Summary: The Dollar rebounded from two-week lows after the US 10-year treasury yield climbed back from all time lows at 1.30% to finish at 1.34%. Upbeat US New Home Sales data saw traders scale back expectations of more Fed policy easing due to the spread of the coronavirus outside China. However, the broader market sentiment remained cautious. The Dollar edged higher against the Yen to 110.42 from yesterday’s 110.00 opening. Sterling slipped back under 1.30 to 1.2915 after European Union Chief Trade Negotiator Michel Barnier said that trade talks with the UK were to be complicated and there was not much time to strike a deal. The Euro closed flat at 1.0885 after failing to clear the 1.0900 barrier. Commodity currencies remained under selling pressure, the Aussie and Kiwi each shed 0.50% to 0.6557 (0.6600), and 0.6305 (0.6330) respectively. On the crosses, EUR/GBP climbed 0.80% to 0.8440 (0.8370) while GBP/JPY was 0.62% lower to 142.52 (143.12). Wall Street stocks closed mostly lower as uncertainty prevailed on the coronavirus spread. The DOW fell 0.4% to 26,960 (27, 195). The S&P 500 was 0.4% lower to 3,117 (3,145). The NASDAQ Composite Index ended up 0.2%.

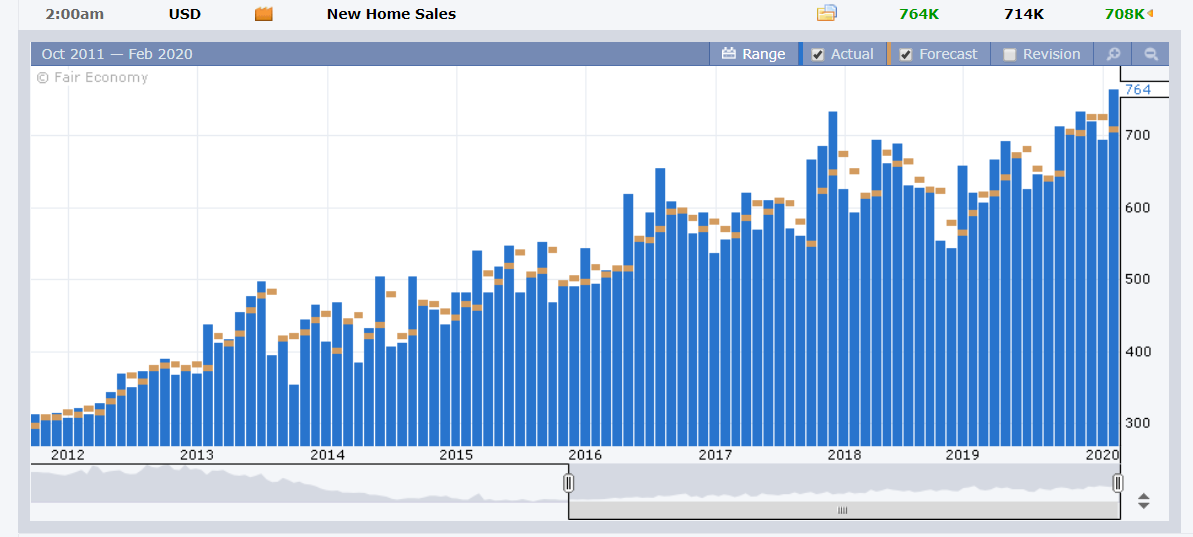

Data released yesterday saw Australian Q4 Construction Work Done fall 3.0%, missing forecasts for a fall of 1.0%. Japan’s BOJ Core CPI this month was steady at 0.3%, matching January’s 0.3%, beating expectations of 0.2%. US New Home Sales in February rose to 764,000 units, beating median forecasts of 714,000 units.

Trading Perspective: Expect consolidation today. The coronavirus uncertainty will continue to lead the way for FX and other markets. Today’s Business Insider reports that the deadly virus has now spread to 40 countries with health experts saying this is a critical week to contain the spread of COVID-19.

On the data front, New Zealand’s Trade Balance, just released saw a deficit of -NZD 340 million, beating forecasts of -NZD 545 million. New Zealand’s ANZ Business Confidence report follows next. Australia’s Q4 Private Capital Expenditure report is expected to improve to 0.5% from Q3’s -0.2%. With the Aussie under selling pressure due to uncertainty from the coronavirus outbreak, the data would have to be better than 0.5% for the Battler to stabilise. Other relevant reports out today are the US Headline and Core Durable Goods Orders (February). Core DGO (which excludes transportation items) are forecast to improve but the Headline number is forecast to fall. US Pending Home Sales Change is expected to see an improvement. If this disappoints, the Dollar will extend its corrective move lower.

USD/JPY – steadied around 110.00 after trading to an overnight low at 110.13 (109.89 on Wednesday) before climbing to a close at 110.45. The USD/JPY currency pair is the most sensitive to moves in the US 10-year yield. The key US rate climbed to 1.345% after touching an all-time low of 1.30%. Broader market sentiment remains cautious. Market positioning is currently short JPY bets. Immediate resistance can be found at 110.70 followed by 111.00. Immediate support lies at 110.20 followed by 109.80. Look to sell USD/JPY rallies with a likely range today of 110.15-110.65.

AUD/USD – The Aussie remained under selling pressure and grinded lower to fresh April 2009 lows at 0.6542 in early Sydney trade. Much will depend on Australia’s CAPEX data due out later today (11.30 am Sydney time). Immediate support lies at 0.6530 followed by 0.6500. Immediate resistance can be found at 0.6580 followed by 0.6610. We highlighted yesterday that net speculative short Aussie bets increase to -AUD 37,477 from -AUD 32,668. The RBA’s Australian Dollar Trade Weighted Index remains near GFC (2007/2008) lows. While the Aussie looks soft, it often does near its base. Look to buy dips in a 0.6530-0.6630 range today.

EUR/USD – The Euro traded to an overnight and 2-week high at 1.09087 before easing to settle at 1.0885, unchanged from yesterday. For today much will depend on the US data and the coronavirus spread to the European continent. The Euro is in the process of a corrective move higher triggered by speculative short covering. Look to buy dips in a likely range of 1.0860-1.0910.

EUR/GBP – The Euro rallied 0.8% against the Pound to 0.8441 overnight highs before easing to settle at 0.8430 (0.8371 yesterday). Overnight low traded was 0.8356. One of the drivers of this cross is the market positioning in the individual currencies, ie short Euro and long Sterling. Expect this cross to correct further and use any dips to buy EUR/GBP. Immediate support can be found at 0.8400 followed by 0.8370. Immediate resistance can be found at 0.8440 and 0.8470. Look to trade a likely range today of 0.8400-0.8470.

NZD/USD – The Kiwi like its bigger cousin the Aussie, was also under selling pressure yesterday. NZD/USD closed at 0.6305 from 0.6330 yesterday for a loss of 0.34%. This morning New Zealand’s trade deficit to -NZD 340 million beating forecasts of deficit of -NZD 545 million in February. The previous month’s surplus was revised lower to +NZD 384 million from +NZD 547 million. Like the Aussie, speculators are also short of Kiwi bets. The latest COT report (week ended Feb 18) saw net NZD/USD short bets increase to -NZD 12,187 contracts from -NZD 4,076. Look to buy Kiwi dips with a likely range today of 0.6285-0.6355.

Please feel free to leave your thoughts on any of the currency pairs or the broader perspective we write about. Happy trading all.