Asian indices started on positive tone today as investors sentiment improved after the U.S. agreed to halt additional tariffs on China and to start again the negotiations. The Nikkei225 finished 2.13 percent higher at 21,729 the Shanghai Composite finished 2.22 percent higher to 3,044, while in Singapore, the FTSE Straits Times index finished 1.54 percent higher to 3,372. Australian equities ended stronger on Monday as ASX200 added 29 points or 0.4% to 6,648.

European equities also traded higher today as markets react positively to news from the G20 meeting in Osaka Japan. DAX30 is adding 1.34 percent to 12,565, CAC40 is 0.76 percent higher at 5,581 while the FTSE MIB in Milan is trading 0.58 percent higher at 21,358. The London Stock Exchange is 0,88 percent higher to 7,491 amid Brexit uncertainty.

In commodities markets, crude oil rebounds from Friday’s closing bell sell off and trades higher at $59.92 after got a boost Thursday from better EIA report and an increase in geopolitical tensions around the globe. Brent oil also trades higher at $66,43 per barrel as major oil producers have yet to agree on adjustments on output. Gold started sharply lower the week piercing the 1,400 level at 1,388 holding above all the major daily moving averages. On the upside, strong resistance will be met at 1,400 psychological figure.

In cryptocurrencies market, bitcoin (BTCUSD) continues the nervous trading around 11,000 mark hitting the daily low at 10,595 and the daily high at 11,410. Immediate support for BTC stands now at $10,434 the Friday low while next support stands at 10,000. On the upside, strong resistance now stands at 12,000 and then at 13,291 the Friday high while I expect extra pressure from sellers at 13,500 and then at 14,000. Ethereum (ETHUSD) trades lower giving up 8 dollars at 296 breaking below the support line 300, with capitalization now to 31.60 billion. On the upside, the immediate resistance stands at 342.70, the high from Friday, while the support stands at 290 the previous resistance which now turns into support, Litecoin (LTCUSD) on the other hand trades higher at 123. The crypto market cap now stands above $320.0 billion.

On the Lookout: The Germany Markit Manufacturing PMI disappointed for one more time as it came in at 45 below market consensus of 45.4 for June. The France Markit Manufacturing PMI also came below analysts’ expectation of 52 for the month of June at 51.9. The Italian Markit Manufacturing PMI came in at 48.4, below economists’ expectations of 48.8 in June.

In Japan, the June consumer confidence index came in at 38.7 versus the expectations of 39.2. The Australia Manufacturing PMI for June came in at 49.4, the prior reading was at 52.7. The China Manufacturing PMI for June came in at 49.4 while the Services PMI came at 54.2.

In macro news from America, we await the US manufacturing PMI releases, both from ISM and Markit, at 14:00 GMT.

Trading Perspective: In forex markets, USD trades 0.44 percent higher at 96.44 after the positive outcome from G20 summit that calm the markets, the Aussie dollar retreats after the recent rally at 0.6997, while Kiwi also trades lower at 0.6701.

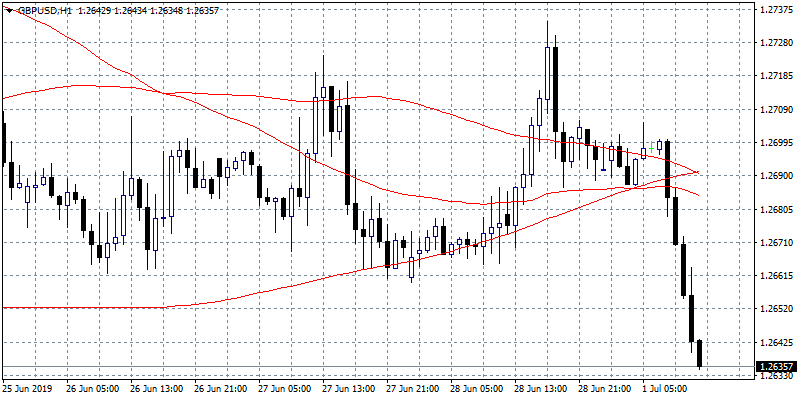

GBPUSD is trading close to daily low at 1.2635 after worst than expected UK PMI data and traders are still cautious around the Brexit developments. Major support now stands at 1.26 which if broken might accelerate the slide further towards 1.2550 round figure. On the upside, immediate resistance now stands at 1.2684, the 50-hour moving average, while more offers will emerge at the 1.27 round figure.

In Sterling futures markets the open interest increased by 2,000 contracts while volume increased by 17,500 contracts.

EURUSD started the week lower at 1.1320 as the pair rejected the previous week at 1.14. The pair today pierced the 200-day moving average at 1.1345 and that attracted extra offers that pushed the pair down to 1.1320. Immediate resistance for the pair stands at 1.14 round figure. A convincing close above 1.14 can lead prices to 1.1450. Support now stands at 1.13, while more bids will emerge at 1.1260 the 100-day moving average.

In euro futures markets, the open interest increase by 1,700 contracts, while volume increased by 10.800 contracts.

USDJPY is outperforming today adding 0.33 percent at 108.30 having hit the daily low at 108.09 and the daily high at 108.52. USDJPY pair will find support around 108.00 round figure and then at 107.89, the 50-hour moving average. On the upside, immediate resistance for the pair now stands at 108.52 the daily high.

In Yen futures markets, the open interest shrunk by 1,500 contracts, while volume also shrunk by 17.600 contracts.

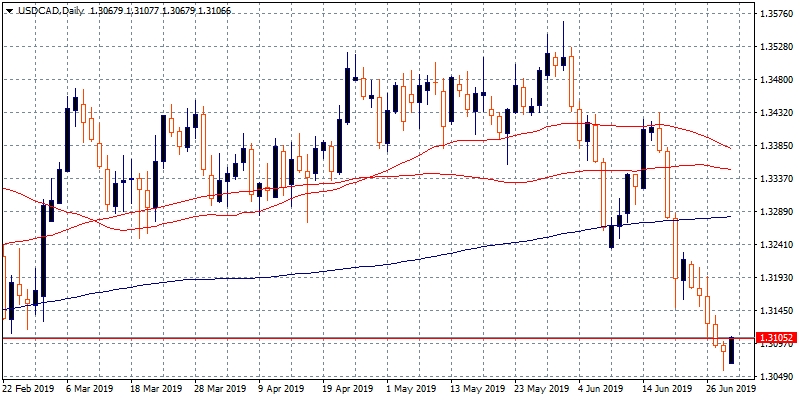

USDCAD attempts a rebound above 1.31 having hit earlier the low at 1.3067 a fresh five-month low, as the rally continues in crude oil prices, Canada’s main export item seems to have added further strength in the Canadian Dollar (CAD). The pair will find immediate support at 1.3060 the low from February 1st while extra support stands at 1.30 round figure. The pair has reached oversold levels so a rebound can’t be ruled out. On the upside, immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.