Summary: The British Pound plunged against the US Dollar and Euro after newly elected Prime Minister Boris Johnson revamped his Brexit plan. After taking control of the UK Parliament in a resounding election win, Johnson announced his plans to ban any extension of a Brexit transition beyond 2020. Sterling ended down 1.12% against the Dollar at 1.3115 (1.3275), 1.18% versus the Euro (EUR/GBP to 0.8495 from 0.8352), and 1.13% against the Yen (GBP/JPY to 143.67 from 146.3). The Dollar Index (USD/DXY) was moderately higher to 97.234 from 97.025, lifted by the dramatic fall in the Pound and better-than-expected housing data.

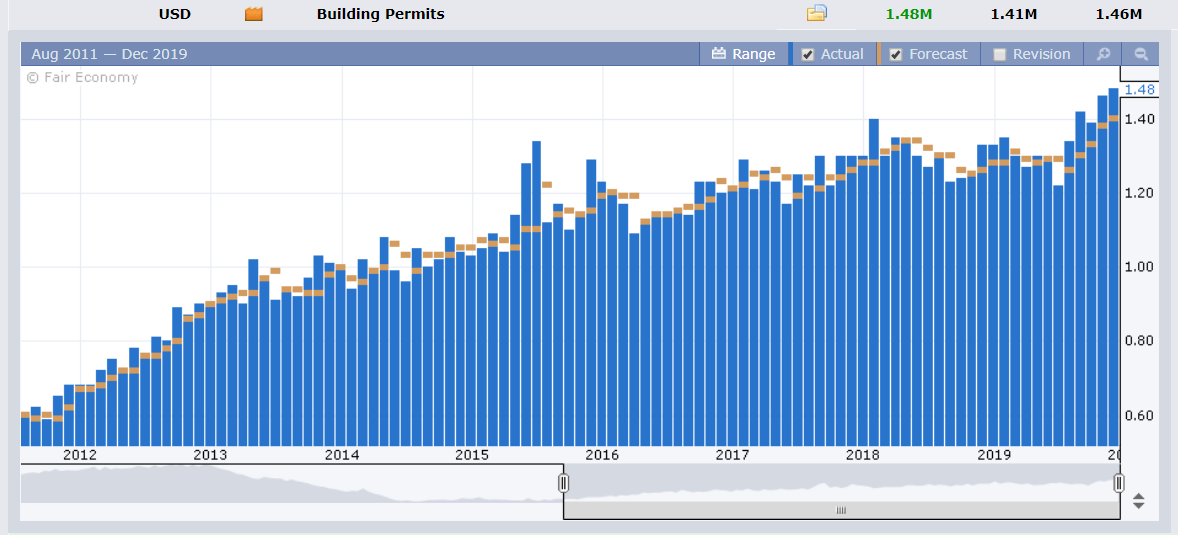

The Euro and Dollar Yen were little changed at 1.1149 (1.1147) and 109.53 (109.60) respectively. The Australian Dollar slipped 0.33% to 0.6849 (0.6892) after the RBA’s latest meeting minutes suggested the central bank may cut interest rates again, as early as February. Wall Street stocks edged lower at the close as uncertainty crept back into markets on the lack of details in the Phase One US-China trade deal. The S&P 500 retreated to 3,188, after hitting a fresh record high at 3,199 (3,195 yesterday). Global bond yields were little changed. The UK’s Unemployment Rate dropped to 3.8% from 3.9% in November while Wages (Average Earnings) dipped to 3.2% from 3.6%. In the US, new residential Building Permits beat forecasts, climbing to 1.48 million against 1.41 million and a previous 1.46 million. US Housing Starts rose to 1.37 million in November from October’s 1.32 million. US Industrial Production climbed 1.1%, beating median forecasts at 0.8%.

- GBP/USD – The Pound plunged to an overnight low at 1.3099, its largest daily decline in over a year, before rallying to settle at 1.3125 from 1.3275 yesterday. Boris Johnson’s revamp of his Brexit plans spooked FX and sent Sterling reeling.

