Summary: The Dollar extended its broad-based losses after US Federal Reserve repeated its pledge to use “it’s full range of tools” to support the economy and warned that virus poses considerable risks to the outlook. The FOMC voted leave the federal funds target rate unchanged at 0-0.25% range with no change to their quantitative easing stance. In his press conference Fed Chairman Jerome Powell said that there will be a need for more fiscal support. Meantime US House Republicans and Democrats appear to be far apart as ever from a deal to support the economy. After dipping yesterday, the Euro outperformed, climbing to 1.1795 from 1.1718 and leading currencies higher against the Greenback. Europe’s control over Covid-19 and the pace of its economic recovery continue to outpace that of the US and the rest of the world, for the time being. The Aussie Dollar traded higher to 0.7189 (0.7159) after Australia’s inflation report was slightly better than expected. Against the Yen, the Dollar eased 0.2% to 104.95 from 105.12. Better-than-expected UK Mortgage Approvals lifted the British Pound to 1.2993 from 1.2933. The USD/CNH pair (Dollar-Offshore Chinese Yuan) dipped to 6.9970 from 7.01 yesterday. Against the Emerging Market currencies, the Greenback was mixed. USD/ZAR (Dollar-South African Rand) was modestly higher at 16.535 (16.525 yesterday) while USD/THB slipped to 31.40 from 31.50. Wall Street stocks kept its gains with the DOW up 0.7% to 26,578. The S&P 500 added 1.34% to 3,265 (3,225). The US 10-year bond yield finished at 0.57% from 0.58%. Germany’s 10-year Bund rate was at -0.50% from -0.51% yesterday.

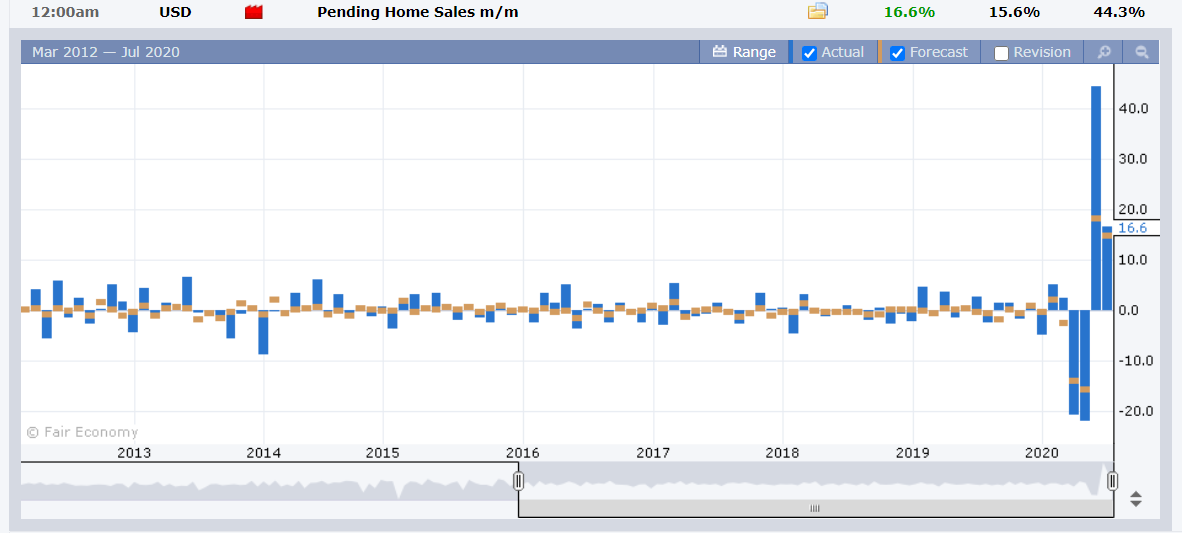

Data released yesterday saw Australia’s Headline CPI dip to -1.9% against forecasts of -2.0%. Australian Trimmed Mean CPI was lower at -0.1% against expectations of +0.1%. UK Mortgage Approvals climbed to 40,000 from 9,000, beating forecasts at 35,000. The US Trade Deficit beat forecasts at -USD 70.6 billion, against expectations of -USD75.5 billion. US July Pending Home Sales were up 16.6%, beating forecasts at 15.6%.

