Summary: FX dozed off in London as the US began its weekend Thanksgiving holiday. The Dollar Index (USD/DXY), a popular measure of the US Dollar relative to a basket of foreign currencies, closed at 98.345, off 0.2% (98.381). Markets switched to risk-off mode after the US signed legislation backing Hongkong protestors. While this was widely expected, caution prevailed on fears of China’s response and possible retaliation. China had warned that it would take “firm counter measures” if the US continued to interfere in Hongkong. Thin, illiquid conditions prevailed, and traders were content to stick to familiar ranges and “keep their powder dry.” The Euro edged up 0.03% to 1.1008 (1.1004) while USD/JPY finished little changed at 109.53 from 109.56 yesterday. Sterling traded in a higher range but finished flat at 1.2909. Pollster YouGov, which predicted the UK 2017 election, had Boris Johnson on course to win the December 12 election. Trading in the Australian Dollar was virtually comatose, the Battler moving in a tight 19-point range, easing 0.02% to 0.6767. Australia’s Q3 Capital Expenditure fell 0.2%, missing forecasts of 0.0%.

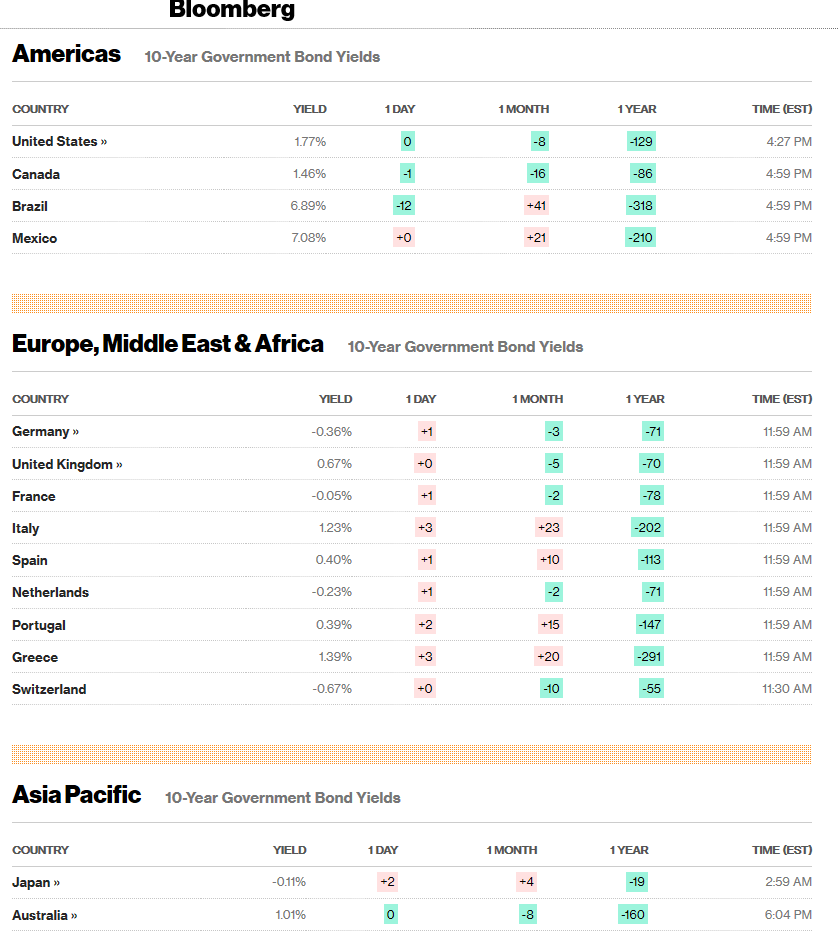

Wall Street stocks slipped on the risk-off mode. The Dow eased 0.15% to 28,130 (28,160) while the S&P 500 was down 0.11% to 3,150 (3,154). The US 10-year bond yield was flat at 1.77%.

Data released yesterday saw Annual Japanese Retail Sales in November drop 7.1% against a forecast fall of 3.8%. Switzerland’s Q3 GDP lifted to 0.4% from Q2’s 0.3%, bettering expectations of 0.1%. Germany’s Preliminary CPI (November) slipped to -0.8% against forecasts of -0.7% while Spanish CPI rose to 0.4%, beating forecasts of 0.2%.

- EUR/USD – The shared currency traded in a narrow range between 1.09986 and 1.10179, finishing at 1.1008, up 0.03%. Trading volumes remained near all-time lows with little expected. However, this may change with a Euro area data deluge expected today.

- USD/JPY – The Dollar eased against the Yen to 109.52 (109.57) but maintained its firm tone despite the risk-off environment. Annual Retail Sales underwhelmed at -7.1%, missing forecasts at -3.8%. a large fall from the previous +9.2%. Today sees a Japanese data dump.

- AUD/USD – The Australian Dollar stuck within a familiar tight range (0.6759 and 0.6778), unable to break out given the low volumes in trading. AUD/USD finished a tad lower at 0.6767 (0.6777).

- USD/DXY – The Dollar Index eased 0.03% to 98.345 from 98.38 yesterday. Overnight high traded was 98.396 with the immediate resistance at 98.50 holding firm.

On the Lookout: Markets will keep their eyes on news headlines out of Asia today to see China’s response to the US backing of Hongkong. After US President Trump signed two bills backing Hongkong’s protestors, the former British colony remains the biggest geopolitical threat.

While the US celebrates their Thanksgiving holiday, today sees a data dump from Japan, the Eurozone, the UK and China.

