Sanctions Imposed in Supervisory Proceedings. The Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) is imposing higher administrative fines in its securities supervision activities than in previous years. At an event held in Frankfurt, BaFin set out how companies can settle with it. The best way of avoiding fines is to ensure the law is not broken in the first place.

Sanctions Imposed in Supervisory Proceedings. The Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) is imposing higher administrative fines in its securities supervision activities than in previous years. At an event held in Frankfurt, BaFin set out how companies can settle with it. The best way of avoiding fines is to ensure the law is not broken in the first place.

Higher, faster, further: this could have been the motto for BaFin’s event on its approach to the imposition of penalties in securities supervision, which drew 150 attendees to the German National Library in Frankfurt am Main at the end of September.

There is indeed every likelihood the volume of administrative fines imposed during the current calendar year will be higher than in previous years. The fines imposed already amounted to €6.7m at the end of August 2019, whereas BaFin imposed fines worth a total of €11.9m in 2017 and 2018 taken together. Of this sum, €2.4m was levied from just one undertaking, which had infringed its duties with regard to the notification of voting rights under the Securities Trading Act (Wertpapierhandelsgesetz – WpHG).

The new trend towards higher administrative fines was explained in Frankfurt by BaFin speaker Stephanie Kirchmeier-Hein, who attributed it to European legislation that had raised the upper limit on administrative fines in November 2015 and July 2016, since when BaFin had also been able to base the calculation of fines on companies’ turnover. “The amounts will carry on going up,” Kirchmeier-Hein predicted.

One-third of proceedings end with an administrative fine

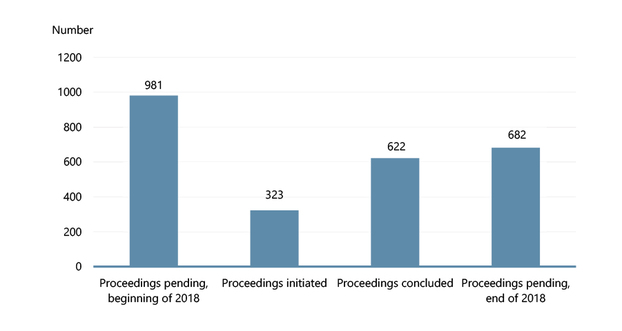

In the meantime, proceedings themselves are being dealt with more rapidly. In both 2017 and 2018, the number of administrative fine proceedings concluded was nearly twice the number of new proceedings that were opened. This enabled BaFin to clearly reduce the number of proceedings still pending by the end of 2018, cutting it to 682 (see graph “Administrative fine proceedings conducted by BaFin during 2018”). At the end of 2015, there were about 1,100 proceedings still pending (see expert article on the BaFin website dated 4 December 2017).

Graph: Administrative fine proceedings conducted by BaFin during 2018

Administrative fine proceedings during 2018. The number of proceedings pending at the beginning of the year is increased by proceedings that are initiated, but reduced by proceedings that are concluded. BaFin

Administrative fine proceedings during 2018. The number of proceedings pending at the beginning of the year is increased by proceedings that are initiated, but reduced by proceedings that are concluded. BaFin

36% of all proceedings ended with an administrative fine. As a result, the penalty rate met the average for the previous years. 64% of the cases in which penalties were imposed ended because BaFin reached a settlement with the companies concerned (see info box “Settlement”). “It is no longer possible to imagine doing our work without settlements,” emphasised BaFin speaker Sabine Canzler. This is reflected positively in another indicator – the appeal rate. The parties concerned appealed against a BaFin administrative fine order in merely 12% of proceedings. If proceedings ended by mutual agreement were removed from the figures, the appeal rate would be 28% and therefore considerably higher.

At a glance:Settlement

Administrative fine proceedings conducted by BaFin’s Securities Supervision/Asset Management Sector are increasingly being concluded by mutual agreement with settlements. When this happens, the parties concerned profit from the fact that the administrative fine can turn out to be as much as 30% lower. Apart from this, settlements expedite the conclusion of proceedings. Rule-of-law principles apply when settlements are arranged. The company must have actually committed the administrative offence, which must be chargeable and provable. Furthermore, the party concerned must acknowledge the offence of which they are accused and accept the fine – this means there cannot be a settlement if the company does not admit that it has committed the administrative offence. Another principle is that BaFin does not bargain with the parties concerned when it comes to settlements. The essential preconditions have been summarised by BaFin in a guidance notice (only available in German).

Capital market law continues to develop

“Capital market law remains a dynamic area of law, and this dynamism also affects the field of sanctions in particular,”said Elisabeth Roegele, BaFin’s Chief Executive Director of Securities Supervision/Asset Management. New questions crop up regularly in practice.

Background knowledge is needed in order to give well-founded answers to these questions. Such background knowledge was supplied at the event by, among others, BaFin speaker Thilo Stucke. He explained the accountability standards applicable under the Act on Breaches of Administrative Regulations (Ordnungswidrigkeitengesetz – OWiG), to which particular significance is attached in capital market law. A large number of provisions in capital market law define special offences, that is to say offences that can only be committed by a particular group of persons with specific attributes. In capital market law, this is frequently the issuer of a security, in other words a legal entity.

People remain responsible

Nonetheless, a legal entity is not itself capable of acting. It is represented legally by a natural person. Under the law of administrative offences, however, the legal entity is held accountable for that person’s breaches of duty, which makes it possible for BaFin to punish such breaches with a corporate fine. The Securities Supervision/Asset Management Sector has been making use of this option to a great extent as well: in practice, according to Stucke, it imposes “the overwhelming majority of fines in separate proceedings on the legal entity itself.

”

But if current law presupposes that a senior executive has breached their duties, should that executive not then be targeted with a sanction from the outset? Prof. Andreas Ransiek, holder of the Chair of Criminal Law and Criminal Procedural Law, especially Economic Criminal Law at the University of Bielefeld, argued against this: “The corporate owner of the business is the correct target because its conduct is directly regulated, not the actions or omissions of natural persons.

” The corporate owner of the business is the company. According to Ransiek, it has rights and duties, and therefore also has to be responsible itself for infringements of those duties.

The situation would be different if the sanctions imposed were rooted in criminal law. Ransiek rejected ideas of this kind: “Transferring corporate sanctions to criminal law will not deliver any advantages.

” In his view, however, the level of sanctions could have a deterrent effect. The precondition for this was that the value of the sanctions was no less than the possible financial benefits to be gained from the offence. Apart from this, there had to be a certain probability of offences actually being detected and punished.

There is no liability gap being opened up by the rise of artificial intelligence (AI) on the capital market. Legally, responsibility remains with the person who takes the decision to deploy artificial intelligence, for example when loans are granted. “People are aware that, with AI, they are using a program that is unpredictable – because it is always learning –, and they have to accept they will be held accountable for taking this risk

,” said Prof. Frauke Rostalski, holder of the Chair of Criminal Law, Criminal Procedural Law, the Philosophy of Law and Comparative Law at the University of Cologne.

Compliance must be more than just a fig leaf

Risks that arise due to the use of AI can be countered by the individuals responsible if they take compliance measures. These include the adoption of an in-house code of conduct, the effect of which depends of course on whether the company’s management monitor and check whether it is being adhered to. “Compliance can pay off

,” said BaFin speaker Julia von Buttlar. Although even a fundamentally efficient system would not be able to prevent every single violation of the rules, it would ultimately lower the number of sanctions and the volume of administrative fines. However, this was dependent on compliance being more than just a fig leaf.