Summary: The Dollar gained back lost as China and the US sought to ease trade tensions. Risk sentiment improved and stocks rebounded. After President Trump announced an increase in tariffs on Chinese goods Friday, the Dollar plummeted against haven-sought Yen while major indices plunged 2%. USD/JPY hit a 2.1/2-year low at 104.45 while the offshore Chinese Yuan (CNH) reached an 11-year low (USD/CNH at 7.1825). Both Trump and Chinese Vice-President Lui He gave signals that they are willing to resolve their trade dispute through “calm” negotiations. The US President, during a press conference at G7 Meeting in France said that Chinese officials had contacted their US trade counterparts and offered to return to the negotiation table. It was risk-on from there. The Dollar lifted against the Yen to end in New York at 106.10, up 0.75% from 105.40 yesterday. The Euro retreated 0.23% to finish at the now-familiar 1.1100 level. The Dollar Index (USD/DXY) bounced 0.51% to close at 98.047 (97.263). Sterling closed little changed at 1.2217. The UK Telegraph reported that Boris Johnson will send his chief Brexit adviser, David Frost to Brussels tomorrow, seen as positive for the Pound. The Aussie Battler bounced on the market’s risk-on stance to 0.6775 from yesterday’s low of 0.6690. USD/CNH retreated to 7.1700 from 7.1823.

Wall Street stocks rallied. The DOW gained 1% to 25,932 (25,685). The S&P 500 rose to 2,885 (2,857). Bond yields were mainly flat. The US 10-year rate closed at 1.54% (1.54%).

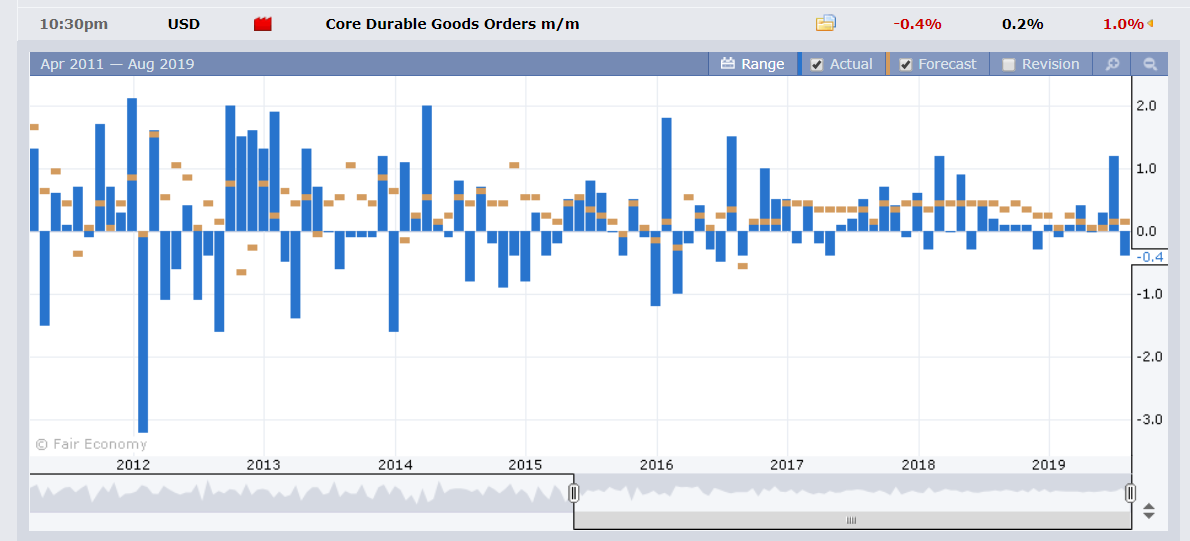

Germany’s IFO Business Climate Index dipped to 94.3 in from 95.8. US Core (excluding transportation) Durable Goods Orders underwhelmed at -0.4% against forecasts of 0.2%.

- USD/JPY – The haven sought Yen had another roller coaster ride in volatile trade. USD/JPY plunged in early Asia to a fresh 2.1/2-year low at 104.45 before bouncing shortly to 105.40 as Japanese markets opened. The rise in risk sentiment saw a spike to 106.42 before settling at 106.07 in late New York.

- EUR/USD – The Euro retreated to 1.1100 pivot level after reaching a high of 1.11638 on broad-based US Dollar weakness. Germany’s IFO Business Climate Index slipped to 94.3 in August, missing median expectations of 95.1 and a previous 95.8.

