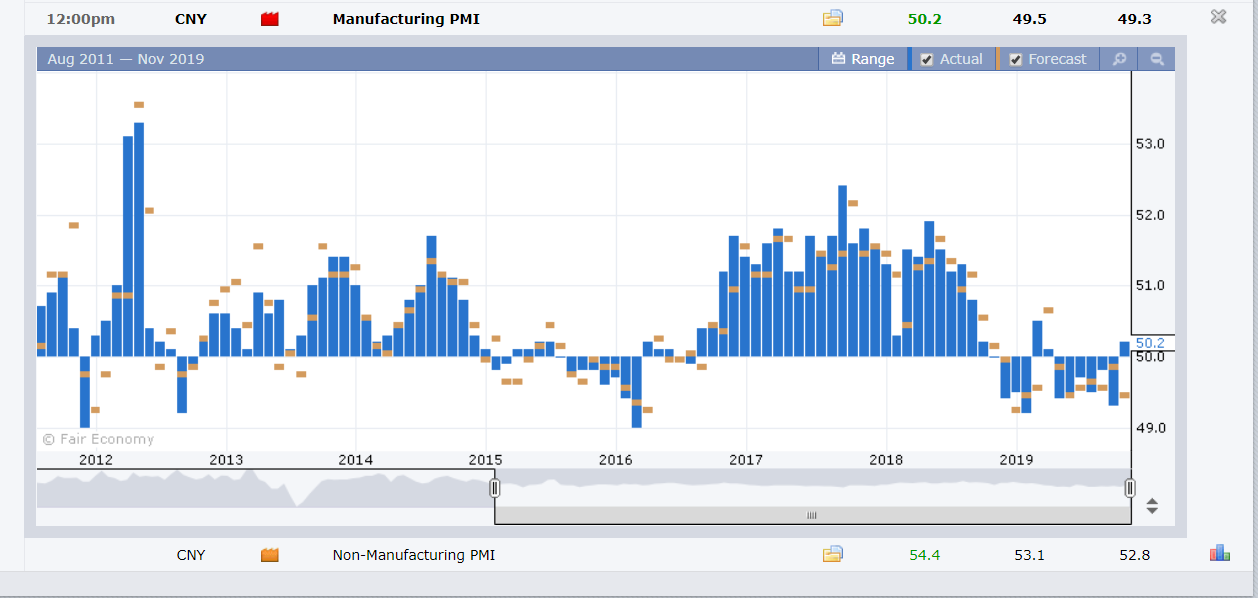

Summary: Early Asian markets on Monday opened with news of an escalation of protests in Hongkong. Fresh anti-government demonstrations Sunday saw riot police firing tear gas to disperse thousands who gathered to show gratitude for US support for the protests. Further protests are planned through the week and will affect the trade negotiations between China and the US. Meantime on the data front, China reported on Sunday that its Manufacturing PMI recorded its first reading above the expansionary 50-level to 50.2 in November (49.3 October). Non-Manufacturing PMI also beat forecasts with a 54.4 reading against 53.1. On Friday, Eurozone Inflation rose in November with Headline CPI up marginally to 1.0%, beating expectations of 0.8% and bettering the previous 0.7%. Eurozone Core CPI beat forecasts, climbing to 1.3% from 1.1%. This saw the Euro rally 0.1% to 1.1022 (1.1008). The Dollar Index (USD/DXY) eased to 98.27 from 98.345 Friday. USD/JPY slipped to 109.45 from 109.55 on Friday. The Australian Dollar was little changed at 0.6760 (0.6766). Trading on Friday was slow with US markets closing early following the Thanksgiving holiday. Trading desks were sparse and volumes were thin. Wall Street stocks retreated from record highs. The DOW finished 0.3% down at 28,065. (28,130). The S&P 500 dropped 0.35% to 3,142. (3,152 Friday).

Germany’s Unemployment Change improved with 16,000 less Jobless against a forecast of 5,000 more. Japanese Consumer Confidence rose to 38.7 (against f/c 37.0) while the country’s Unemployment Rate was flat at 2.4%. Japan’s Industrial Production fell to -4.2% from a forecast drop of -2.0% in November. Australia’s Private Sector Credit fell 0.1% in November from 0.2% the previous month.

- EUR/USD – The Euro advanced to 1.1022 on Friday from 1.1007 opening. An improvement in Eurozone CPI lifted the shared currency after it had dropped to an overnight and near two-month low at 1.09812.

- USD/JPY – The Dollar retreated against the Yen to 109.45 from 109.55 Friday morning. USD/JPY traded to a high at 109.67. Japan’s 10-year JG yield climbed 2 basis points to -0.09% while the US 10-year rate was unchanged at 1.78%.

- AUD/USD – The Aussie Dollar was little changed at 0.6760 from 0.6765 after trading in a familiar 25-point range. Upbeat Chinese Manufacturing and non-manufacturing PMI data released yesterday should support the Aussie although President Trump’s signing of the Hongkong bill and fresh HK protests may impact Sino-US trade negotiations and prevent any significant gains.

On the Lookout: Monday starts off with a data dump featuring global Manufacturing PMI’s. Incoming ECB President Christine Lagarde addresses the European Parliament with a speech in Brussels. The big events for the first week in December are the RBA (Tuesday) and BOC (Wednesday) interest rate meetings followed by Friday’s US Payrolls report.

