Summary: Risk appetite faltered further in early Asia after New Zealand reported two new Covid-19 cases following a run of 24 days with no new infections. Mounting concerns on new lockdown measures in Beijing and a spike in coronavirus cases in several US states weighed on risk appetite. Geopolitics saw military tensions between India and China simmer over a border dispute. The US Dollar edged higher while stocks slipped. Greenback gains were capped after Fed Chair Jerome Powell told House lawmakers that the economy needed more fiscal support. The Dollar Index (USD/DXY) a favourite gauge of the Greenback’s value against a basket of 6 foreign currencies was mildly up to 97.076 (97.019). Haven sought currencies, the Yen and Swiss Franc outperformed. The USD/JPY pair slipped to 106.97 from 107.30 while USD/CHF (Dollar-Swiss Franc) finished at 0.9490 (0.9515). The Euro dipped to 1.1240 from 1.1265 while Sterling was sold off to 1.2555 (1.2575). The Australian Dollar closed 0.15% down at 0.6885 (0.6895) while the Kiwi (New Zealand Dollar) eased to 0.6459 (0.6467). Against the Canadian Loonie, the Greenback was up 0.20% to 1.3565 (1.3545 yesterday). Wall Street stocks retreated after 3 straight days of rising. The DOW slipped 0.59% to 26,167 (26,307) while the S&P 500 was 0.31% lower to 3,117 (3,129). Bond yields were little change. The key US 10-year bond yield closed at 0.74% (0.75% yesterday).

Data released yesterday saw Japan’s trade balance at -JPY 0.6 trillion, beating expectations of –JPY 0.68 trillion. UK Headline CPI matched forecasts with at 0.5% print while Core CPI slipped to 1.2% from the previous months 1.4% and forecasts of 1.3%. The Eurozone’s Final CPI was at 0.1%, matching expectations. Canada’s Headline CPI slipped to 0.3%, missing forecasts at 0.8%. US Building Permits in May were at 1.22 million, against forecasts at 1.23 million. Housing Starts saw a dip to 0.97 million against median expectations of 1.10 million.

On the Lookout: Today is a busy one and sees a pickup in events and economic data. New Zealand just reported its Q1 GDP slumped to -1.6% from the previous quarter’s 0.5% underwhelming forecasts at -1.0%. The Kiwi initially jumped to 0.6478 from 0.6458 before dropping back to its current 0.6455.

Australia reports its Employment data where a loss of 105,000 jobs are forecasts from the previous loss of 594,300. Australia’s Unemployment rate is expected to climb to 6.9% from 6.2%. Anything less than these expected number will see the Australian Dollar sold off. China reports its Foreign Direct Investment data. European reports kick off with Switzerland’s Trade Balance followed by the Swiss National Bank’s rate decision and Monetary Policy Assessment. The SNB is widely expected to keep interest rates unchanged as the relaxation of restrictions in Europe ease concerns. The Bank of England has its monetary policy announcement where traders are expecting the BOE to increase their bond buying program. Should the BOE increase their QE more than expected or introduce negative rates, the British Pound would break lower.

Canada reports its ADP Non-Farms Payrolls Change and Wholesale Sales data. Finally, the US sees its Philadelphia Fed Manufacturing Index and Conference Board’s Leading Index.