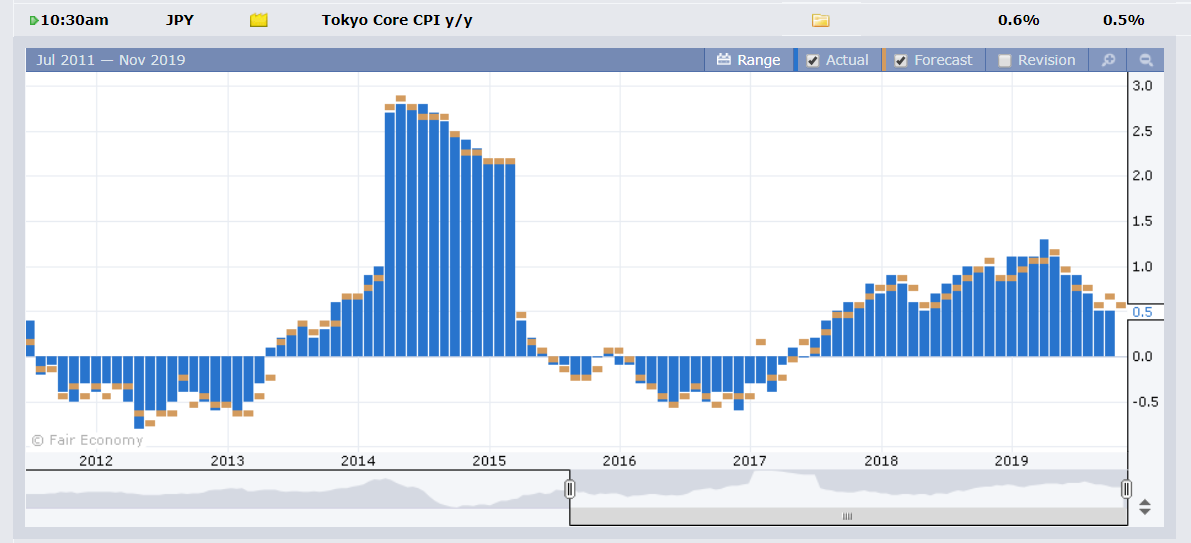

New Zealand kicks off with its November Building Consents. Japan follows with its Tokyo Core CPI (Annual), November Unemployment Rate, Preliminary Industrial Production, Consumer Confidence and Housing Starts. Australian Private Sector Credit and HIA New Home Sales follow.

Euro area reports start off with Germany’s November Retail Sales and Unemployment Change, France reports its Consumer Spending, Preliminary CPI and Q3 GDP. Switzerland reports on its KOF Economic Barometer followed by Italy’s Unemployment Rate. The Eurozone Flash Headline, Core CPI and Unemployment Rate follow. The UK reports on its GFK Consumer Confidence, Mortgage Approvals and Net Lending to Individuals. Canadian GDP (m/m) follows. Early Saturday morning (Sydney and Asia) sees Chinese Manufacturing and Non-Manufacturing PMI’s.

Trading Perspective: Market conditions will keep FX confined to tight and familiar ranges. However, there is a risk that the same conditions could witness a break-out should geopolitical tensions escalate and the proverbial s… hits the fan. Most political analysts see no military intervention from China as likely in Hongkong. Still risks remain with the Hongkong the biggest geopolitical threat. Not a time to be complacent. In situations as such, market positioning is crucial. And FX is currently long of US Dollar bets. The risk, for this writer, is for a lower US Dollar and stocks.

- USD/DXY – The Dollar Index traded within a narrow range of 98.264 and 98.396, closing at 98.345, down 0.03%. Immediate resistance at 98.50 will continue to cap any gains while the immediate support at 98.20 is formidable. With the Euro carrying almost 60% of the weight in the Index, USD/DXY will be heavily influenced by EUR/USD trade. A data dump from the Euro area is due today. Recent data from Europe have mostly bettered expectations. Look for a likely trade today of 98.10-98.40, prefer to sell rallies.

- EUR/USD – The Euro held strong support at 1.0990 yesterday, managing to close 0.03% higher at 1.1008. Overnight low traded was 1.09986. Immediate support lies at the 1.0990 level. Immediate resistance can be found at 1.1020 followed by 1.1050. Today sees Eurozone Flash Headline and Core CPI reports as well as a host of other Euro area data. Market positioning remains short of Euro bets. The latest COT report saw a rise in speculative Euro shorts to 4-week highs at -EUR 62,503 contracts. Look to buy dips with a likely 1.1000-1.1050 range today.

- AUD/USD – The Australian Dollar eased to 0.6767 from 0.6777 yesterday. Australian Capital Expenditure for Q3 missed forecasts (-0.2% vs f/c of 0.0%) which weighed on the Battler. AUD/USD traded in a tight 0.67591-0.67780 range overnight. Market positioning remains short of Aussie bets with the total net speculative at -AUD 47,240, the biggest since mid-October and a climb 16%. That’s huge. Immediate resistance can be found at 0.6780 and 0.6810. Immediate support lies at 0.6760 followed by 0.6740. Look to trade a likely range today of 0.6760-0.6810. Prefer to buy dips today.

- USD/JPY – finished little changed at 109.52 from 109.57 yesterday. The Dollar stayed bid on weaker Japanese Retail Sales and divergence in bond yields. Yesterday the US 10-year bond rate was unchanged at 1.77%. However, Japan’s 10-year JGB yield was up 2 basis points to -0.11%, narrowing the gap. The thin market conditions kept USD/JPY steady. USD/JPY has immediate resistance at 109.60 (overnight high traded 109.558). Net resistance can be found at 109.80. Immediate support lies at 109.30 (overnight low 109.331) followed by 109.00. Market positioning remains short JPY (-JPY 35,031 contracts) and the US-Japanese rate differential has narrowed. Look to sell rallies with a likely 109.10-109.60 range.

Happy Friday and trading all, top weekend ahead.