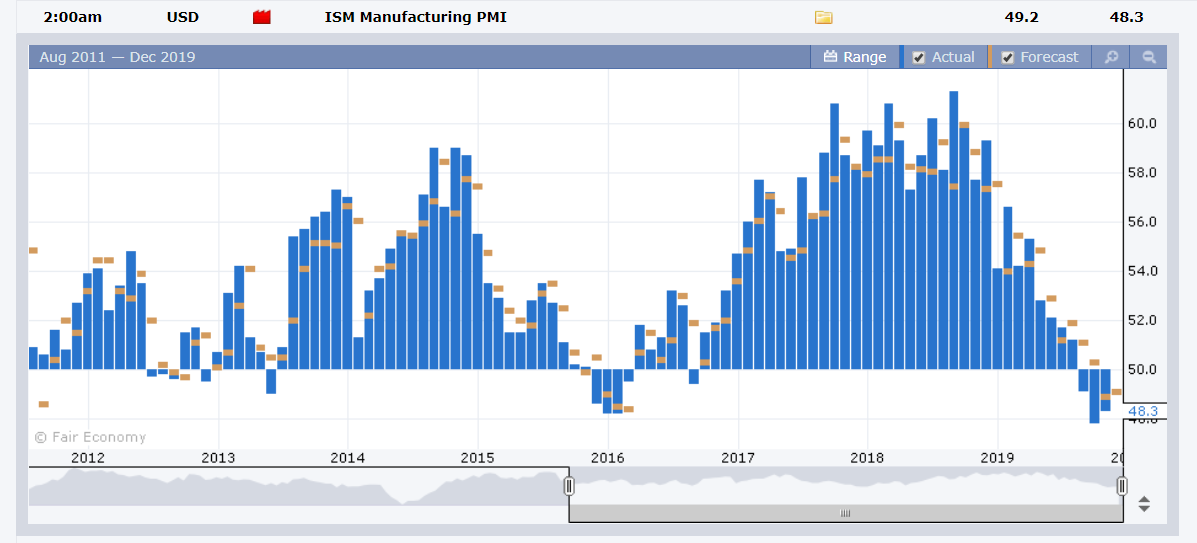

Today kicks off with Australia’s AIG Manufacturing Index, Building Approvals and ANZ Job ads. Japan reports on its Final Manufacturing PMI as well as Capital Spending. Chinese Caixin Manufacturing PMI follows. Switzerland opens European data with its Retail Sales and Final Manufacturing PMI. Euro area Final Manufacturing PMI reports see Italian, French, German and the Eurozone reports. The UK reports on its Final Manufacturing PMI. Canada reports on its Manufacturing PMI. The US round up today’s reports with its Final Manufacturing PMI as well as the important ISM Manufacturing PMI. Analysts are expecting an improvement. US Construction Spending is also due.

On the trade front, Hongkong protests remain a thorn in negotiations between the world’s two largest economies. Markets will be monitoring press releases.

Trading Perspective: More positive Manufacturing PMI reports will be offset by any hiccups in the trade talks between China and the US. Today’s data dump of global PMI’s as well as the US ISM Manufacturing PMI will impact the Greenback. Market positioning is currently long US Dollars and the risk, according to this writer, is lower for the Dollar. We look at the latest COT/CFTC report which is due tomorrow.

- EUR/USD – The Euro had a good bounce off overnight lows at 1.09812, advancing to 1.1022, its highest weekly close. The climb in Eurozone inflation supported the shared currency. Speculative short Euro positioning at its highest in four weeks, expect the Euro to remain supported into the release of Euro area manufacturing PMI’s. EUR/USD has immediate support at 1.1000 followed by 1.0980. Immediate resistance can be found at 1.1030 (overnight high 1.1028) followed by 11050. A clean break through 1.1050 could see the Euro advance back to the 1.1100 area. Look to buy dips with a likely range today of 1.1010-1.1060.

- USD/JPY – The Dollar Yen retreated to 109.45 after climbing to an overnight high at 109.668. The two-basis point climb in Japan’s 10-yaer JGB yield will keep USD/JPY capped at 109.70 immediate resistance. Risk appetite will ease following the escalation of Hongkong protests which will delay the China-US trade talks. Immediate support can be found at 109.40 (overnight low 109.398) followed by 109.10. Look to sell rallies today with a likely range of 109.10-109.60.

- AUD/USD – The Australian Dollar kept within a familiar tight 25-point range and closed little changed at 0.6760 from 0.6765. The Aussie Battler initially dipped to 0.67543 overnight low following a fall in Australia’s Private Sector Credit data. Tomorrow sees the RBA policy meeting where the cash rate is expected to remain unchanged. The RBA statement will be closely monitored. Last week, (Tuesday) RBA Governor Philip Lowe, speaking to business economists, said that negative interest rates are on the cards. Lowe also outlined what he would need to pull the trigger on QE. This writer’s view is still that while the Australian Dollar Trade Weighted Index remains near 2008 GFC levels, the RBA are not going to ease interest rates. Immediate support lies at 0.6750 followed by 0.6730. Immediate resistance for the Battler can be found at 0.6780 followed by 0.6810. Look to buy dips with a likely range today of 0.6750-0.6800.

Have a good week ahead all, happy trading.