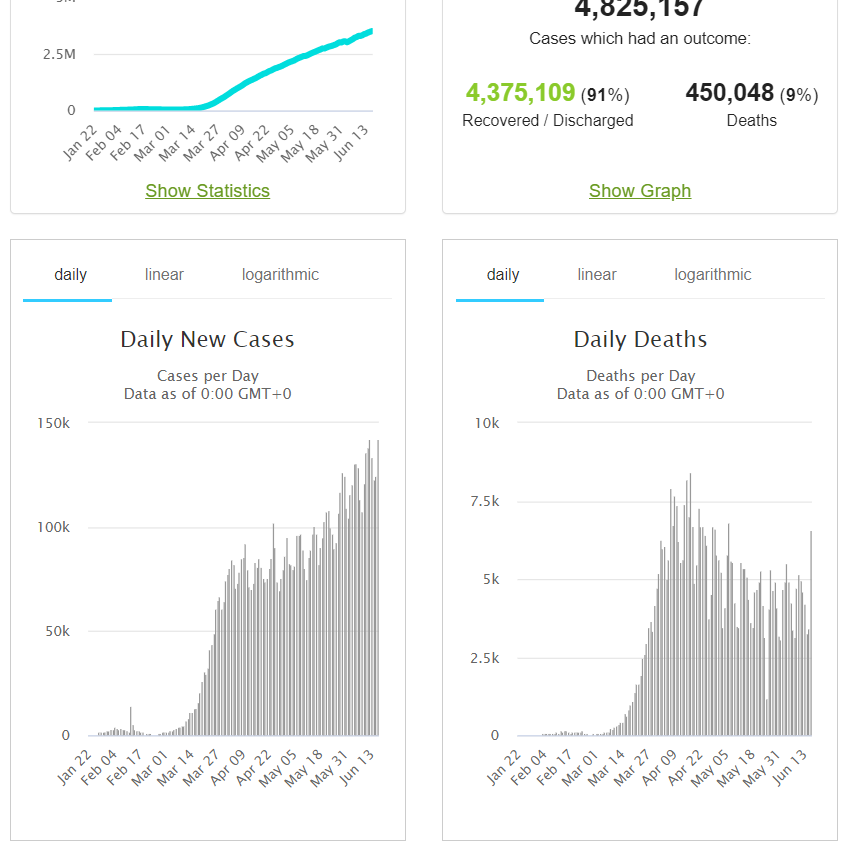

Trading Perspective: Traders will continue to monitor geopolitical tensions in the region (India and China and North and South Korea) as well as the spikes in new cases around the globe. These will weigh on risk appetite and continue to provide the US Dollar with mild support. The search for a vaccine to Covid-19 continues to intensify with pockets of bright spots in some countries. While there has been a spike in new coronavirus cases, the rise in the rate of deaths is starting to slow. Meantime central banks and governments will be looking to take more monetary and fiscal action to keep economic recoveries going which is expected to be a long road back.

Market positioning will continue to play a part in the next FX moves. We reported yesterday that the latest Commitment of Traders report saw an increase in net speculative US Dollar shorts.

Expect more consolidation initially as we await fresh data and developments. On balance, the Dollar’s support is strong, and the Greenback may be gaining momentum to climb higher.

AUD/USD – Two-Day Decline Halts. Focus on Aussie Jobs, Covid-19 Updates

The Australian Dollar steadied after two straight days of losses trading at 0.6480 in early Asian trade, close to its New York finish at 0.6486. The pressure is still on the downside following this morning’s report of a rise in two new Covid-19 cases in New Zealand, breaking its record of 24 days of none. Asian geopolitics will also be monitored by FX in the region, including the Aussie Dollar. Any upticks on either of these events will see the Aussie Battler pressured lower.

Aussie traders now have their focus on Australia’s Employment report for May. Market expectations are for a fall in Full-Time Employment of between -105,000-125,000 jobs from the April’s fall of-594,300 jobs. The Jobless rate is forecast to increase to between 6.9-7.0%. Markets will also look at the breakdown between full-time and part-time employment as well as the change in the participation rate. There is a rather wide range of forecasts in the numbers and anything better or worse than the above forecasts will see the Aussie Dollar move.

AUD/USD has immediate support at 0.6850 followed by 0.6820 and 0.6770. Immediate resistance can be found at 0.6920, 0.6960 and 0.7000 cents. Look for consolidation ahead of the Aussie Jobs report today with a likely range between 0.6830 and 0.6930. Prefer to sell rallies and trade from the short side.

