By Giles Coghlan, Chief Market Analyst, HYCM

On Tuesday, January 10, Fed Chair Jerome Powell made his first public appearance of the new year. Speaking at the Symposium on Central Bank Independence in Stockholm, Sweden, Powell emphasised the importance of central bank independence from political influence and said that central banks ought to “stick to our knitting, and not wander off to pursue perceived social benefits that are not tightly linked to our statutory goals and authorities.”

These “perceived social benefits” include issues like climate change and race, which the Fed has been criticised in the past for paying lip service to. With the recent appointment of a Republican Speaker of the House of Representatives, it appears that Powell was keen to draw a clear line under what he perceives to be the Federal Reserve’s mandated roles of achieving maximum employment and price stability.

What was notably absent from his appearance were any indications for avid Fed-watchers regarding a possible change of course, or even a doubling-down on the Fed’s current hawkish stance. Powell avoided discussing his economic or monetary outlook, which European markets appear to have interpreted as a positive sign, opening higher on Wednesday. All eyes are now firmly fixed on the US CPI, to be announced on Thursday, January 12, for an indication of the possible path ahead.

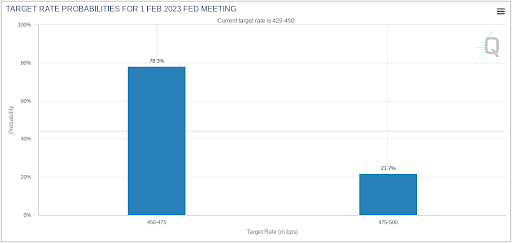

According to the Fed’s dot plot from December, the majority of FOMC members see US interest rates topping 5% in 2023 with no cuts expected until 2024. Meanwhile, short-term interest rate market predictions are currently only pricing in a 22% chance of a 50-basis point hike next month, down from 50% a month ago, with a 78% chance that the first interest rate decision of the year will be a 25-basis point hike in February.

Powell has been diligent in his efforts to take the possibility of a pivot off the table, which has led investors to start viewing even the possibility of a pause as bullish because it signals that the worst is over for their portfolios. As this tug of war between what markets expect (or perhaps more accurately, want) continues to resolve itself, the question on the minds of many investors is whether it’s time to jump back in, or whether to expect a further leg down in equity prices.

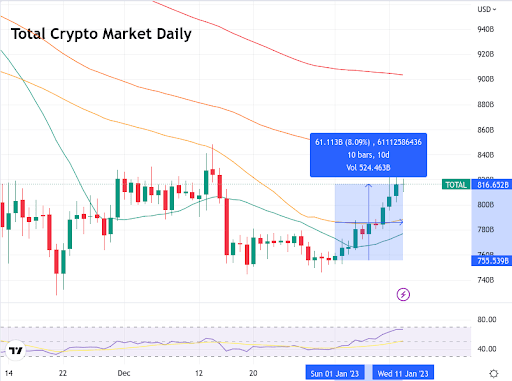

The crypto market, which locates itself at the far end of the risk curve, and has recently acted as a barometer of broader risk appetite in US equities, has been recently flashing some positive signals. The total market has experienced a +10% rally from its lows in the new year (currently 8% up), with many of the riskier “altcoin” projects like ADA, SOL, and XTZ, currently up between 20-60% since the beginning of the year.

While not fighting the Fed is often cited as sound wisdom for market participants, it also seems like the hardest thing for many investors to do. Such is the temptation of timing the bottom, in this instance, or the top in the year gone by, that people are willing to go against their better instincts and the emphatic forward guidance of central bankers in the search for those extra percentage points of alpha.

In this situation, fighting the Fed may be a sport advised only for the most risk-tolerant of investors. This is because there is nothing at the moment, aside from the recent stirrings of the crypto market, to warrant such bullishness. With so much uncertainty still present, buying a bottom here is an exceedingly risky proposition, particularly if the Federal Reserve follows through on its promises of higher for longer.

Imagining for a moment that the bottom is actually in, but that risk aversion causes an investor to miss it while waiting for further confirmation, there’s really nothing wrong with losing out on even the first 10-20% of the rally to make sure it’s not a fake-out.

On the other hand, buying a bottom before a further 10-20% drop can be a far more costly proposition. Not only does it mean a significant portfolio hit, but it ties up precious capital that would have otherwise been better kept on the sidelines for future trades.

At HYCM, we’re far more concerned with providing a balanced view of trades instead of just focusing on reasons to justify the trade. At the end of the day, there’s nothing wrong with sitting on some “dry powder” as the traders call it; holding onto your cash is also a trade.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.