Summary: The British Pound maintained its stellar performance, climbing to May 2019 highs (1.3165), settling at 1.3160, up 0.4%. Ahead of next week’s election, expectations of a majority win by Boris Johnson’s Conservatives firmed. The Dollar Index (USD/DXY) eased 0.23% to 97.422 (97.682) despite an unexpected fall in Weekly Unemployment Claims. Which offset yesterday’s poor ADP Private Employment report and makes volatile session into today’s US Payrolls number. The Euro gained 0.16% to 1.1100 (1.1070 yesterday). With ECB officials leaning towards fiscal policy, sentiment on the shared currency is turning. The Australian Dollar dipped 0.25% to 0.6832 (0.6847) after November Retail Sales fell to 0.0% against a forecast of 0.3% and October’s 0.2%. USD/JPY slipped to 108.75 from 108.95. Meanwhile, trade talks between China and the US continued to drag on. Wall Street stocks closed little changed. The DOW closed at 27,675, up 0.10% while the S&P 500 ended flat at 3,117.00. Global bond yields climbed. The US 10-year treasury rate gained 3 basis points to 1.80%. Germany’s 10-year Bund yield ended at -0.3% from -0.32%. Japan’s 10-year JGB yielded -0.05% from -0.06%.

Australia’s Trade Surplus shrank to AUD 4.5 billion in November, missing forecasts at 6.5 billion. Germany’s Factory Orders dipped -0.4% lower than expectations of 0.3%. Eurozone Retail Sales climbed 0.2%, matching forecasts. The US Trade Deficit shrank in October to -USD 47.2 billion, beating median estimates of -USD 48.7 billion. This was the lowest level in close to 1.1/2 years. The fall in the deficit was the result of a large decline in imports, indicative of slower domestic demand.

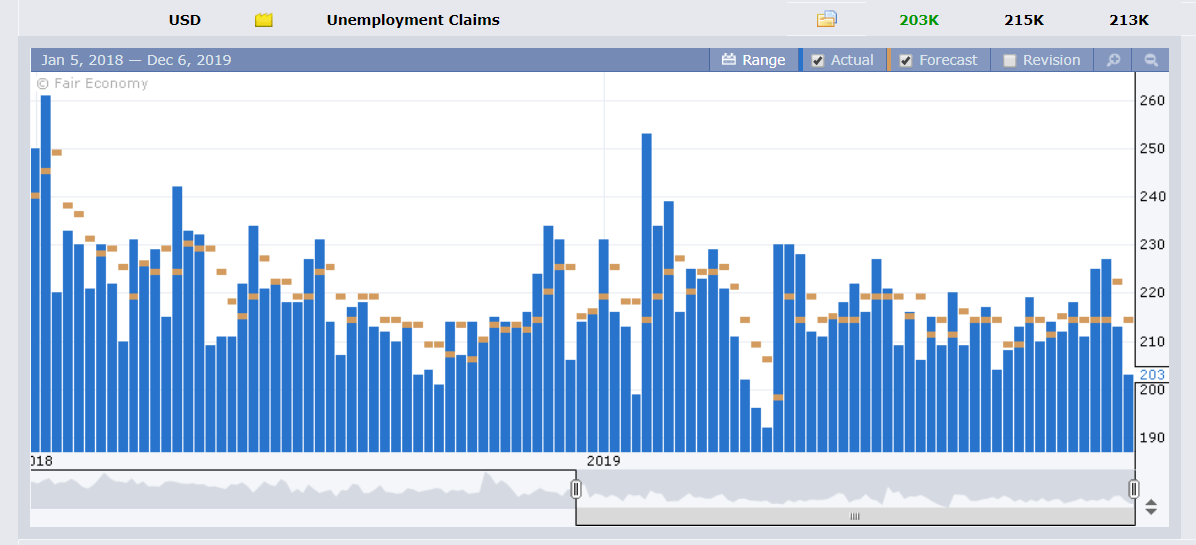

US Weekly Unemployment Claims dropped unexpectedly to 203,000 from the previous 213,000.

- EUR/USD – The Euro extended its advance against the Greenback to close around 1.1100, up 0.16% despite weaker than forecast German Factory Orders. ECB President Christine Lagarde is seen favouring fiscal measures to stimulate the Eurozone economy as opposed to any QE. Short market positing is also supporting the shared currency.

- GBP/USD – Sterling continued to climb higher as latest polls showed that the Conservatives have cemented their advantage and appear headed to a majority win in next week’s election. The strong British Pound is pressurising the Greenback lower.

- USD/JPY – slip-sliding away, the Dollar slipped to 108.76 from 108.95 yesterday. With trade negotiations between China and the US dragging on, USD/JPY looks set to extend its slide.

- AUD/USD – Disappointing Australia Retail Sales and Trade data derailed the Aussie’s rally. The Aussie Battler closed 0.25% lower to 0.6832 (0.6847 yesterday) after dropping to an overnight low at 0.68208 following the data. The Battler looks to consolidate ahead of the US Payrolls report.

On the Lookout: With the Sino-US trade talks dragging away, today is all about the US Payrolls. And the recent conflicting US employment data make for a volatile session tonight. So, “let’s get ready to rumble!” Before the US Jobs report other data releases today start off with Japanese Average Cash Earnings, Household Spending and Leading Economic Indicators (November). Euro area reports follow next with German Industrial Production, and Italian Retail Sales. The UK reports Halifax House Price Index. Canadian Employment report and Unemployment rate follow. The comes the US Employment report and Preliminary University of Michigan Consumer Sentiment.

