Summary: Equity markets led by Wall Street dropped sharply amid continued fear on the economic impact of the Covid-19 spread. Investors shrugged off the Federal Reserve’s emergency rate cut on Sunday. The risk aversion spread to FX where the Yen advanced 1.8% against the US Dollar, USD/JPY dropping to 105.90 from 107.95 yesterday. Risk FX leader the Australian Dollar plunged to an overnight and November 2008 low at 0.60785 before climbing in late NY to 0.6105, for a loss of 1%. The Euro finished up 0.75% to 1.1170 (1.1100) after jumping to 1.12213. Sterling slumped to 1.22022, its weakest since October before recovering to close at 1.2263 from 1.2274 yesterday. Against the Canadian Loonie, the US Dollar climbed to 1.4000, touching 1.40178, the strongest since December 2015 as Brent Crude Oil prices plunged 12% (USD 29.75). The Dollar Index (USD/DXY) lost 0.73% to 98.028 from 98.691. Emerging Market currencies plummeted. The South African Rand dropped 3.35% (USD/ZAR to 16.68 from 16.24).

In late New York trade, the DOW was down 11.5% to 20,485 (23,015). The S&P 500 lost 10.5% to 2,405 (2,703 yesterday). US Bond yields fell sharply. The benchmark 10-year rate was down 24 basis points to 0.72%. Two-year US bond yields slipped 13 basis points lower to 0.36%. Germany’s 10-year Bund yield climbed 8 basis points to -0.47%. Japanese 10-year JGB yielded +0.005% (-0.01%).

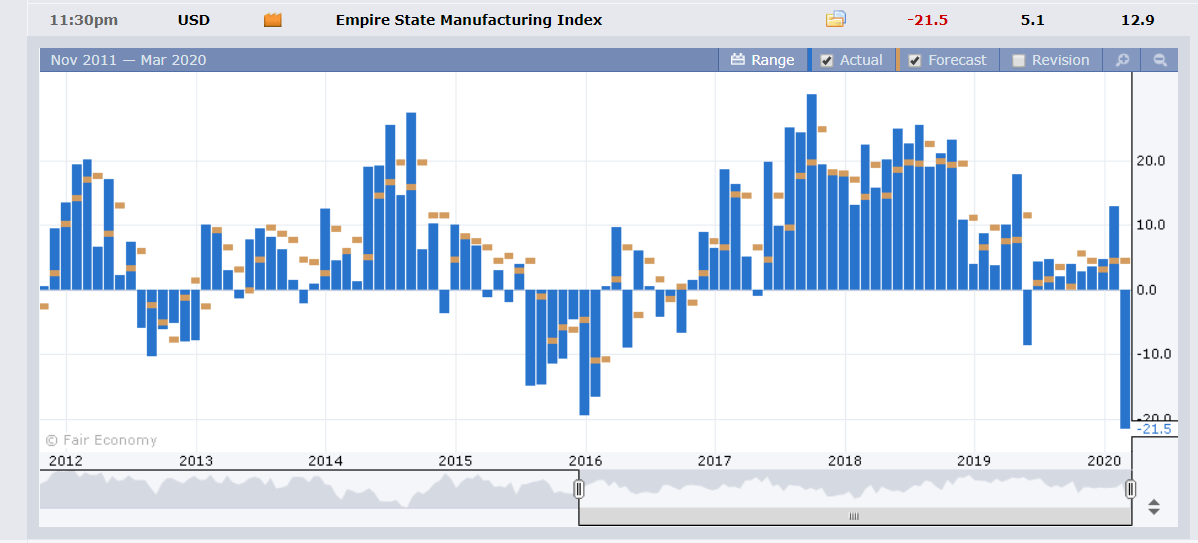

China’s Industrial Production slumped -13.5% missing forecasts at -3.0% while Retail Sales dropped to -20.5% against expectations of -4.0%. China’s Fixed Asset Investment plunged -24.5% versus forecasts of -2.0%. US Empire State Manufacturing Index plunged to -21.5 widely missing expectations of +5.1.

On the Lookout: Stimulus efforts around the globe increased after the US Fed and the RBNZ cut rates. China, Australia, Europe, and others added further measures. Which further increased investor alarm about the rapid spread of Covid-19 and how it has weakened global economic growth. China’s trifecta of primary economic data released yesterday all tumbled in January and February. The US Empire State Manufacturing Index plunged to its weakest since 2009.

While all the focus is on the spread of the Coronavirus, economic data will come under scrutiny in the next few weeks to see just how bad the global economies are affected by the pandemic.

Today sees UK Employment data, German and Eurozone ZEW Economic Sentiment Index, US Capacity Utilization, Industrial Production and JOLTS Job Openings.

Trading Perspective: The risk-off sentiment weighed on risk currencies, the Aussie, Canadian Dollar, Kiwi and EMS. Against the majors the US Dollar retreated. The key US 10-year bond yield dropped 24 basis points while its global rivals either climbed or retreated to a lesser extent. This will eventually result in a lower US Dollar overall.

US economic data released yesterday saw a huge drop in the Empire State Manufacturing Index. The coronavirus impact in the U.S. has yet to reach its peak, which makes its currency even more vulnerable in the future.

FX volatility which doubled in the past few weeks, has subsided in most currencies. That said, it remains elevated.

