Summary: US Lead Trade negotiator Robert Lighthizer touted on Sunday (CBS news) that the “phase one” China/US trade deal agreed on Friday was totally done. This would nearly double US exports to China in the next two years. There would be a need for revisions to its text and translations said Lighthizer. Earlier, China’s State Council Customs tariff commission announced that it had suspended additional tariffs on some US goods (meant to be implemented on December 15). President Trump pledged to reduce tariffs he had places on USD 360 billion worth of Chinese goods. At the close on Friday in New York, the Dollar rebounded against the British Pound (1.3335 from 1.3500), Euro (1.1118 from 1.1170) and Australian Dollar (0.6875 from 0.6905) Against the Yen, the Greenback was little changed (109.35). Wall Street stocks closed barely up on Friday while Treasury yields slumped. The benchmark US 10-year yield was down 8 basis points to 1.82%. The DOW was up 0.04% to 28,155 while the S&P 500 finished 0.06% higher at 3,172.

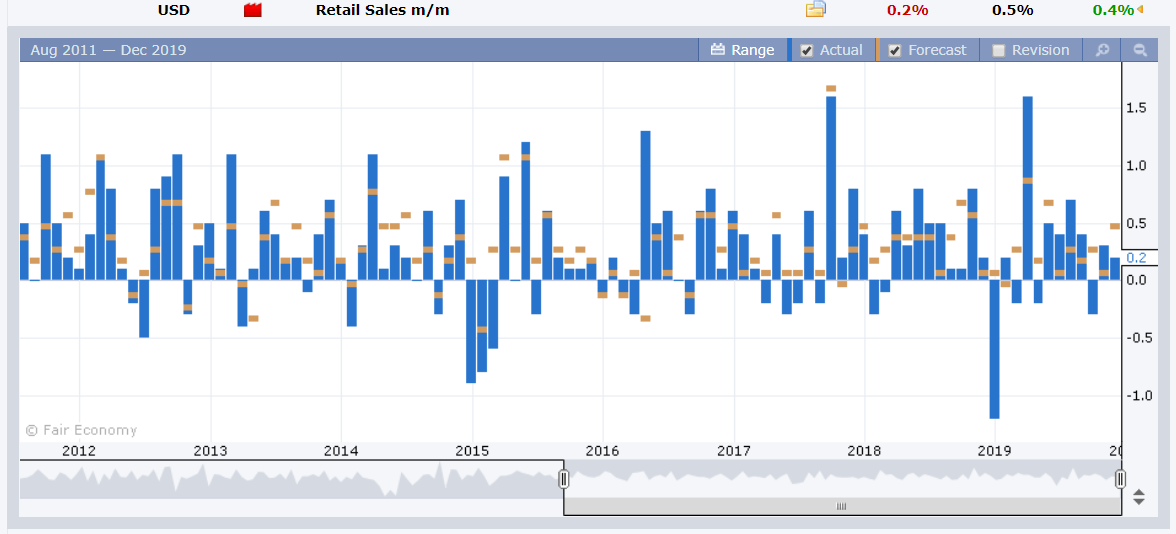

Data released on Friday saw Japan’s Revised Industrial Production fell 4.5% against expected forecasts of a 4.1% drop. US Retail Sales underwhelmed with Headline Sales dipping to 0.2%, missing median expectations of 0.5%, while Core Sales slumped to 0.1% against forecasts of 0.4%.

- EUR/USD – The Euro had a spectacular turn-around after trading to a high at 1.1200, plunging to 1.1117 at the New York close on Friday. Ahead of the last full week of trading this week, liquidity thinned while volatility rose. Expect more of the same.

- GBP/USD – “What goes up, must come down”, the British Pound began a corrective move lower following Boris Johnson’s resounding election victory on Friday. GBP/USD plunged to 1.3335 from Friday mornings high at 1.3515. Sterling though was up 1.5% for the week, and it’s third consecutive weekly advance.

