Brexit uncertainties weighed on Asian markets, and in Japan, the Nikkei225 main index lost 0.99 percent to 21,290, and the Hang Seng benchmark in Hong Kong gave up 0.39 percent at 28,920. The Shanghai Composite shed 1.09 percent at 3,026, while stocks in Australia has extended its longest losing streak for the year, recording loses for a fourth straight day with geopolitical concerns continuing to weigh on the local market. Soft US inflation data and further Brexit uncertainties weighed on the ASX 200 as the index fell 13 points or 0.22% to close the session at 6161.2.

In commodities markets, the Crude oil added 30 cents to $57.18/barrel while Brent oil is 21 cents higher at $66.89/barrel. Gold is trading at the daily top around $1306 after yesterday managed to break above the $1300 resistance zone. The precious metal price gets a boost from US-China trade deal, and Brexit uncertainties that favor safe havens. XAU may find support at $1297 where the 50-day moving average crosses, ahead of testing the 100-day simple moving average down to $1293.

Soft tone is prevailing in early European trading as investors watch the developments surrounding the Brexit frontier and can offer the intermediate direction to markets. DAX30 is giving up 0.13 percent to 11,507, CAC40 is 0.28 percent higher at 5,286 while FTSE100 in London is flat at 7,151.

On the Lookout: Yesterday, PM Theresa May suffered another defeat on her Brexit deal as expected, but the defeat was smaller than the first time around (149 versus 230 last time), and 40 Conservative MPs switched, including the former Brexit secretary David Davis. Today, the UK government announced temporary cuts to the import tariffs on agriculture and cars in the case of a no-deal Brexit.

In the US economic calendar, the main event will be the release of durable goods orders data, followed by PPI figures that might influence the US Dollar price dynamics and eventually produce some short-term trading opportunities.

Trading Perspective: The Aussie dollar is trading almost unchanged the last hours at the 0.7065 zone against the news and a big drop in the Westpac consumer confidence index. The Kiwi is losing 30 pips to daily lows at 0.6835. The US dollar index breached the lower band of the recent trading range between 97 and 97.70 and as of writing it is trading to daily lows giving up 0.12 percent at 96.90.

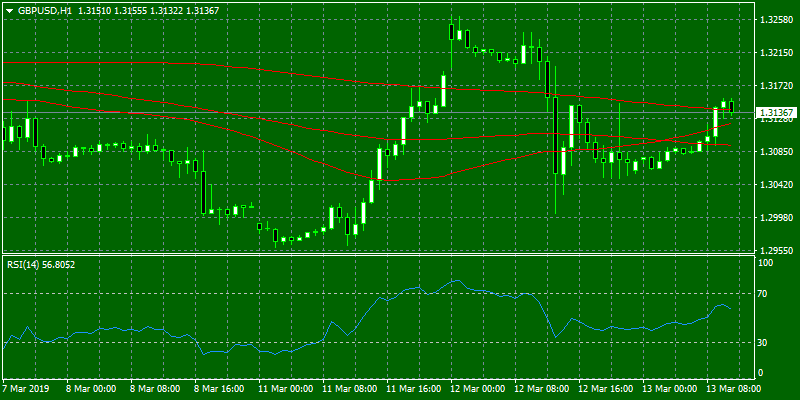

GBPUSD: Volatility is the name of the game for the pair this week as good and bad news crossing the wires. Traders are closely watching the developments around Brexit votes and rumors, and we can see huge moves in the pair.

We have a busy Brexit Calendar, here are the main upcoming events:

- 13th March – Parliamentary vote on opposing “no deal” exit option

- 14th March – Parliamentary vote on extending negotiations/Article 50

- 21st – 22nd March – EU Leaders’ Summit

- 29th March – Article 50 end date

- 9th May – European Council (heads of state) meeting

- 18th – 23rd May – EU Parliamentary elections

- 20th – 21st June EU Leaders’ Summit

The technical picture is bullish for GBPUSD, and an attempt to 1.33 area looks possible. On the downside, major support will be found at 1.2990 where the 50 and 200-day moving averages are crossing. On the flip side, major resistance can be found at 1.3190, and a break above can lead the way to 1.3260 zone.

Open interest in Pound futures markets increased modestly for the second straight session on Wednesday, while volume extended the uptrend for yet another session, this time expanding by around 76.1K contracts.

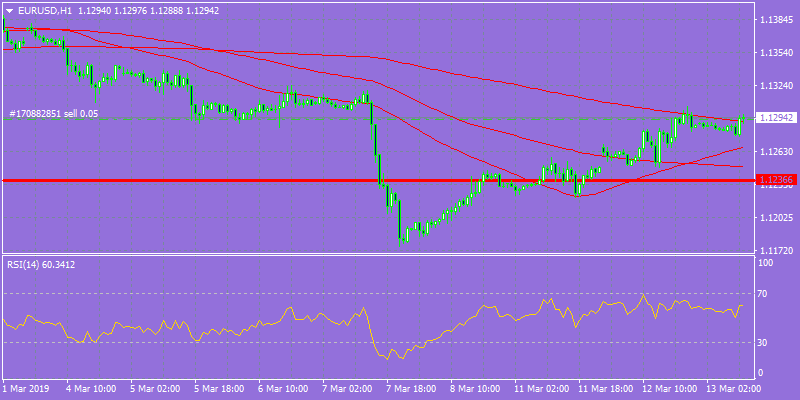

EURUSD started the day higher at 1.1292 area in an attempt to regain some of the previous week losses. The pair is trading in the middle of the range between the 100 and 200-day moving averages targeting to conquer the 1.13 area. The low from yesterday session at 1.1244 provides immediate support, while the key support for the pair stands at yearly lows at 1.1175.

In Euro future markets, traders reduced their open interest positions by nearly 9.9K contracts on Tuesday from the previous day. Volume, instead, rose for the second session in a row, this time by around 162.2K contracts, the largest daily build so far this year.

USDJPY continues the choppy activity around 111.30 with low volume that opens the door for the continuation of the sideline theme in the mid 111.00 for the short-term horizon.

In Yen futures markets open interest shrunk by more than 2.7K contracts on Tuesday vs. Monday’s final 199,681 contracts, extending the choppy activity so far this week. Volume, instead, rose by more than 14.3K contracts, reversing the previous day drop.