Summary: The Dollar extended its losses against its rivals bar the Yen as global tensions eased. Dismal ISM data yesterday depressed US bond yields which triggered further unwinding of bullish Dollar bets. The British Pound rallied anew to 1.2240 (1.2085) on hopes that a hard-Brexit may be avoided. Christine Lagarde, most likely the next ECB President warned about the negative effects of unconventional policies. The Euro rose 0.56% to 1.1032 (1.0995 yesterday) while USD/JPY finished up at 106.40 (105.98). The Dollar Index (USD/DXY), often a mirror of the Euro, fell 0.58% to 98.427 (98.95). In Asia, risk appetite rose as Hongkong’s leaders scrapped the controversial extradition bill that saw months of often violent protests. The Dollar dipped against the offshore Chinese Yuan (USD/CNH) to 7.1470 from 7.1790. The Aussie climbed to 0.6798 (0.6765). Emerging Market currencies were all higher versus the Greenback.

Wall Street stock were up. The Dow finished at 26,370 (26,115) while the S&P 500 gained 1.16% to 2,938. US bond yields were steady near their lows. The 10-year rate closed at 1.47% (1.46%).

Australia’s Q2 GDP matched forecasts at 0.5%. China’s Caixin Services PMI beat forecasts at 51.7, rising to 52.1 in August. Euro area Serviced PMI’s mostly matched expectations. UK Services PMI dipped to 50.6 versus forecasts of 51.0.

The Bank of Canada kept its Overnight rate unchanged at 1.75%.

Fedspeak yesterday was balanced between the hawks (Williams, Rosengren) and doves (Bullard, Kashkari).

- EUR/USD – Against the overall weaker US Dollar, the Euro rallied 0.56% to 1.1032 from yesterday’s close at 1.0995. Expectations of ECB measures to stimulate the economy, to be announced next week have weighed on the shared currency.

- GBP/USD – Sterling extended its rally as more shorts were forced to cover after British lawmakers took another step to block as no-deal Brexit. GBP/USD soared to 1.2240 from its close yesterday at 1.2085.

- USD/JPY – The Dollar rose against the Yen to 106.40 (105.98) as risk appetite increased.

