International investors and traders have historically been left out of the US market for two main reasons. First, access to US markets has been limited to expensive brokerage platforms that don’t cater to the average investor. Second, the elevated US dollar coupled with high forex money transfer fees made it cost-prohibitive for global investors to get excited about American stocks.

Fortunately, the advancement of technology on two fronts makes it possible for global investors to get in on the Wall Street action.

US Dollar Weakness

The US dollar index, that is the value of the US dollar versus a basket of global currencies, entered 2021 at its weakest level in years. In fact, it was not far removed from its lowest point in five-years.

When the US dollar weakens, a foreign currency like the pound or euro becomes more valuable by default. An investor who initiated a currency transfer at the beginning of 2020 and bought the US dollar could have seen their foreign currency holding gain around 6.5%. If the investor had simultaneously invested in an S&P 500 index fund, they banked another 16%. This would bring their total return on US stocks to more than 20%.

Analysts aren’t overly optimistic the US dollar will reverse course and gain in value in 2021 and beyond. Naturally, this bodes well for global investors with exposure to the US markets as the foreign currency gain compounds strong equity returns.

The case for continued US dollar weakness is based in part on the ongoing accommodative monetary stance from the Federal Reserve. Known as the reflation trade, at least one analyst sees the US dollar losing at least 5% and up to 10% in 2021.

“We think that a similar backdrop of accommodative Fed policy and a recovering global economy will maintain this tight connection between a weaker dollar and higher equities,” another expert said.

As more global investors demand exposure to US assets, one would expect the already rich US stock market valuation to further expand into a bubble balloon.

The main advantage of a balloon is it can expand indefinitely. The current bull run has lasted more than a decade and calls for the balloon to burst has been ongoing for just as long. Just be sure not to be the last investor standing when the balloon ultimately pops.

Innovation In Currency Transfer Industry

Big banks are notorious for exorbitant forex money transfer fees resulting in many global investors avoiding a currency transfer because they know they are getting ripped off. Banks are known to charge 2.5% and upwards on all foreign exchange transactions — on top of their fixed fees.

Important to keep in mind this 2.5% fee applies to just one side of the transfer. Once an investor wishes to take their profits off the table and transfer it back to their home currency, the bank will help themselves to another fee of at least 2.5%.

So, a 16% return on the S&P 500 in 2020 minus the two forex money transfer fees means a return is lowered to 11%. Granted, this is still a respectable profit by any measures but it is ridiculous how a bank asserts itself as a default silent partner in an investor’s global portfolio with their guaranteed fee but zero risks.

The advancement of financial technology currency transfer companies in recent years is credited with innovating the forex money transfer industry.

Companies like Transferwise, OFX, Currencies Direct, and many others are able to facilitate a currency transfer at or very close to the mid-market rate at a cost of around just 0.5%.

The way it works is simple: Suppose an investor is based in Germany and wants to transfer 500 euros to US dollars. Modern and tech-driven forex money transfer companies can automatically match the transaction with someone in the US looking to exchange their dollars for euro.

This allows a currency transfer to take place at exactly the mid-market rate — that is the exchange rate one sees on Google.

The ability for global investors to save 2% on fees on each side of the transaction is a very welcome move that can further fuel interest in the US stock market and prolong the inflated stock market bubble — perhaps even indefinitely.

One would assume demand for global forex money transfer services to merely increase as industry awareness is still very low. Even the most expensive online money transfer company can offer a superior exchange rate compared to traditional legacy banks.

Rise Of The Fintech Brokers

Coinciding with the rise of new-age forex money transfer companies are a handful of fintech stockbrokers that market themselves to common, everyday investors — that is the ones that have a few hundred pounds or euros to invest, not a few hundred thousand.

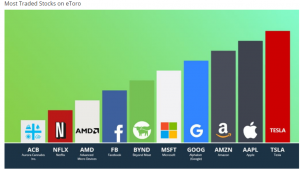

Some of the brokers that offer global investors access to US markets include eToro, Ninety Nine, Degiro, Trading 212, among others.

These brokerage firms have yet to even begin scratching the surface of their true potential. EToro, as an example, registered a 427% spike in new users globally in the first four months of 2020 alone. The platform has surged in popularity given a unique feature where all account holders can copy another experienced user who publicly shares their portfolio.

Cheap Forex Money Transfer + Cheap Trading = Happy Investors

The era of banks and brokers catering to the wealthy and ripping off the rest through high fees has come to an end. Fintech companies with a desire to completely change the status quo are part of a trend that will continue gaining momentum over the years.

This is great news for global investors looking to take advantage of the combination of cheap currency transfer services with the US dollar weakness and US stock market strength.