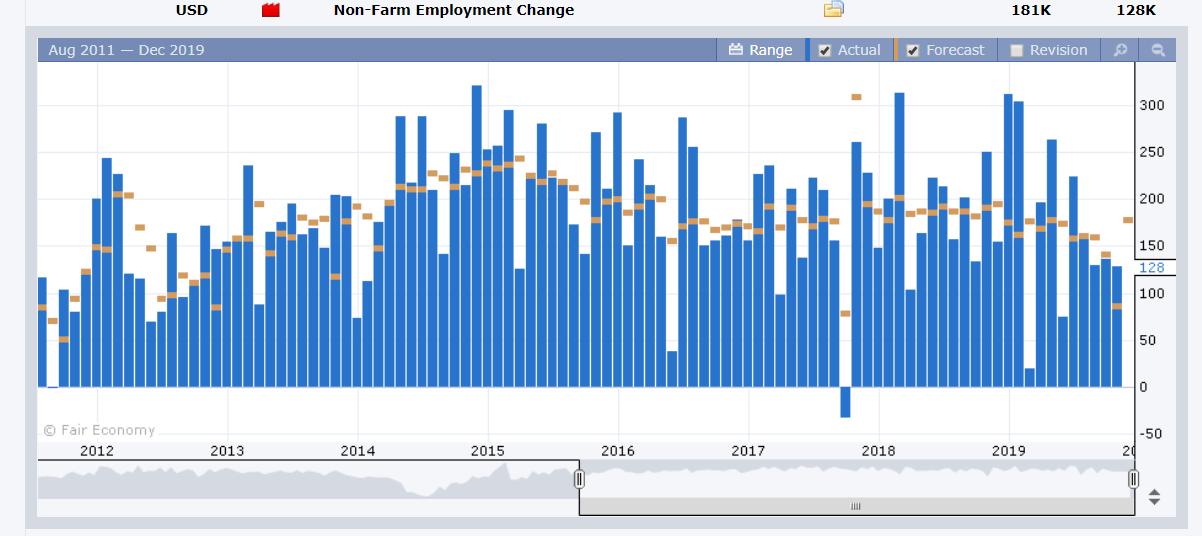

Despite the fall in ADP Private Employment, median estimates for today’s US NFP Employment continue to centre on a gain of 185,000 Jobs from October’s 128,000. This is because most of the employment gains are expected to come from the Services sector. The Unemployment rate is expected to hold steady at 3.6% while Wages are forecast to accelerate to 0.3% from 0.2%.

After a string of “good” Payrolls reports, we may be in for a weak one tonight. Which is where the risk lies.

Trading Perspective: The Dollar eased despite an expected improvement in US Payrolls. Anything less than a gain of 180,000 could see further Greenback selling. A Payrolls number of 155,000 or less would see an acceleration of the Dollar’s downside slide. We would need to see a gain of 200,000 for the Greenback to turnaround.

- EUR/USD – The shared currency continues to grind higher on short covering. Overnight high for the Euro was 1.11078. Immediate resistance lies at 1.1110 followed by 1.1130. Immediate support can be found at 1.1080 and 1.1060. A weak US Payrolls number could see a break above 1.1130/50 which would lead to 1.1200. Ahead of tonight’s number, look for consolidation with a likely range of 1.1075-1.1115. Remember that the speculative market is short of Euros. Be nimble but look to buy on dips or on the break above 1.1130.

- USD/JPY – The Dollar slipped moderately lower against the Yen to 108.75 from 108.97 yesterday. A weak Payrolls number would see US bond yields tumble, and this would weigh on the Dollar-Yen. Overnight low traded was 108.655. Immediate support can be found at 108.50 followed by 108.20. Immediate resistance lies at 109.00 (overnight high 109.00) followed by 109.30. Expect consolidation with a likely range of 108.60-108.90. Prefer to sell rallies.

- USD/DXY – The Dollar Index, a popular gauge of the Greenback’s value against a basket of major currencies (mainly the EUR, GBP and JPY) continues to edge lower. Last night, USD/DXY slipped to an overnight and near one-month low at 97.358 before settling at 97.422. Technically, the Dollar Index looks headed to 97.00 medium term support. Immediate support can be found at 97.30 followed by 97.00. Immediate resistance lies at 97.60 (overnight high 97.593) followed by 97.80. A weak Payrolls number will see 97.00 tested while a strong Jobs report will see 97.80. Look for consolidation with a likely range today of 97.30-97.60. Prefer to sell rallies.

- AUD/USD – The Aussie Dollar’s rally fizzled out following the weaker retail sales and lower trade surplus reports yesterday. AUD/USD slipped to 0.6832 from 0.6847. Overnight low traded was 0.68208. From here, the next moves in the antipodeans will be dictated by the US Dollar. AUD/USD has immediate support at 0.6820 and 0.6800. Immediate resistance lies at 0.6860 (overnight high 0.6855) followed by 0.6890. A weak US Payrolls report will see the Aussie’s uptrend re-emerge. Let’s not forget that the speculative market is currently short of Aussie bets. Expect consolidation ahead of the US Payrolls of 0.6820-0.6860. Prefer to buy dips.

Friday Payrolls Day! Happy trading all.