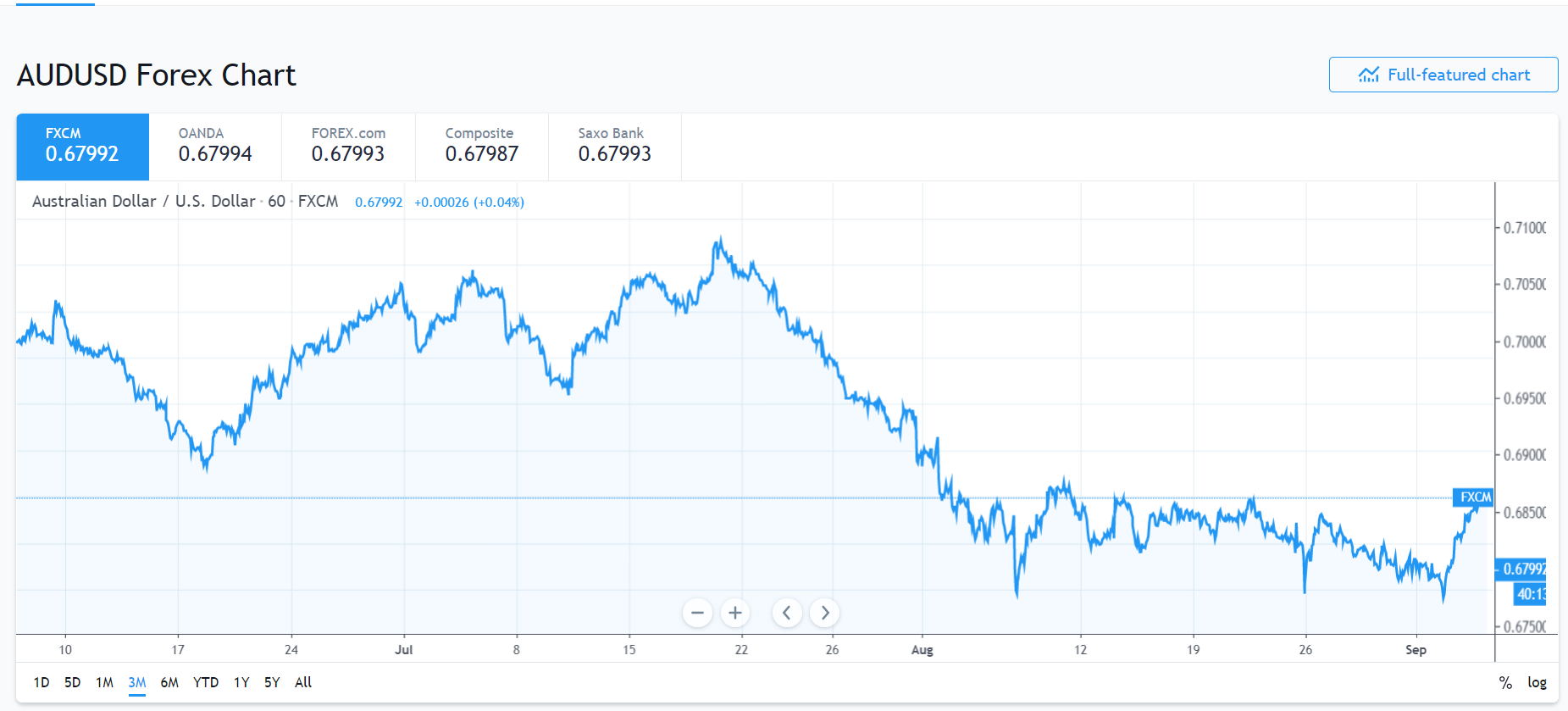

- AUD/USD – The Aussie extended its gains versus the Greenback to 0.6798 from 0.6765. The Battler has been weighed down by overall bearish sentiment on expectations of a more dovish RBA. The rally in EM currencies and metal prices supported the Aussie.

On the Lookout: After the big moves this week, expect some consolidation today heading into tomorrow’s US Payrolls report. The employment portion of yesterday’s dismal ISM report underwhelmed and could impact tomorrow’s NFP.

Markets will continue to monitor geopolitical developments.

Today’s data starts off with Australia’s Trade Balance. Swiss Q2 GDP kicks off Europe’s reports followed by Germany’s Factory Orders (August). US reports round up today’s data starting with Challenger Job Cuts, ADP Non-Farm Employment Change (Private Sector) report, Weekly Unemployment Claims, Factory Orders, US Final Services PMI and ISM Services PMI.

Trading Perspective: Heading into the US Payrolls number, we look at the current market positioning in FX. The latest Commitment of Traders/CFTC report for the week ended 27 August saw gross speculative USD longs versus 10 IMM currencies reduced further to 14-month lows according to Saxo Bank’s report. The reduction in USD longs were mainly against the Pound, Yen and Swiss Franc. We look at a few of these currencies.

- EUR/USD – The Euro has been under heavy pressure this week as speculation mounts on further ECB measures to stimulate the flagging economy. The Euro traded to a low at 1.09687 overnight before rallying to finish above 1.1000 to 1.1035. The turnaround on the US Dollar following yesterday’s dismal ISM Manufacturing report supported the Euro. Italy’s political pressure eased after PM Mario Conte unveiled a new cabinet that united the two main opposing parties. Christine Lagarde, most likely new ECB head put doubt over the scale of any ECB stimulus package next week. Net speculative Euro short bets were little changed at -EUR 38,804 contracts (week ended 27 Aug) from -EUR 37,977. Immediate resistance lies at 1.1040 followed by 1.1070. Immediate support for the shared currency is found at 1.1000 and 1.0970. Look for a likely range today of 1.0995-1.1055. Prefer to buy dips.

- USD/JPY – The Dollar rose against the Yen to 106.40 from 105.95 yesterday on a build in the market’s risk appetite. US 10-year bond yields were steady at 1.47% from 1.46% yesterday. The Yen and Canadian Dollar are the only major IMM currencies where speculators are short USD. Net speculative JPY long bets increased to +JPY 33,607 contracts (week ended 27 Aug) from +JPY 31,154 the previous week. Today, immediate resistance in USD/JPY lies at 106.50 (overnight high 106.45) followed by 106.80. Immediate support can be found at 106.10 and 105.80. Prefer to buy dips with a likely range of 105.85-106.55.

- GBP/USD – Sterling soared to 1.2240 which is basically near its overnight highs as shorts ran to cover after the UK lawmakers defeated Boris Johnson’s no-deal Brexit plans. The Pound fell to as low as 1.19587 yesterday in Europe before reversing back to 1.2085, and 1.2240. The latest COT/CFTC report saw net speculative GBP shorts pared to -GBP 89,028 contracts from -GBP 92,418. Immediate resistance today lies at 1.2250 followed by 1.2280. Immediate support can be found at 1.2200 and 1.2160. Look for a likely range today of 1.2180-1.2280. Just trade the range shag on this one, stay nimble.

- AUD/USD – The Aussie has also been under heavy pressure this week, falling to a low at 0.66876 yesterday before recovering on broad-based US Dollar weakness. AUD/USD closed at 0.6797. The latest COT/CFTC report (week ended 27 Aug) saw net speculative AUD short bets pared to -AUD 61,032 contracts from the previous week’s -AUD 62,781. Despite the reduction the number of Aussie short bets are still relatively large (83% of the year’s high). AUD/USD has immediate resistance at 0.6820 followed by 0.6850. Immediate support can be found at 0.6770 and 0.6740. Look to buy dips with a likely range today of 0.6775 to 0.6825.

Happy trading all.