By Giles Coghlan, Chief Currency Analyst, HYCM

Mid-January proved to be a difficult period for the US markets, with equities suffering their worst drawdown since the heights of the pandemic back in March of 2020. The S&P 500 closed the week ending January 21 down almost 6%, and almost 9% off its January highs. The Nasdaq closed the week down over 7.5% and is currently trading more than 15% off from its highs.

Risk markets await Fed rate decision

Meanwhile, even higher beta crypto markets experienced a mammoth selloff, down over 22% on the week and down 46% from the broad market’s November highs.

Risk markets are clearly on tenterhooks, awaiting further clarity from the Federal Reserve regarding how many times it intends to hike rates in 2022 and when these hikes are likely to take place. As things currently stand, markets seem to be pricing in an initial 0.25% interest rate increase in March.

This week we have a slew of highly important economic indicators to keep an eye on, including advance quarter-over-quarter US GDP readings on Thursday, and core month-over-month US PCE on Friday. These will, of course, play second fiddle to the FOMC statement, Federal funds rate announcement, and subsequent press conference, all due to take place on Wednesday.

Dollar muted

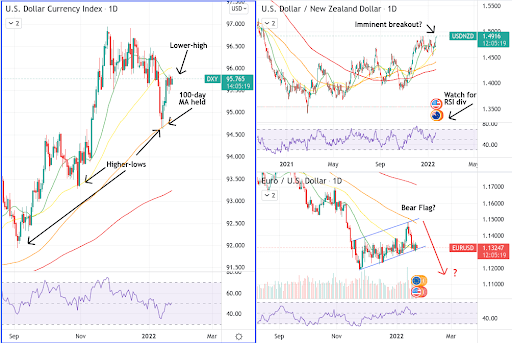

Considering the volatility we’ve witnessed in other markets of late, the US dollar has been rather muted in its performance relative to its major trading peers. After failing to hold the 50-day moving average in early January, the DXY appears to have found support at the 100-day (at around 94.6) in mid-January and has been attempting to stage a bounce since then. The index is currently testing the 20-day moving average from below, and until it convincingly breaks and closes above 96.4, all moves should be treated with caution and regarded as little more than a daily lower-high.

EURUSD had been trading in a range between 1.11 and 1.13 since November. A bout of USD weakness following recent US inflation data saw EURUSD rising to highs just shy of 1.15 in mid-January before the entire move was retraced. A falling dollar briefly gave commodity and risk markets a bump too, however, uncertainty has returned as market participants seem to be weighing up the merits of the inflation trade against the prospect of a strengthening dollar should the Fed’s hawkish tone be borne out in firmer policy changes.

EURUSD stopped just short of the 100-day moving average and has subsequently gone back down to around 1.13. As things currently stand, there’s the technical possibility that the pair is forming a bearish flag, which could mean further downside for the euro and another run of dollar strength. However, similar to the DXY, any move below around 1.14.8 should be just viewed as a lower-high.

It’s all about the US dollar though, the upcoming Italian presidential election could also provide some surprises on the euro front, so be sure to keep abreast of these developments starting this week.

Commodity currencies in focus

Ann example of just how much uncertainty currency markets are currently contending with, the New Zealand dollar has been underperforming its US counterpart even though the Reserve Bank of New Zealand has already commenced its own series of rate hikes. In its final policy meeting of the year, the RBNZ raised interest rates for the second month in a row to 0.75%. The market is currently pricing in a further 157 basis points of rate hikes for the Antipodean central bank throughout 2022.

Despite losing ground against its other major commodity partners such as the Aussie and the loonie, the US dollar is currently testing its December highs against the New Zealand dollar and appears about ready to break out. Technically, this would represent the first higher-high of the year set by the US dollar against the Kiwi, with the next key level to be found at around 1.51.

With the RBNZ’s upcoming rate hikes appearing priced in at this point, any further movement in this specific pair is likely to have more to do with how the US dollar performs as markets look to the Federal Reserve for more clarity.

Will 2022 be characterised by competition between central banks regarding which tightens the most? Or are we getting ahead of ourselves? This week’s FOMC, while perhaps not providing us with an unequivocal answer, should be the first step towards understanding what lies in store.

USD pairs and other currency pairs are available to trade at HYCM, as well as instruments in other asset classes including stocks, commodities, indices, ETFs*, and cryptocurrencies*.

*Note: Cryptocurrencies and ETFs are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.