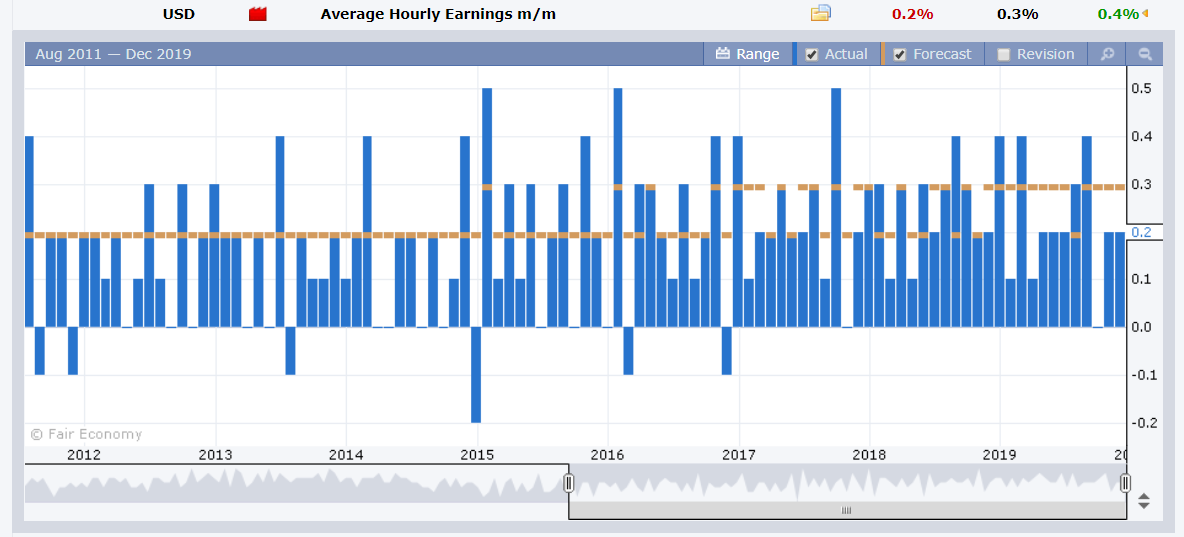

Summary: The US economy in November created 266,000 Jobs, beating economist’s consensus expectations while the Unemployment Rate dropped to 3.5%, a 50-year low. Both October and September’s Employment Gains were revised higher. The Dollar Index (USD/DXY), a popular measure of the Greenback’s value against 5 major currencies rallied 0.27% to 97.677 (97.422 Friday). The bulk of that increase came against the Euro, which fell 0.46% to 1.1062 (1.1100) due to a surprise fall in German Industrial Production. Sterling finished 0.2% lower at 1.3137 (1.3160) ahead of this week’s (Thursday) UK Parliamentary elections with the Conservative Party leading polls. The Dollar finished lower against the Yen at 108.60 (108.77) after US Wage Growth disappointed, down to 0.2% against forecasts at 0.3%. The Australian Dollar was little changed at 0.6841 from 0.6835 Friday.

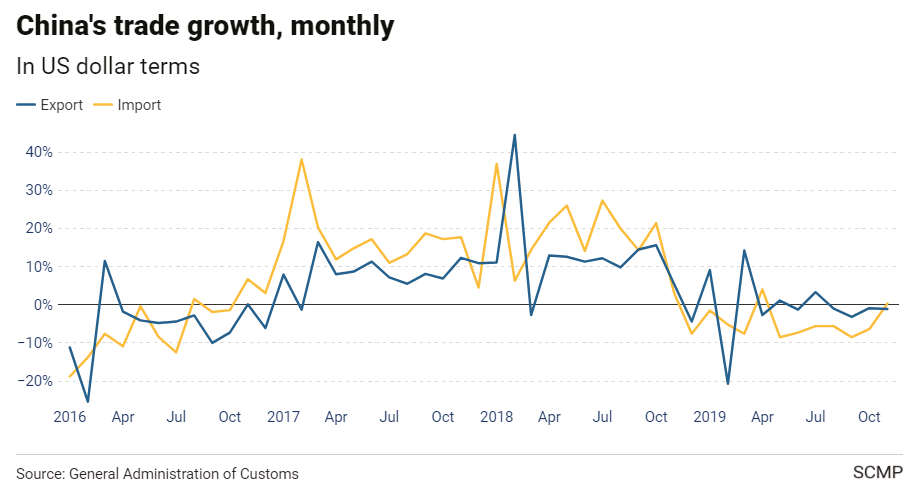

Wall Street stocks rebounded, cheered by the employment report. The DOW gained 1.2% to 28,010 (27,675), while the S&P 500 rose 0.92% to 3,146 (3,116). Treasury prices fell and bond yields rose. The US 10-year note yield was up four basis points to 1.84%. Germany’s 10-year Bund yield closed at -0.29% (-0.30%). Japanese 10-year JGB yields were up 3 basis points to -0.02%. On Saturday, China reported that it’s Trade Surplus dropped to USD 38.7 billion from USD 44.5 billion as exports plunged 1.1% on an annual basis. The China-US trade dispute has persistently pressured Chinese manufacturers. In Hongkong yesterday, protestors turned out in their biggest number since last month. Other date released Friday: German Industrial Production in November unexpectedly fell 1.7% when a gain of 0.1% had been expected. Canada’s Employment disappointed, decreasing by 71,200 against a forecast increase of 10,000 while the number of unemployed jumped to 5.9% from 5.5%.