- AUD/USD – The Aussie closed at 0.6848, a loss of fell 0.33% (0.6892 yesterday) following the release of the RBA’s latest meeting minutes. AUD/USD traded to a low at 0.68385 on suggestions that the RBA might trim interest rates again in February.

- EUR/USD – The Euro finished little changed against the US Dollar at 1.1149 (1.1147 yesterday). The Euro ended 1.18% higher against the Pound at 0.8495 (0.8352).

- USD/DXY – The Dollar Index was up modestly to 97.234 (97.025) which was mainly due to the dramatic fall of the British Pound. Sterling carries 11.9% of the weight in the Dollar Index.

On the Lookout: Improved US housing and industrial production data supported the Dollar which managed to gain modestly against its rivals. On the trade front, the lack of details on the China-US Phase One deal saw stocks retreat from fresh highs. Bloomberg’s El- Erian saw the trade deal more as a truce in an opinion piece.

FX has been more realistic given its reaction to the trade news.

Today sees Japan’s Trade Balance and Australian M1 Leading Index reports. Europe sees Germany’s IFO Business Climate Index and November PPI, and Eurozone Final Headline and Core CPI. The UK reports on its Headline and Core CPI, and PPI Input. Canadian Headline and Trimmed CPI round up today’s reports.

Trading Perspective: Yesterday’s action was all in the British Pound. The Dollar’s main support came from Sterling’s plunge. Otherwise, the Dollar was little changed against its other main rivals.

“What goes up, must come down, spinning wheel got to go round,” sang Blood Sweat and Tears in 1970, a classic tune which described Sterling’s fortunes in the past week. GBP/USD started the month under 1.30 (1.2940). The lead up to the UK election has seen Sterling rocket up to a high at 1.3515 on Friday from 1.2950 (December 5). The up move was the result of massive short covering. Speculative GBP Shorts went from -GBP 36,576 (week ended December 3) to -GBP 22,639 (week ended December 10). Yesterday’s Pound plunge was the result of traders entering fresh shorts. In this last full trading week of the year, expect more volatility in the Pound. The US Dollar should see a near term recovery.

- GBP/USD – Sterling plunged to an overnight low at 1.3099 before settling at 1.3125 in early Sydney. Immediate support for the Pound can be found near the overnight low at 1.3095 followed by 1.3050 (low last Friday). Immediate resistance lies at 1.3150 and 1.3200. Look for consolidation in choppy trading between 1.3080-1.3180 today. The risk is for lower first, look to sell rallies.

- EUR/USD – The Euro held against the US Dollar, finishing at 1.1149 (1.1147 yesterday) despite the Pound’s plunge. The shared currency has immediate resistance at 1.1175 (its overnight high) followed by 1.1200. Immediate support lies at 1.1130 followed by 1.1100. Look to trade a likely range today of 1.1120-70 as the Euro further consolidates. Just trade the range shag on this one.

- AUD/USD – The Australian Dollar slumped to 0.68385 from 0.6892 yesterday after the release of the RBA’s meeting minutes suggested that policymakers may cut interest rates again in February. Between now and then is a long time in FX. AUD/USD closed at 0.6848. The latest COT report (week ended Dec 10) saw a modest increase in net Aussie short bets to -AUD 36,808 contracts from -AUD 36,433. On the day, AUD/USD has immediate support at 0.6840 followed by 0.6810. Immediate resistance can be found at 0.6880 and 0.6910. The speculative market it still short. Prefer to buy dips in a likely range today of 0.6840-90.

- USD/DXY- The Dollar Index grinded higher on the Pound’s dramatic plunge to 97.234 from 97.025 yesterday. Immediate support at 97.00 should hold. The next support level is found at 96.80. Immediate resistance lies at 97.30 (overnight high traded 97.295) followed by 97.60. Look for consolidation within a likely range of 97.20-97.50. Just trade the range shag on this puppy.

Happy trading all.