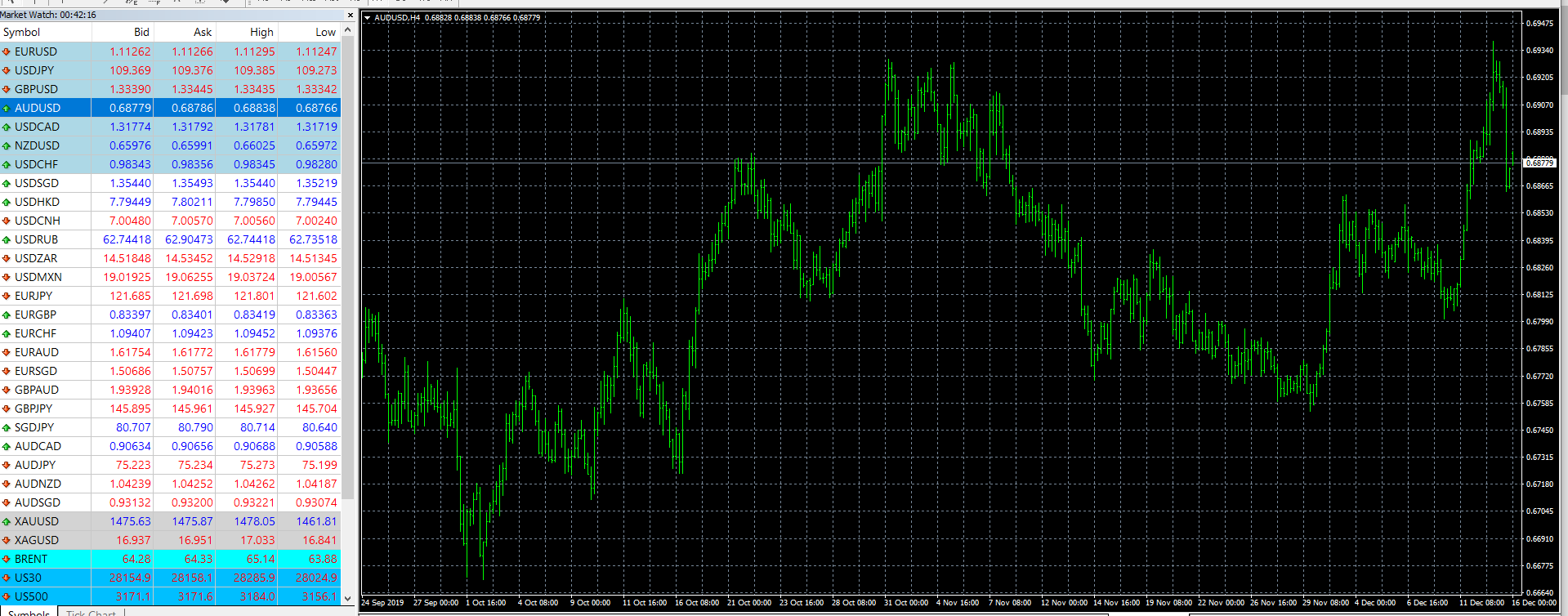

- AUD/USD – The Aussie Dollar which had rallied to 0.69387 on Friday, reversed its gains ahead of the weekend. AUD/USD slumped to 0.6875 from it’s opening on Friday at 0.6915 despite the optimism on the China-US phase one trade agreement. Australia’s Flash Manufacturing and Services PMI released just now showed a dip in both reports.

- USD/JPY – The Dollar was little changed against the Yen, closing at 109.35 from 109.32 on Friday morning despite the fall in Japan’s revised Industrial Production report for November.

On the Lookout: The last full trading week of the year see a data dump today. China reports on its trifecta of Fixed Asset Investment, Industrial Production and Retail Sales. China’s Unemployment Rate is also released. Flash Manufacturing and Services PMI reports are due from Japan, Germany, France, the Eurozone, United Kingdom and the United States. The Bank of England’s Financial Stability Report and Financial Policy Committee’s Meeting Minutes are also released.

The Bank of Japan and Bank of England set policy amid a flurry of updates of official data from around the globe. In Asia, central banks from Taiwan, Thailand and Indonesia have their monetary policy meetings. Sweden’s Riskbank and Norway’s Norges Bank also hold their rate policy meetings.

Today, China’s Industrial Production and the US Flash Manufacturing PMI reports will be scrutinised in the light of the China-US trade war.

Australia’s Flash Manufacturing PMI, just released, slipped to 49.4 from the previous 49.9. The Aussie Dollar had no reaction to the report, trading flat at 0.6875.

Trading Perspective: The Euro’s spectacular failure at the 1.1200 area should see further short-term US Dollar appreciation. The thorn in the Greenback’s side was Friday’s fall in US bond yields, which were not matched by its global rivals. This bears watching, and a further narrowing of the yield gap between the US and its global rivals will see the Dollar extend its corrective losses. The week ahead is the last full trading week of the year and liquidity will thin out. Expect more volatility, which most traders love at this time of the year. Unless you are in a large institutional trading room having to watch large stop-loss orders from the institution’s clients☹

The best strategy is to get your support and resistance levels and trade on what they tell you with a strong degree of flexibility. Be nimble and be quick.

- EUR/USD – The Euro failed spectacularly at the 1.1200 level and the downward reversal was fast and furious. The Euro closed at 1.1117 in New York after an overnight low of 1.11075. This morning, EUR/USD opens at 1.1127, a tad higher. We can expect consolidation at the outset in Asia today. Immediate support lies at the 1.1105, followed by 1.1065. Immediate resistance can be found at 1.1145 and 1.1175, with 1.1200 providing strong resistance. Overnight, Germany’s 10-yaer Bund yield was 2 basis points lower at -0.29%, less than the 8- basis point drop in its US counterpart. This will provide the Euro with some support. Look for a likely range today of 1.1110-1.1140. Trade the range until the dust settles.

- GBP/USD – Sterling experienced the classic “but the rumour, sell the fact” action on Friday morning. The downward correction took the British currency down to near 1.3300, closing at 1.3335. Immediate support lies at 1.3300 followed by 1.3270. A break down through 1.3270 could see Sterling slump to 1.3200 and 1.3170. Immediate resistance lies at 1.3370 and 1.3410. Look for consolidation in choppy trade between 1.3280-1.3380 today. Trade the range and be nimble.

- AUD/USD – The Aussie dropped back to 0.6875 after its failure to clear 0.6940 (overnight high traded was 0.69387). The Aussie Battler has immediate support at 0.6860 (overnight low traded 0.6863). The next support can be found at 0.6840. Immediate resistance lies at 0.6900 and 0.6940. China’s trifecta of Industrial Production, Retail Sales, and Fixed Asset Investment will be biggest Aussie drivers today. Keep a lookout for that (1 pm Sydney time). Later on in the week, the RBA releases its latest monetary policy meeting minutes (Tuesday). Australia’s Employment report (November) is due on Thursday. A big week for the Aussie as we approach the last full trading week of the year. Overnight, Australia’s 10-year bond yield was up to 1.25% (1.13% Friday). Given the fall in the US 10-year rate, the Aussie should get support. Look for a likely range today of 0.6865-0.6915. Prefer to buy dips.

Have a good week ahead all, happy trading.