- EUR/USD – the shared currency was the worst performing Major, falling 0.46% to 1.1060 from 1.1100 on Friday morning. The combined effects of a robust US Jobs creation and dismal German Industrial Production weighed on the Euro. The Euro dropped to an overnight low at 1.1040 before stabilising to 1.1060.

- USD/DXY – The Dollar Index gained 0.27% to 97.677 from Friday’s 97.422. The stellar US Employment report lifted the Dollar Index off its lows at 97.355. The rebound is far from convincing with most of the gains coming against the Euro’s expense.

- GBP/USD – Sterling slipped 0.19% to 1.3137 from Friday’s opening at 1.3160. The British currency held stable against the strong US data. Boris Johnson’s Conservative Party maintained its advantage heading into Thursday’s Parliamentary Elections.

- USD/JPY – The Dollar edged lower against the Yen to 108.60 from 108.77 on Friday. USD/JPY saw selling despite the upbeat US data and positive risk sentiment. USD/JPY enters this big week with a neutral tone.

On the Lookout: The week ahead is huge for FX with the Fed, ECB policy rate meetings and the UK Parliamentary Elections the biggest events. Data reports see Chinese CPI and PPI (tomorrow), US Core and Headline CPI (Wednesday), US Core and Headline PPI (Thursday). Friday sees Japan’s Tankan Manufacturing and US Retail Sales.

Today sees New Zealand’s Manufacturing Sales, Japanese Current Account, Final Q3 GDP, Q3 GDP Price Index and Economic Watcher’s Sentiment Index. Euro area data kick off with German Trade Balance, Swiss Unemployment Rate, Eurozone Sentix Investor Confidence Index. Canada reports its Building Permits and Housing Starts.

After Friday’s stellar Jobs report, the Federal Reserve is expected to keep interest rates unchanged at its meeting this week (early Thursday morning in Sydney). However, markets will focus on the interest rate outlook for 2020. Christine Lagarde overseas her first interest rate policy meeting as ECB President on Thursday. Which will be crucial for the shared currency.

Trading Perspective: Despite the better-than-expected US Payrolls report which also saw upward revisions to September and October’s employment gains, the Dollar’s performance can be described as tame. The Greenback’s gains were also not as broad-based as one would expect. Lastly FX has extended its period of unusual calm. A few years back, we would have experienced a big break-out in ranges. Could FX traders see a return to volatility this week? The risks are there.

- EUR/USD – The Euro finished as worst performing currency on the surprise fall in Germany’s Industrial Production in November. The shared currency slumped to an overnight and one-week low at 1.10399 before a modest bounce to 1.1060. Immediate support at the 1.1030/40 level should hold. A clean break at 1.1030 could see 1.1000 tested followed by 1.0970. Immediate resistance can be found at 1.1080 and 1.1100. The ECB policy meeting on Thursday is huge for the Euro. While no change in policy is expected, markets will be looking into Christine Lagarde’s policy preference for the ECB looking forward. Look for consolidation today with a likely range of 1.1030-1.1080.

- USD/JPY – The Dollar closed moderately lower against the Japanese Yen to 108.58 from 108.77 Friday. USD/JPY opens slightly firmer in early Sydney this morning at 108.61. Risk sentiment was generally positive on Friday and bond yields rose. Japan’s 10-year JGB yield also climbed 3 basis points which will put a lid on USD/JPY. Immediate resistance lies at 108.90 (overnight high 108.92) followed by 109.10. Immediate support can be found at 108.50 (overnight low 108.494). Japanese Final Q3 GDP is released today. Look for USD/JPY to consolidate between 108.45-108.85. Trade the range, the preference is to sell rallies.

- GBP/USD – Sterling held stable against the Greenback, slipping 0.19% to 1.3137. Thursday’s election remains the main driving force for the British currency, and final results won’t come until Friday. Tomorrow sees UK Manufacturing and GDP data releases. Immediate resistance for Sterling is found at 1.3160 (overnight high 1.31655). Immediate support lies at 1.3100 (overnight low 1.31005) followed by 1.3070. Look for consolidation with a likely range today of 1.3110-1.3160. The Conservatives maintained their lead in the polls, and should they gain a majority in Parliament, the Pound should rally further to the 1.34/1.35 level.

- AUD/USD – The Australian Dollar closed little changed at 0.6840 (0.6835 Friday). The Aussie Battler traded to an overnight low at 0.68235. Immediate support lies at 0.6820 followed by 0.6800. Immediate resistance can be found at 0.6860 (overnight high 0.68572). The next resistance level lies at 0.6890. The stronger Greenback should see the Aussie under pressure early today but expect 0.6820 to hold. Look for a likely range of 0.6825-0.6860 today. Prefer to buy dips to 0.6825.

Have a good week ahead. Happy trading.