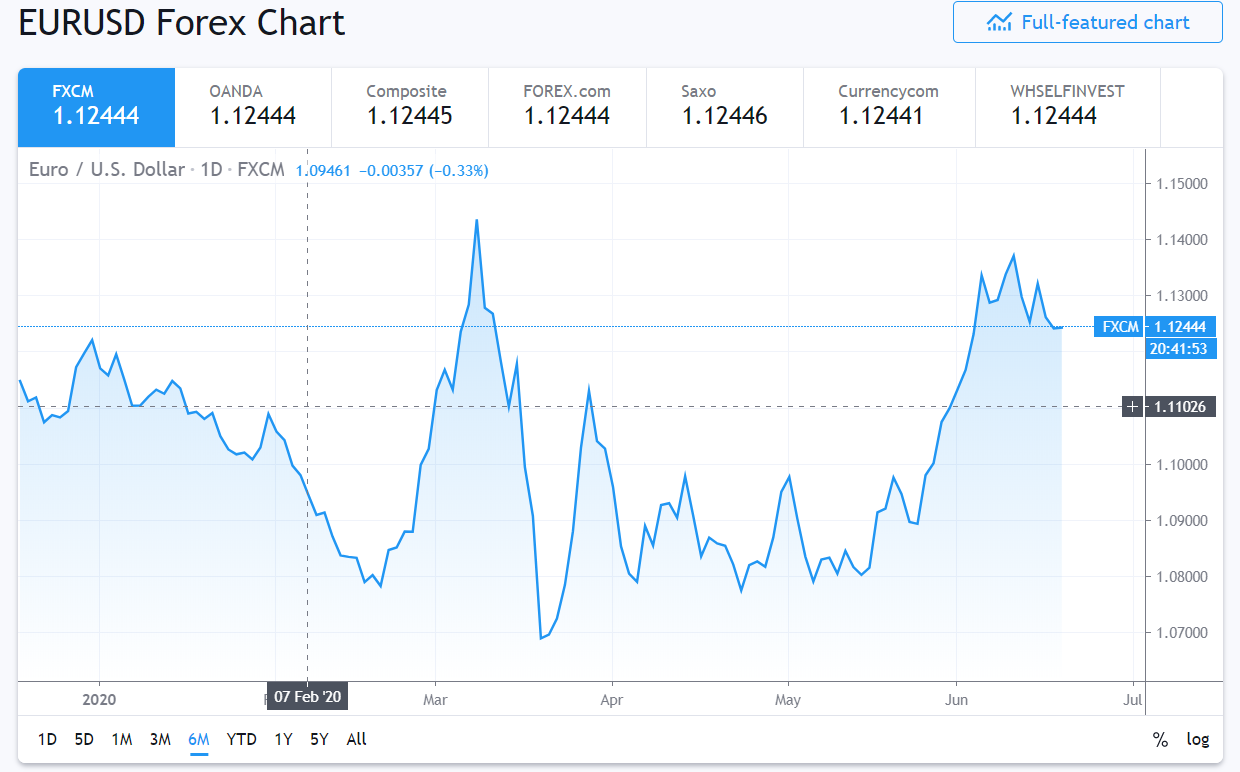

EUR/USD – Recent Recovery in Doubt as Long Bets Sweat, Risks Lower

The Euro extended its two-day decline, finishing at 1.1240 in New York after trading to an overnight low at 1.1207. EUR/USD traded to a peak of 1.1294 in a choppy session. Overall US Dollar strength weighed on the shared currency. Eurozone CPI data yesterday matched forecasts but the market’s risk aversion stance due to a rise in global Covid-19 cases weighed on the shared currency.

Meantime, Germany’s Far Right AFD (Alternative for Germany) party announced fresh legal action over the European Central Bank monetary easing yesterday. The opening of this second front legal battle will weigh on the Euro, even as the ECB seeks to resolve a separate six-week dispute with the German Constitutional Court.

EUR/USD has immediate support at 1.1230 followed by 1.1210 and 1.1170. The 1.1170 level is strong and a clean break through will see the Euro lower. Immediate resistance lies at 1.1270 followed by 1.1300 and 1.1330. Look for another choppy day in the Euro with a likely range today of 1.1180-1.1280. Prefer to sell rallies.