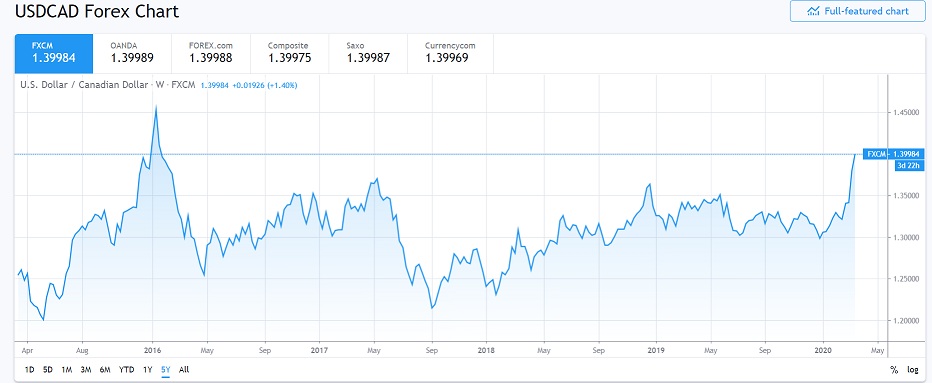

USD/CAD – Loonie Plays Catch-Up with Risk FX, 1.4050 Caps

The Canadian Dollar (Loonie) played catch-up with its risk and Dollar bloc partners, the Aussie and Kiwi, slumping 1.5% against the US Dollar. USD/CAD soared to February 2016 highs at 1.40178 before easing to settle at 1.3995. The combination of weaker risk currencies and a 12 % drop in Brent Crude Oil prices to under USD30.00 weighed on the Canadian currency.

The Bank of Canada cut interest rates earlier this month and is not expected to repeat the move until it meets next month (April). The Covid-19 spread in Canada is less widespread than other countries around the globe including its southern neighbour. For now.

USD/CAD has immediate resistance at 1.4020 followed by 1.4050. Immediate support lies at 1.3960 followed by 1.3910. Look for a likely trading range today of 1.3920-1.4020. Prefer to sell rallies.

AUD/USD – Trading Heavy, But Wary as the Battler Approaches 0.60 cents

The market’s risk-off stance impacted the Australian Dollar heavily and the currency plunged to a fresh November 2008 low at 0.60785. The Aussie was also under pressure against its other rivals. AUD/JPY dropped 2.4% to 65.05 while the AUD/NZD cross hit 1.00210, January 2015 lows. AUD/USD closed at 0.6115, down 1.05% from 0.6183 yesterday.

Traders will keep their eye on today’s RBA Monetary Policy Meeting Minutes for March. The focus on the minutes will be on any Quantitative Easing rather than an interest cut. If the RBA do expand their balance sheet, this will be the first time ever that the RBA would implement QE.

Chief CBA economist Gareth Aird said on the Australian Business Insider he expects the RBA to cut the cash rate to 0.25% on Thursday.

The RBA will be vigilant with the Australian Dollar Trade Weighted Index at its lowest since the 2008 financial crisis.

AUSD/USD has immediate support at 0.6075 followed by 0.6035 and then 0.6000. Immediate resistance can be found at 0.6160 and 0.6210. Look for a choppy trading session today between 0.6080-0.6210. Look to buy dips, a lower US Dollar will mean a higher Australian Dollar in time.

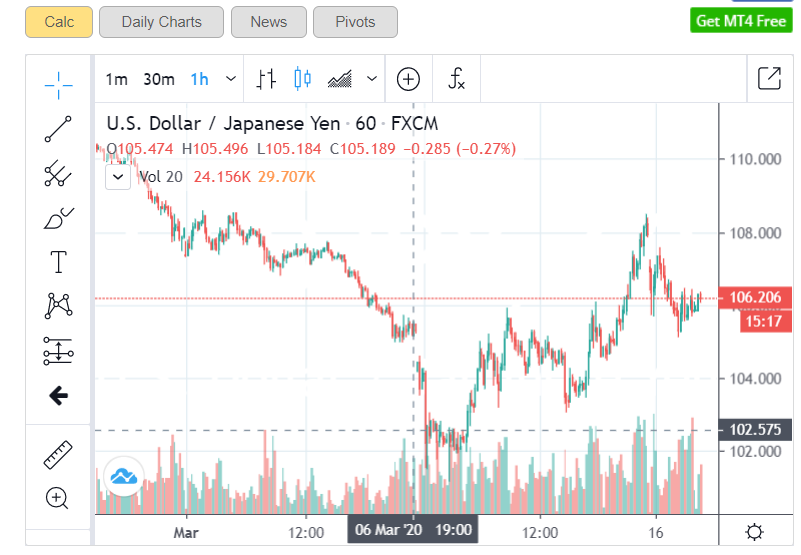

USD/JPY – Trading Heavy, Range Shifts to 104.5-107.5, Beware BOJ

The Yen outperformed FX, the US Dollar dropping 1.08% against the Japanese currency. USD/JPY finished at 106.02 in New York, further easing in early Sydney to 105.85 before settling at its current 106.15.

Apart from risk-off, the other driver of USD/JPY is the US 10-year yield, which dropped 24 basis points last night. In contrast Japanese 10-year JGB rates were up 0.5 basis points to +0.005%. This also added to downward pressure on the Dollar.

USD/JPY traded to an overnight low at 105.146 before rallying to its NY close of 106.05. Immediate support comes in at 105.60 followed by 105.20. Immediate resistance can be found at 106.30,106.80 and 107.20. Look for another choppy session in the USD/JPY pair, likely 105.20-107.20. Just trade the range shag on this one today.