI report. Headline CPI is forecast to fall to 0.2% from 0.5% while the Trimmed Mean CPI, which is what the RBA watches, is expected at 0.4%, the same as the previous quarters 0.4%. A weaker-than-expected inflation reading will have markets expecting an RBA rate cut in their May 7 meeting.

Japan releases its All Industries Index report (March). Europe sees the release of Germany’s IFO Business Climate report. The Bank of Canada’s interest rate decision rounds off today’s data and events. The BOC is expected to keep its policy unchanged and maintain its overnight rate at 1.75%. The week’s big event is Friday’s US Q1 Advance GDP report.

Trading Perspective: The Dollar’s sway over its Rivals occurred in low volume trade where markets continued to search for yield. Overnight, the US 10-year bond yield fell 3 basis points to 2.56%, moving farther away from 2.6%. Other global yields were either flat or moved higher. Only Australia’s 10-year yield fell by more than the drop of its US counterpart ahead of today’s CPI report. Unless the Greenback can maintain this yield advantage at current levels, expect the Dollar to struggle to move much higher from here as trading volumes pick up. Market positioning, which is still net US Dollar long, will also affect the Greenback’s performance.

- USD/DXY – The Dollar Index rallied to an overnight and 22-month high of 97.78 before easing to settle at 97.58 in New York. Immediate resistance can be found at 97.80 which is strong. The next resistance level lies at 98.00. Immediate support can be found at 97.40 followed by 97.10. Look for consolidation with a likely range of 97.40-97.80. Prefer to sell rallies.

- EUR/USD – The Euro traded to an overnight low of 1.11921 before rebounding to settle at 1.1227. Immediate support at the 1.1180-90 level is strong and should hold any downside attempts. Bear in mind that current market positioning remains short Euro bets are multi-year highs. Immediate resistance in the EUR/USD can be found at 1.1260 followed by 1.1300. Overnight, Germany’s 10-year Bund yield rose 2 basis points to 0.04%. Look for a likely trading range of 1.1200-60. Prefer to buy dips.

- AUD/USD – Once again the market finds itself bearish on the Aussie with expectations that today’s CPI release will be near the lower end of the RBA’s target. We shall see. The Aussie traded to an overnight low of 0.70811 before rebounding to 0.7103 at the New York close. Immediate support lies at that 0.7080 level. The next support can be found at 0.7050. Immediate resistance lies at 0.7130 followed by 0.7160. Current market positioning remains short of Aussie Dollar bets. Look for a likely range today of 0.7085-0.7145. Prefer to buy dips.

- USD/JPY – Trading in this currency pair remained constricted to a relatively tight range with the Dollar easing to 111.87. Overnight low traded was 111.65 which is where immediate support lies. The next support level comes in at 111.30. Immediate resistance can be found at 112.00 and 112.30. Ahead of tomorrow’s BOJ interest rate decision, look for a likely trading range of 111.55-112.05 range today. Prefer to sell rallies.

Happy trading all.