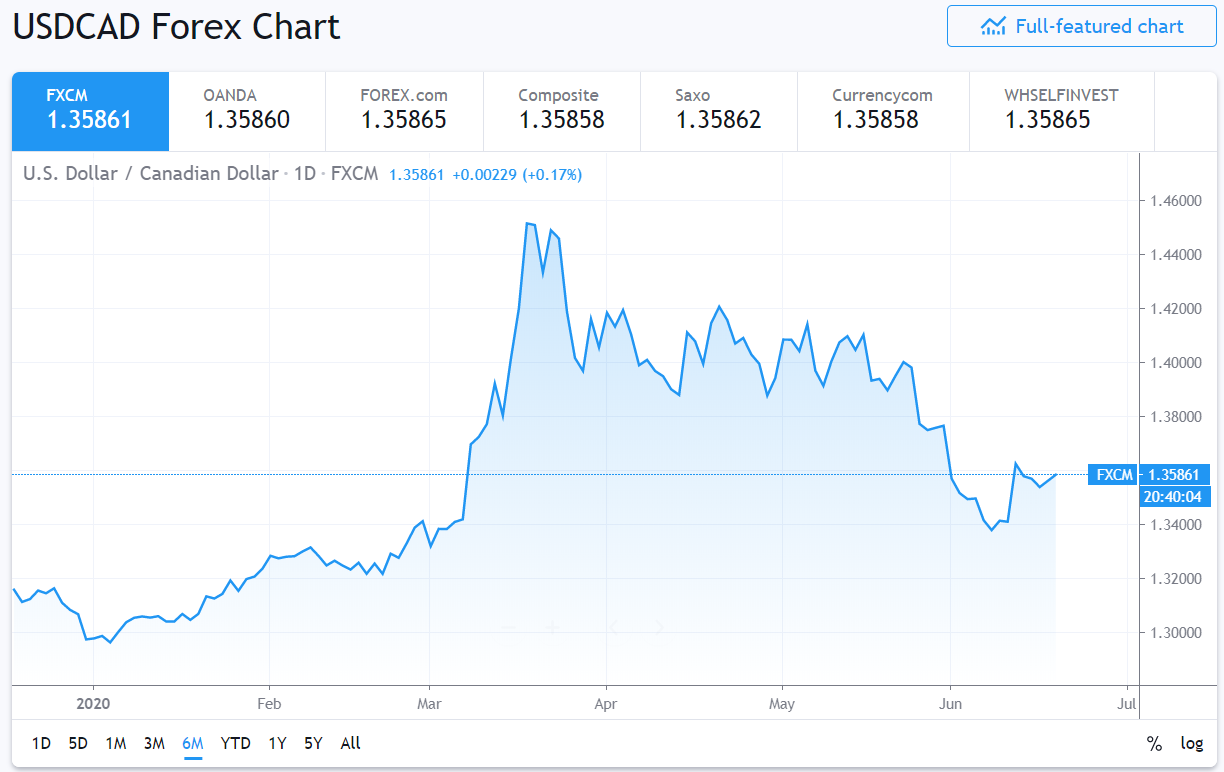

USD/CAD – Grinding Up, More Risk Aversion Will See Topside Break

The US Dollar grinded higher against the Canadian Loonie as risk aversion hit FX with the spike in new Covid 19 cases. Reports of increasing infections in several US states such as Texas, Arizona and Florida, the reintroduction of travel restrictions in Beijing as a result of a new outbreak and the latest report of 2 new cases in New Zealand where none existed in the past 24 days weighed on risk appetite. This outweighed the positive news of a slowing rise in coronavirus death rates and the desire of global central banks led by the US Fed to provide fresh stimulus to keep the economic recoveries moving. A drop in Canada’s inflation rate also weighed on the Loonie.

USD/CAD closed at 1.3565 from 1.3545 yesterday. Immediate resistance lies at 1.3600 (overnight high traded was 1.35944). Immediate support can be found at 1.3530 followed by 1.3500 and 1.3470. Look for consolidation today in a likely range between 1.3530 and 1.3630. Prefer to buy dips with a topside break likely.