On the Lookout: The spotlight today falls on the US Q2 Advance GDP report which is forecast to plunge to -34.5% from the Q1’s downwardly revised -5.0% (from -4.8%). New Zealand just reported its Building Consents which beat forecasts, rising to 0.5% against flat expectations. New Zealand’s ANZ Business Confidence Index follows. Japan follows next with its Retail Trade for June. Australia follows with its Building Approvals (July) and Q2 Import Prices. European reports begin with Germany’s Preliminary CPI, Unemployment Change and Q2 GDP. Switzerland reports its KOF Economic Barometer. Spain releases its Flash CPI. Italy reports on its Unemployment Rate (July). The Eurozone’s Unemployment Rate round up European reports. US data kick off with US Q2 Advance GDP, Advance Q2 GDP Price Index, and finally US Weekly Unemployment Claims.

Global Coronavirus Total Cases have risen to 17,132,568 with alarming rises in the US, Brazil, India, and South Africa. Markets have shrugged this second wave upsurge which may now come more into focus.

Trading Perspective: FX has been selling Dollar’s all week in anticipation of a dovish leaning Fed. The US central bank has signalled that the coronavirus has become its focus and policymakers will do all that is needed to get the economy going. While monetary stimulus is likely to remain accommodative for the foreseeable future, the “commitment to do whatever it takes to get the economy going again” is a positive for the Greenback. The Dollar managed to close off its lows and is drifting higher in early Asia. US data released last night were better than expected.

The market maintains its bearish bias towards the Dollar heading into tonight’s Q2 GDP report which is expected to see GDP contract a massive -34.5% from Q1’s downwardly revised -5.0%. FX is also carrying short USD positions, in some cases at multi-year highs against its rivals. The risk is for a flat or less than expected drop in the Q2 GDP. Which will see a considerable amount of Greenback short covering. We look at a few currencies.