- AUD/USD – a return to risk-on saw the Aussie Battler bounce off its overnight and 12-month low of 0.66899 to 0.6775 in New York. Australia’s Business Insider today highlighted RBA Governor Lowe’s belief that cutting interest rates will do a whole lot to help the economy.

On the Lookout: The market’s uncertainty around trade will continue with FX volatile.

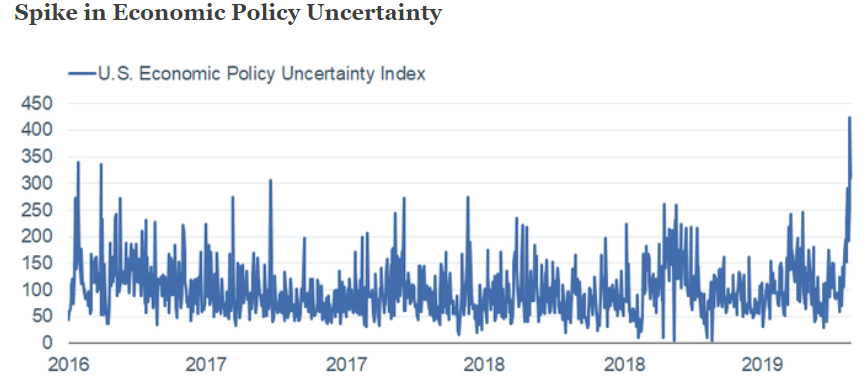

Events and economic data reports pick up today. The weaker than forecast US Core Durable Goods Orders were overlooked with the markets focus on trade issues. Further weak US economic data will push US yields and the Dollar lower. US economic policy uncertainty has risen according to the Bloomberg Economic Uncertainty Index Chart (see below). The Index is considered highly volatile, but the trend is for further uncertainty.

RBA Deputy Governor Guy Debelle speaks at an economic conference in Canberra (12 noon, Sydney). Japan starts off the data releases with its annual BOJ nationwide Core CPI report. The Euro area features Germany’s Final GDP (Q2) report. US House Price Index (August) and the S&P Case Shiller 20 Composite House Price Index (y/y) follow. Finally, the US Conference Board Consumer Confidence Index for August is released.

Trading Perspective: US Bond yields were little changed although the 2 and 10-year yields were both at 1.54%. Any inversion of the yield curve traditionally indicates a recession. Which will weigh on the Greenback. The Dollar’s recovery may prove to be short-lived.

- EUR/USD – The shared currency retreated to the 1.1100 pivot level after trading to an overnight and near two-week high at 1.11638. The overnight low traded was 1.10942, which is not far from this morning’s close. The Euro will struggle to gain headway against the Dollar unless we see further broad-based Greenback selling. EUR/USD has immediate support at 1.1090 and 1.1080. The next support can be found at 1.1060. Immediate resistance lies at 1.1120, 1.1160 and 1.1180. Prefer to buy dips with a likely range today of 1.1090-1.1140.

- USD/JPY – The Dollar had a decent bounce as traders pushed the Greenback to 104.45 in early Asia where the liquidity would have been thin. Japanese companies, mainly importers would have soaked up USD/JPY offers all the way back to 105.40 as Japan entered the market. USD/JPY then traded a tight 105.20-105.50 range before the positive trade news emerged. USD/JPY closed at 106.15. Immediate support can be found at 105.70 followed by 105.40. Immediate resistance lies at 106.20 and 106.50 (overnight high 106.415). Look to trade a likely range today of 105.60-106.60. Prefer to buy dips.

- AUD/USD – The Aussie rallied with the improved risk sentiment to finish at 0.6775 after testing fresh 12-month lows at 0.66899. AUD/USD rallied to an overnight high at 0.6788. Immediate resistance lies at 0.6790 followed by 0.6820. Immediate support can be found at 0.6750 and 0.6730. Look to trade a likely range of 0.6760-0.6810. Prefer to buy dips.

- GBP/USD – Sterling finished little changed at 1.2217 after trading to an overnight high at 1.22857 on the generally weaker US Dollar. The Telegraph report that Boris Johnson is sending his chief Brexit negotiator David Frost to Brussels is a positive step for Brexit. And the British Pound. GBP/USD has immediate support at 1.2200 followed by 1.2170. Immediate resistance can be found at 1.2250 and 1.2280. Look to buy dips with a likely range today of 1.2200-1.2300.

Happy trading all.