Four US agencies announced a new market integrity task force.

The four agencies are: the US Department of Justice (USDOJ), the Securities and Exchange Commission (SEC), the Consumer Financial Protection Bureau (CFPB), and the Federal Trade Commission (FTC).

Here’s part of a press release from the USDOJ.

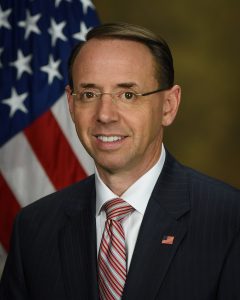

“Deputy Attorney General Rod Rosenstein today announced the establishment of a new Task Force on Market Integrity and Consumer Fraud. The Task Force, which is formed pursuant to Presidential Executive Order, will provide guidance for the investigation and prosecution of cases involving fraud on the government, the financial markets, and consumers, including cyber-fraud and other fraud targeting the elderly, service members and veterans, and other members of the public; procurement and grant fraud; securities and commodities fraud, as well as other corporate fraud, with particular attention to fraud affecting the general public; digital currency fraud; money laundering, including the recovery of proceeds; health care fraud; tax fraud; and other financial crimes.

“Deputy Attorney General Rosenstein was joined in the announcement by Acting Director Mick Mulvaney of the Bureau of Consumer Financial Protection, Chairman Jay Clayton of the Securities and Exchange Commission, and Chairman Joe Simons of the Federal Trade Commission.”

“Fraud committed by companies and their employees has a devastating impact on American citizens in the financial markets, the health care sector, and elsewhere,” said Deputy Attorney General Rosenstein. “The President’s order directs the Task Force to invite participation from our law enforcement partners at many departments and agencies. By working together, we can achieve more effective and efficient outcomes. Drawing on our pooled resources, including subject-matter expertise, data repositories, and analysts and investigators, we can identify and stop fraud on a wider scale than any one agency acting alone.”

“As Acting Director of the Bureau, one of my top priorities has been to go after bad actors,” said Acting Director Mick Mulvaney of the Bureau of Consumer Financial Protection. “The Bureau takes its mandate to enforce the law seriously, and the Bureau will continue to apply the law to achieve this end of combatting fraud against Americans. The recent settlement with Wells Fargo is a great example of the Bureau coordinating closely with sister regulators to remedy legal violations. Interagency cooperation is incredibly important for these complex issues, as criminals do not stay neatly within state lines or even national borders. This task force is an example of the growing cooperation of the Bureau’s work with other federal and state authorities to combat a multitude of bad actors out there today.”

“At the SEC we work every day to protect Main Street investors,” said SEC Chairman Clayton. “This Task Force will allow us to build on the close partnerships we have with our fellow regulators and law enforcement agencies to deter and combat retail fraud.”

“At the SEC we work every day to protect Main Street investors,” said SEC Chairman Clayton. “This Task Force will allow us to build on the close partnerships we have with our fellow regulators and law enforcement agencies to deter and combat retail fraud.”

The CFPB is a new agency which was the brainchild of Democratic Senator from Massachusetts, Elizabeth Warren; it was created as part of Dodd/Frank and responsible for consumer protection in the financial sector.

While the agency has garnered much attention in the US, its effect on the trading industry is limited because trading related malfeasance is already investigated by the SEC, the Commodities Futures Trading Commission (CFTC), and the USDOJ.

The FTC has a mandate of consumer protection and the elimination and prevention of anticompetitive business practices.

Both the CFPB and the FTC have taken action against certain cryptocurrency scams with a May 2018 article noting that the CFPB got “a whopping 358 complaints about Coinbase in a single week.”