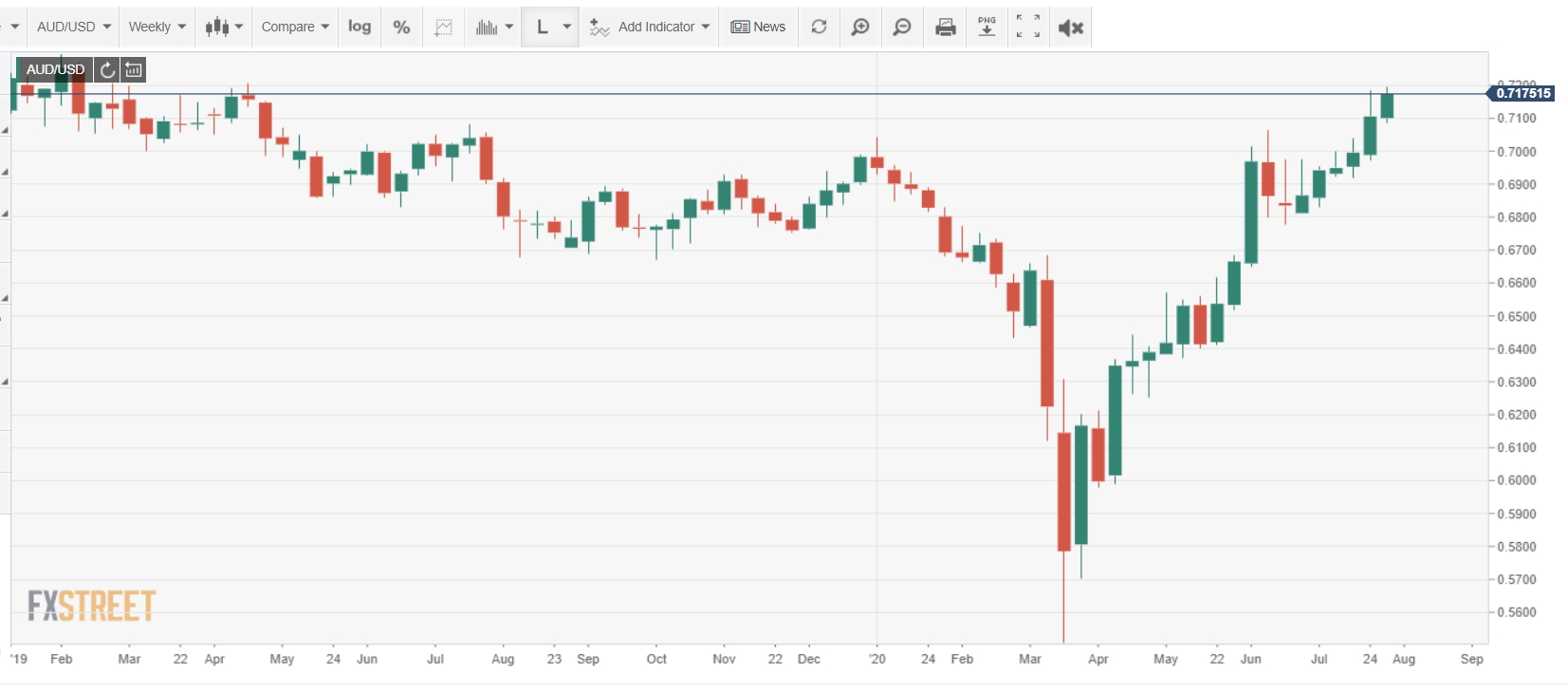

AUD/USD – Lifts to 0.7200 on Dovish Fed, New Covid-19 Spike Weighs

The Australian Dollar slid from its New York close at 0.7190 after trading to 0.7197 highs overnight after the Fed kept rates unchanged but signalled it will keep policy accommodative to battle Covid-19 in the US. In early Asia, the Aussie Battler slid to 0.7170 on breaking news that Victoria, Australia’s second largest state recorded a “horrifying spike in Covid-19 with a staggering 723 new cases and 13 deaths in the biggest surge in the country since the pandemic began. Other states, including Queensland are also seeing new virus climbs. This latest surge in the virus infections will impact the Australian economy and keep the Aussie under pressure.

AUD/USD has immediate resistance at 0.7200 followed by 0.7240. Immediate support can be found at 0.7150 and 0.7120. Look for the Australian Dollar to grind lower in a likely range today of 0.7090-0.7190. Prefer to sell rallies.

EUR/USD – Advances to 1.1800, German GDP, Europe Virus Uptick in Focus

The Euro continued its advance, outperforming FX, climbing to an overnight high at 1.18064 before easing to settle at 1.1795 in New York. Europe’s economic recovery has outpaced that of the US and many parts of the world with its success in controlling the coronavirus outbreak. The generally brighter outlook has enabled the shared currency to outperform its US counterpart as well as other currencies. Tonight’s German GDP report, while forecast lower, is much better than what is expected from the U.S. Even at current levels, it looks like bright skies and the green light for further Euro advances. Sentiment is very much in favour for the shared currency.

That said, speculative long Euro bets in the futures market continues to climb to new multi-year peaks. The recent uptick in virus cases in Europe need to be monitored. And a weaker-than-expected German GDP report could very well see a set-back for the Euro.

EUR/USD has immediate resistance at 1.1810 followed by 1.1840. Immediate support lies at 1.1750 followed by 1.1710. Look for consolidation in a likely range today of 1.1700-1.1800. Preference is still to sell rallies, a corrective pullback will begin soon.